When you buy Bitcoin, Ethereum, or any cryptocurrency, you want to know your money is safe. That’s where blockchain comes in—the technology behind crypto that ensures your funds are secure. But how does it work? This beginner-friendly guide explains how blockchain keeps your cryptocurrency safe using simple terms, covering its key security features and tips to protect your investments in 2025.

What is Blockchain and Why Is It Secure?

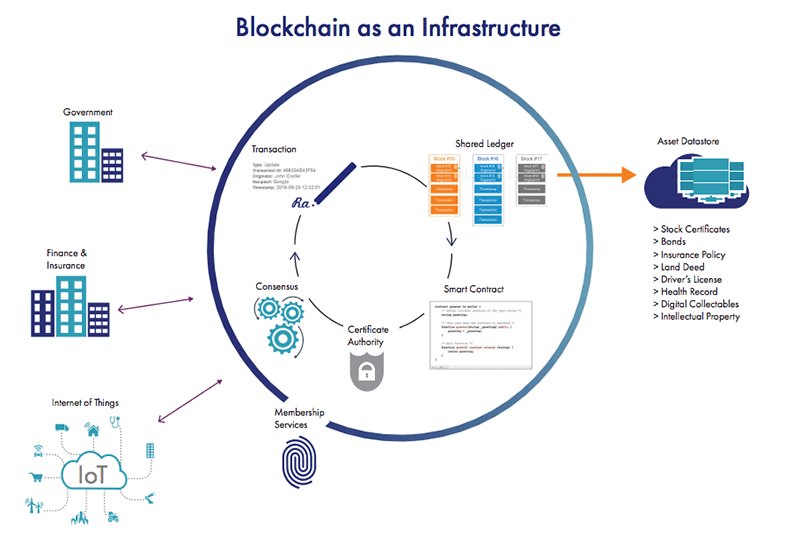

Blockchain is a digital ledger that records cryptocurrency transactions, like sending Bitcoin or buying Ethereum, across a network of computers worldwide. Unlike a bank’s ledger, which is controlled by one entity, blockchain is decentralized, meaning no single person or company can alter it. This decentralization, combined with advanced security features, makes blockchain incredibly safe for storing and transferring crypto.

Think of blockchain as a notebook where every page (or “block”) lists transactions. Once a page is filled, it’s locked with a digital seal and linked to the previous page, forming a tamper-proof chain. This structure is why blockchain is trusted to secure billions in crypto.

How Blockchain Protects Your Crypto

Blockchain uses several key features to keep your cryptocurrency safe. Let’s break them down in simple terms.

1. Decentralization: No Single Point of Failure

In a traditional bank, your money is stored in a central database. If hackers breach it, your funds are at risk. Blockchain avoids this by storing data across thousands of computers (nodes) worldwide. To hack a blockchain like Bitcoin’s, a hacker would need to control over half of these nodes—an almost impossible task due to the network’s size.

Example: When you send Bitcoin, every node verifies and records the transaction, ensuring it’s legitimate without relying on a central authority.

2. Cryptography: Locking Your Transactions

Blockchain uses cryptography, a method of encoding data, to secure transactions. Every transaction is protected by a digital signature created with your private key—a secret code only you know. This signature proves the transaction came from you and prevents anyone from tampering with it.

How It Works: Your private key signs transactions, and your public key (like an address) lets others verify it’s you. Even if someone intercepts the transaction, they can’t change it without your private key.

Tip: Never share your private key or wallet’s seed phrase. Store them offline, like in a safe or on a hardware wallet like Ledger.

3. Immutability: Transactions Can’t Be Changed

Once a transaction is added to the blockchain, it’s permanent. This is called immutability. Each block is linked to the previous one using a unique code called a “hash.” If someone tries to alter a transaction, the hash won’t match, and the network rejects the change.

Example: If a hacker tries to change a Bitcoin transfer from 2024, they’d need to rewrite every block since then across all nodes—a feat requiring immense computing power.

