Imagine waking up to headlines where the world’s biggest asset manager – the one handling trillions for pensions and billionaires – hands a golden ticket to crypto traders. That’s the vibe on November 16, 2025, as BlackRock’s BUIDL token, already a $2.5 billion beast, slides into Binance’s collateral lineup. This isn’t just another listing; it’s a quiet revolution unlocking over $500 million in tokenized liquidity for big-league plays, blending safe Treasury yields with high-octane crypto bets. For everyday folks eyeing crypto’s mainstream glow-up, this move whispers: Wall Street’s not invading – it’s investing.

Unpacking BUIDL: BlackRock’s Secret Sauce for On-Chain Cash

At its core, BUIDL (short for BlackRock USD Institutional Digital Liquidity Fund) is like a digital piggy bank backed by boring-but-brilliant stuff: short-term U.S. Treasury bills, repo agreements, and cash equivalents. Pegged at $1 per token, it spits out daily yields – think 4-5% APY right now, minus BlackRock’s slim 0.2-0.5% fee – straight to holders. Launched in March 2024 on Ethereum via Securitize (a tokenization whiz), it’s exclusive to deep-pocketed institutions dropping at least $5 million to play.

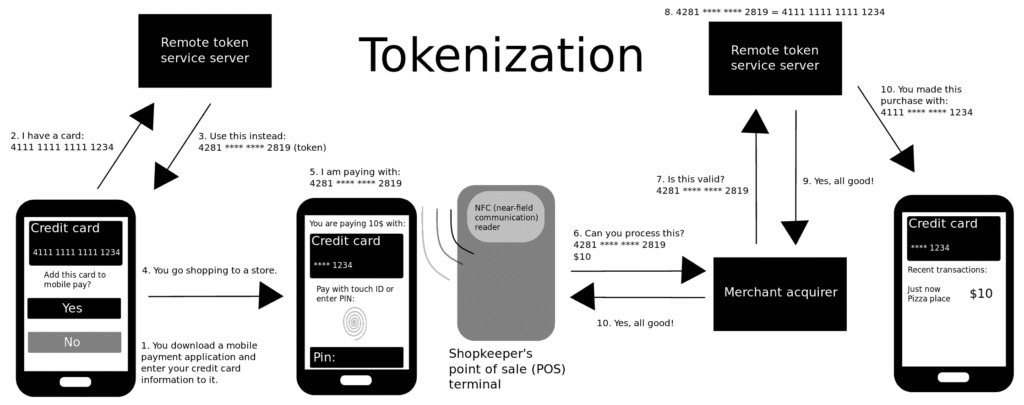

What makes it tick? Tokenization turns these sleepy assets into blockchain zips – transferable in seconds, verifiable 24/7, no middleman drama. By November 2025, BUIDL’s grown to $2.52 billion in value, leading the pack of tokenized funds and outpacing rivals like Circle’s USYC ($1.06 billion) and Franklin Templeton’s BENJI ($850 million). It’s not a stablecoin knockoff; it’s yield-earning collateral that doesn’t sleep on the job.

The Binance Bombshell: Collateral Status and BNB Chain Boost

Binance dropped the news on November 14: BUIDL is now “off-exchange collateral” for institutional trades. What does that mean in plain English? Big traders can pledge BUIDL holdings – kept safe with custodians like Ceffu or banking triparty partners – to back derivatives, margin loans, or spot trades on Binance. No need to yank assets onto the exchange; everything settles on-chain with a yield kicker.

This unlocks serious firepower. With BUIDL’s $2.5 billion pool, analysts estimate over $500 million in fresh liquidity for leveraged plays, per early CryptoNinjas breakdowns. Plus, BlackRock’s rolling out a fresh BUIDL share class on BNB Chain – Binance’s speedy blockchain with $7.4 billion TVL. Now live on Ethereum, Solana, Arbitrum, Aptos, and Avalanche, BUIDL’s multi-chain hop makes it a one-stop shop for cross-network hustles.

Catherine Chen, Binance’s VIP & Institutional head, nailed it: Institutions crave “interest-bearing stable assets” for trading without the hassle. Robbie Mitchnick, BlackRock’s digital assets boss, added that this “brings foundational elements of traditional finance into the onchain finance arena.” It’s like giving crypto a Wall Street upgrade: safer, yieldier, and scalable.

Why This Matters: From Niche Toy to Trading Powerhouse

Tokenized real-world assets (RWAs) like BUIDL aren’t fluff – they’re the glue pasting TradFi to crypto. Stablecoins ruled collateral for years (Tether and USDC still do for retail), but they yield zilch. BUIDL flips that: Earn while you trade, with the transparency of blockchain audits and the safety of BlackRock’s rep.

A Boston Consulting Group report from Q3 2025 pegs the tokenized asset market at $16 trillion potential by 2030, with Treasuries leading the charge at $8.57 billion today. Binance’s nod makes BUIDL one of just three tokenized options for collateral there – a VIP club signaling trust. For institutions, it’s capital efficiency on steroids: Borrow more against high-quality collateral, dodge custody risks, and tap crypto’s 24/7 volatility without ditching yields.

Everyday ripple? As more funds tokenize, fees drop, access widens (maybe someday beyond $5M minimums), and crypto gets less “wild west.” BUIDL’s daily dividends – auto-reinvested or withdrawn – show how blockchains can mimic money markets, minus the fax machines.

Quick Stats: BUIDL’s Rise vs. The RWA Pack

| Token/Fund | Issuer | TVL (Nov 2025) | Yield (APY) | Chains Supported | Collateral Venues |

|---|---|---|---|---|---|

| BUIDL | BlackRock | $2.52B | ~4.5% | 6+ (incl. BNB) | Binance, Others |

| USYC | Circle | $1.06B | ~4.2% | Ethereum | Select Exchanges |

| BENJI | Franklin Templeton | $850M | ~4.0% | Stellar | Limited |

| cUSDO | Ondo Finance | $450M | ~4.3% | Multiple | Emerging |

Data: RWA.xyz & DeFiLlama, November 16, 2025. BUIDL’s multi-chain edge and BlackRock backing give it the lead – expect that $500M liquidity unlock to swell volumes fast.

The Flip Side: Hurdles in This Hybrid Highway

No party’s perfect. BUIDL’s institutional-only gate keeps retail out (for now), and regulatory fog – like SEC scrutiny on tokenized securities – could slow the party. Yields track Treasuries, so Fed cuts might trim returns. Plus, while Securitize’s audits shine, blockchain risks (smart contract bugs) linger, though rarer than in 2022’s chaos.

Bloomberg notes this as a “shift in crypto plumbing,” but warns: Over-reliance on one fund could amplify black swan events. Still, with BlackRock’s $13.4 trillion AUM, BUIDL feels like a fortress, not a gamble.

Final Take: A Bridge Too Far – Or Just Far Enough?

BlackRock’s BUIDL on Binance isn’t hype; it’s a maturity marker. Unlocking $500M+ in yield-bearing collateral pulls more suits into crypto, juices liquidity, and proves tokenization’s no fad. For the average Joe, it’s a peek at finance’s future: Assets that work harder, settle faster, and span worlds.

If you’re an institution, this is your cue to diversify collateral. For the rest? Watch how it ripples – lower fees, broader access, maybe even tokenized retirement funds someday. Crypto’s not conquering Wall Street; they’re co-authoring the next chapter.

Deeper dive: Boston Consulting Group – “Tokenization: The $16 Trillion Opportunity” (2025 Edition)

Your thoughts? Does BUIDL make crypto feel ‘legit’ yet, or still too fancy for Main Street? Drop a comment – I chime in on all.