What if the world’s biggest money manager suddenly poured hundreds of millions into a blockchain you might not even know? That’s happening right now on Avalanche, where tokenized real-world assets (RWAs) just exploded by nearly 69% in a single quarter. BlackRock’s big move—tokenizing its massive BUIDL fund—has supercharged this growth, pushing total locked value past $1.3 billion. This isn’t just hype; it’s a sign that traditional finance is rushing into blockchain, one tokenized asset at a time.

Why Avalanche Is Suddenly a Hot Spot for Real-World Assets

Real-world assets mean turning things like bonds, loans, or funds into digital tokens on a blockchain. These tokens trade faster, cost less, and stay transparent—perfect for big institutions that hate paperwork but love efficiency.

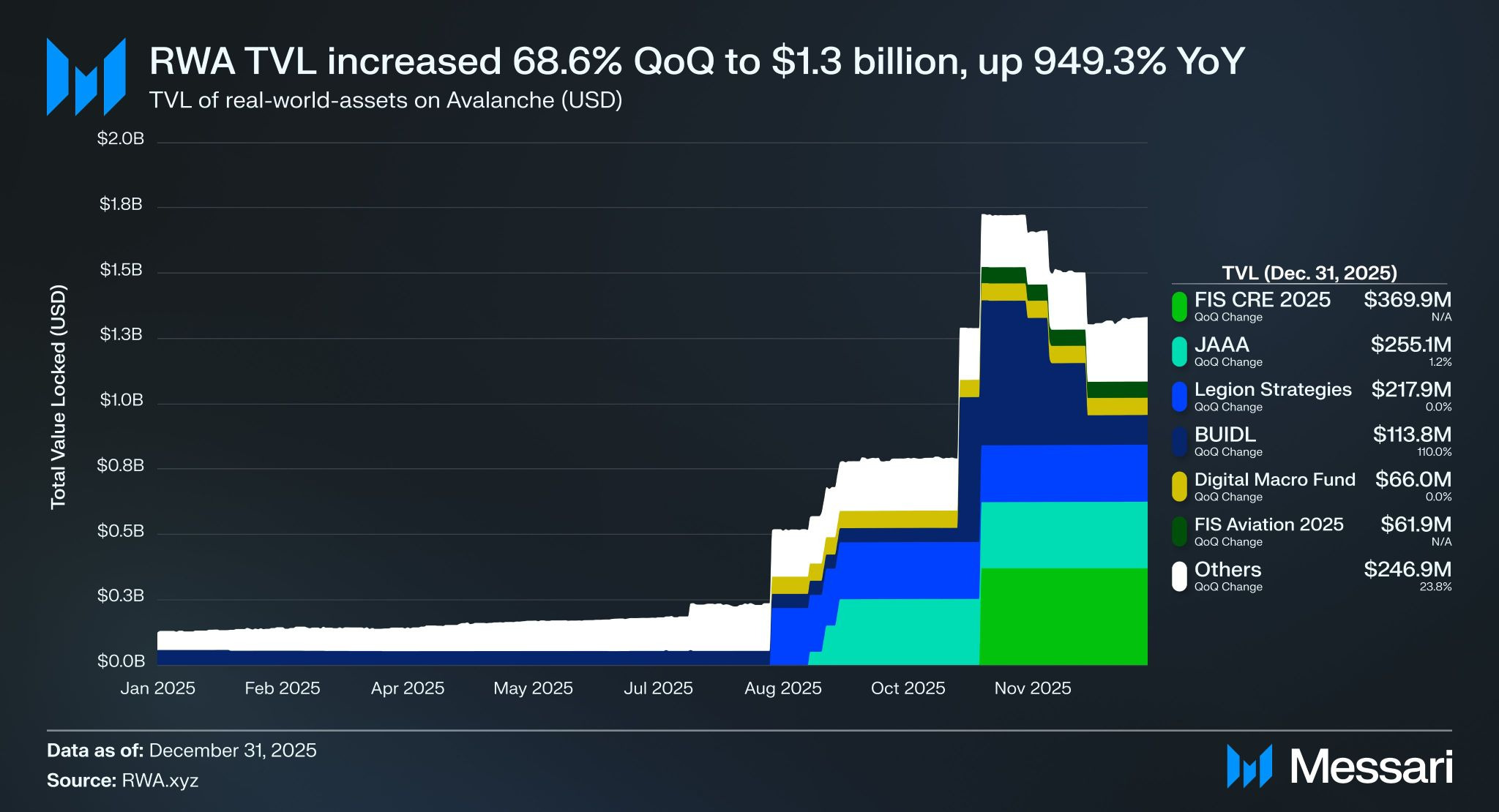

Avalanche stands out because of its fast speed, low fees, and customizable “subnets” that let companies build private, compliant blockchains. That’s why big names are flocking here. In Q4 2025, Avalanche’s RWA TVL jumped 68.6% to $1.33 billion—a 949% rise from the year before. The star? BlackRock’s BUIDL fund, which tokenized $500 million worth of assets.

Avalanche RWA TVL hits $1.3B – Is AVAX next to rally? – AMBCrypto

This chart shows the explosive growth in Avalanche’s RWA TVL, skyrocketing in late 2025 thanks to major institutional pushes.

BlackRock’s BUIDL: The Game-Changer That Sparked the Surge

BlackRock, managing trillions in assets, launched its USD Institutional Digital Liquidity Fund (BUIDL) on Avalanche in late 2025. BUIDL is a tokenized money market fund backed by U.S. Treasuries—basically a super-secure way to earn yield on stable assets.

When BlackRock brought BUIDL to Avalanche, it added hundreds of millions in value overnight. This isn’t small-time stuff; it’s the largest onchain money market fund on the network. Other players like FIS (tokenizing loans) and S&P Digital Markets (launching indices) joined in, fueling the boom.

BlackRock Launches Digital Liquidity Fund BUIDL on Avalanche via …