4. Consensus Mechanisms: Ensuring Trust

Blockchain networks use rules called consensus mechanisms to agree on valid transactions. The most common are:

- Proof of Work (PoW): Used by Bitcoin, where nodes (miners) solve complex math problems to validate blocks, making attacks costly.

- Proof of Stake (PoS): Used by Ethereum in 2025, where validators stake crypto to verify transactions, incentivizing honesty.

These mechanisms ensure only legitimate transactions are recorded, protecting your crypto from fraud.

5. Transparency: Public Verification

Most blockchains, like Bitcoin’s, are public, meaning anyone can view transactions. This transparency builds trust, as you can verify your crypto was sent or received correctly. While transaction details are public, your identity remains private, linked only to a wallet address.

Example: You can check a Bitcoin transaction on a blockchain explorer like Blockchain.com to confirm it’s secure.

Why Blockchain Security Matters for Crypto

Blockchain’s security features are critical for keeping your crypto safe in 2025. Here’s why:

- Protection from Hacks: Decentralization and cryptography make it nearly impossible to steal funds directly from the blockchain.

- No Middleman Risks: Unlike banks, there’s no central entity that can freeze or lose your funds.

- Global Trust: Blockchain’s transparency ensures your transactions are verifiable anywhere in the world.

However, blockchain security doesn’t protect against user errors, like losing your private key or falling for scams. That’s where your responsibility comes in.

Your Role in Keeping Crypto Safe

While blockchain is secure, your actions play a big role in protecting your crypto. Follow these beginner-friendly tips:

- Secure Your Private Key: Store your wallet’s seed phrase (12–24 words) offline, like on paper or in a Ledger hardware wallet. Never save it digitally.

- Use Trusted Wallets: Choose reputable wallets like Trust Wallet or MetaMask for safe storage.

- Enable 2FA: Use two-factor authentication on exchanges like Coinbase with apps like Google Authenticator.

- Avoid Scams: Never share your seed phrase or click suspicious links promising “free crypto.” Learn more at CoinDesk.

- Verify Transactions: Double-check wallet addresses before sending crypto, as blockchain transactions are irreversible.

Common Threats Blockchain Can’t Prevent

While blockchain itself is secure, you should be aware of risks outside its control:

- Phishing Scams: Fake websites or emails trick you into sharing your private key.

- Exchange Hacks: If you store crypto on an exchange like Binance, a hack could target the platform, not the blockchain.

- User Errors: Sending crypto to the wrong address or losing your seed phrase can’t be undone.

Solution: Move your crypto to a personal wallet and practice safe habits to complement blockchain’s security.

How to Start Exploring Blockchain and Crypto Safely

Ready to dive into crypto with confidence? Here’s how to begin in 2025:

- Learn the Basics: Read beginner guides on CoinDesk or Cointelegraph to understand blockchain.

- Buy a Small Amount: Start with $10 of Bitcoin or Ethereum on Coinbase to see blockchain in action.

- Secure Your Funds: Transfer your crypto to a wallet like Trust Wallet for safety.

- Join Communities: Ask questions on Reddit’s r/cryptocurrency or r/blockchain for tips.

Tips for Staying Safe with Blockchain and Crypto

Maximize blockchain’s security with these beginner tips:

- Backup Your Wallet: Write down your seed phrase and store it in multiple secure locations.

- Use Reputable Platforms: Stick to trusted exchanges like Kraken or Coinbase.

- Stay Updated: Follow 2025 crypto trends on Cointelegraph to avoid new scams.

- Start Small: Test transactions with small amounts to build confidence.

Conclusion

Blockchain keeps your cryptocurrency safe through decentralization, cryptography, immutability, and consensus mechanisms, making it one of the most secure technologies for digital assets in 2025. By combining blockchain’s built-in protections with smart habits like securing your private key and avoiding scams, you can trade and hold crypto with confidence. Ready to start? Explore blockchain with a small purchase on Coinbase, secure your funds with a Ledger wallet, and discover the power of this revolutionary technology!