Imagine a company that treats Bitcoin not just as an investment, but as the core engine driving its entire future growth. That’s exactly what Strategy (formerly MicroStrategy) has become under Michael Saylor’s vision—and now, with a fresh $2.2 billion in cash reserves, they’re gearing up for even smarter moves in the crypto world.

Michael Saylor Presents The 21 Ways To Wealth At Bitcoin 2025

What Just Happened: Building a Massive Cash Buffer

In late December 2025, Strategy made a surprising shift. Instead of pouring every dollar into buying more Bitcoin as they’ve done for years, the company raised about $748 million through stock sales and boosted its cash reserves to roughly $2.19 billion.

This isn’t a retreat from Bitcoin—far from it. As detailed in the company’s December 22, 2025 SEC filing, this “USD Reserve” is designed to cover dividends on preferred stock and interest payments on debt for over two years, giving them breathing room during volatile markets (source: Strategy Form 8-K, December 22, 2025).

Why now? Bitcoin’s price has been fluctuating, and building this liquidity acts like a safety net, ensuring the company can weather storms without being forced to sell any BTC holdings.

Bitcoin on track for $100,000 in 2025, historical growth guides …

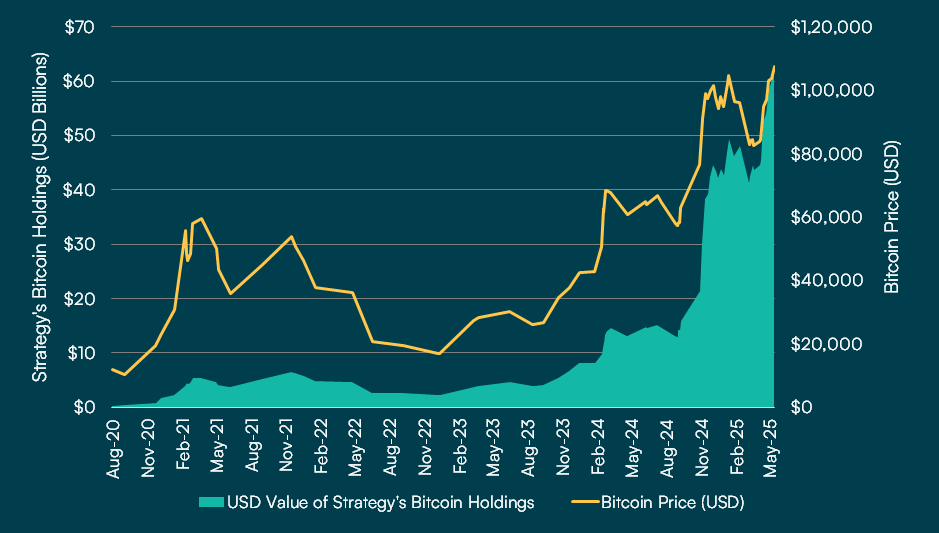

The Current State of Strategy’s Bitcoin Treasury

Strategy remains the undisputed leader in corporate Bitcoin adoption, holding a staggering 671,268 BTC as of mid-December 2025. That’s over 3% of all Bitcoin that will ever exist, acquired at an average price of around $74,972 per coin for a total cost exceeding $50 billion.

These holdings are currently worth billions more, delivering substantial unrealized gains despite recent market dips. Analysts note this positions Strategy uniquely as a “Bitcoin treasury company,” where the digital asset forms the backbone of its balance sheet (source: Bitcoin Magazine, December 2025 reports).

Michael Saylor’s MicroStrategy Bitcoin Trade

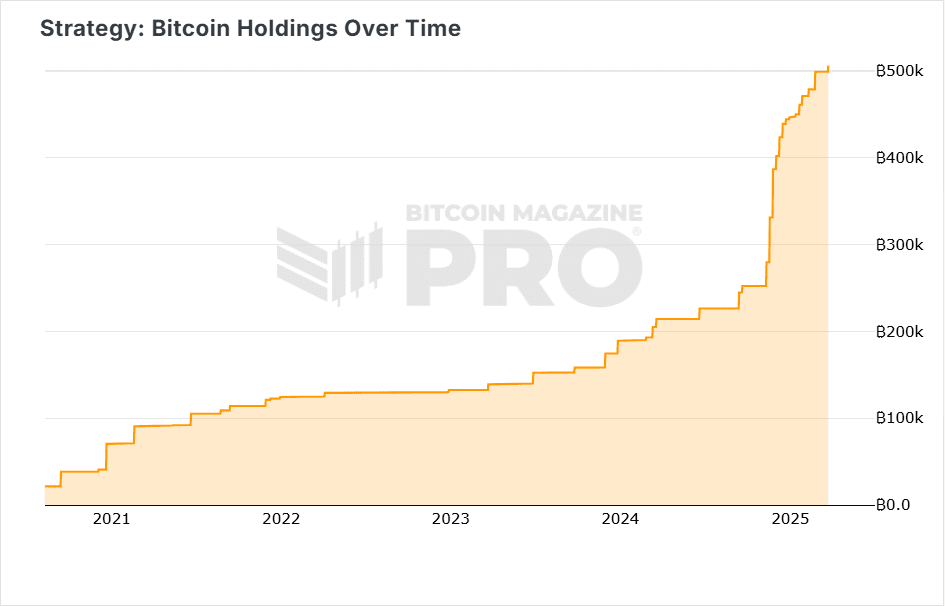

How Strategy’s Holdings Have Grown Over Time

The journey started in 2020, but 2025 saw aggressive accumulation, including multiple $1 billion-plus purchases. Here’s a visual look at the steady climb:

Can Strategy’s MSTR Price Surpass $1,000 In 2025?