BlackRock and Securitize partnering to launch BUIDL on Avalanche—marking a huge step for institutional tokenization.

ETFs and Institutions: More Fuel for the Fire

The excitement isn’t stopping at tokenization. New Avalanche ETFs, like VanEck’s spot AVAX fund, are now live. These ETFs give everyday investors easy exposure to AVAX while including staking rewards—making it simpler to join the action.

Big institutions love Avalanche’s setup for compliance and speed. From hedge funds to governments digitizing property deeds, the network is proving it’s ready for serious money.

BlackRock’s BUIDL aids Avalanche tokenization value boom in Q4 …

Another view of the RWA TVL surge, highlighting how BlackRock’s BUIDL and other funds drove the 68.6% quarterly increase.

What This Means for You: Opportunities and What to Watch

This surge shows blockchain isn’t just for crypto enthusiasts anymore—it’s becoming the backbone for traditional finance. Tokenized assets could make investing in bonds or funds easier, cheaper, and more accessible.

For Avalanche users, it means more liquidity, better yields, and growing DeFi options. Even as AVAX’s price has struggled, the network’s fundamentals are stronger than ever.

What Is Asset Tokenization? Meaning, Examples, Pros, & Cons …

A simple illustration of how real-world assets get tokenized on blockchain—turning physical or financial assets into digital tokens for easier trading.

Looking Ahead: The Future of Tokenized Finance

Avalanche’s RWA boom, powered by BlackRock and new ETFs, points to a future where trillions in traditional assets live on blockchain. This could reshape how we invest, lend, and trade.

If you’re curious about crypto or just want better yields, keep an eye on Avalanche—it’s bridging old-school finance with the new digital world.

Sources: Messari State of Avalanche Q4 2025 report, RWA.xyz analytics, Cointelegraph coverage, and official Avalanche announcements.

This shift isn’t hype—it’s the real start of mainstream adoption.