Unlocking a Smarter Strategy: Why Liquidity Changes Everything

This $2.2 billion cash pile isn’t sitting idle—it’s a strategic tool. It reduces risks from debt obligations and preferred dividends, which total hundreds of millions annually. With this buffer, Strategy can avoid dilutive fundraising in bad times and pounce on Bitcoin dips when opportunities arise.

Experts see it as a mature evolution: from relentless buying to balanced treasury management. As S&P Global Ratings has highlighted in similar analyses, such reserves help “prefund” obligations and stabilize credit profiles in volatile assets (source: CCN analysis, December 2025).

MicroStrategy’s BTC Correlation and Leverage: Is MSTR Overvalued …

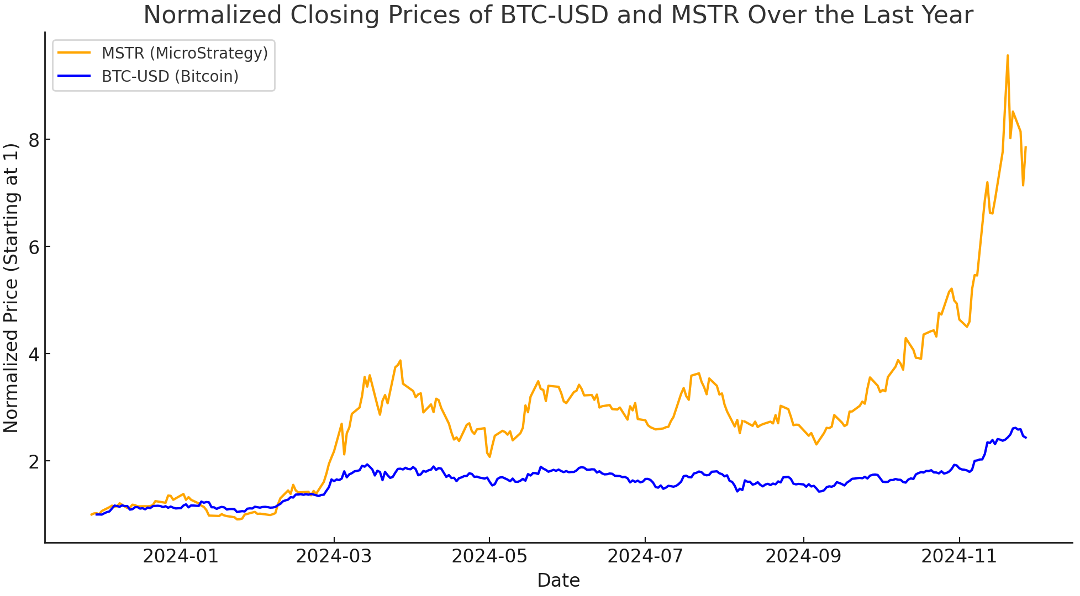

Comparing Performance: MSTR Stock vs. Bitcoin

While Bitcoin has delivered strong long-term returns, Strategy’s leveraged approach has amplified gains (and risks) for shareholders:

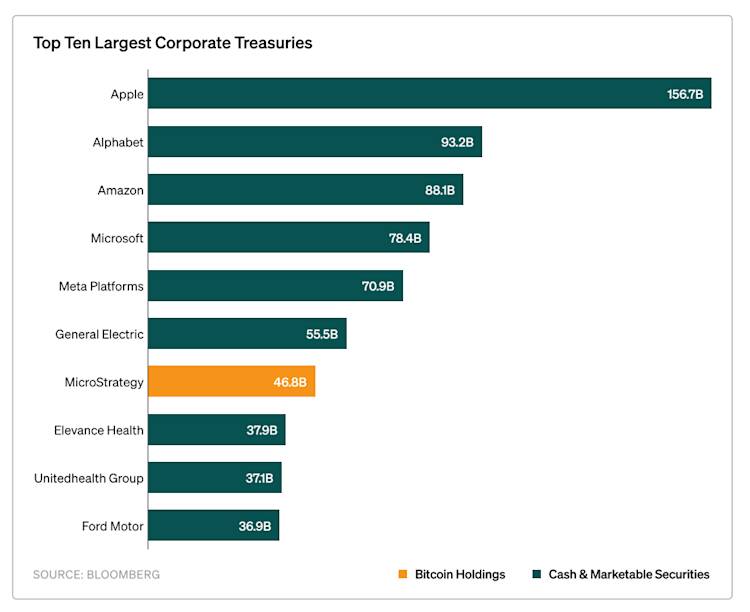

What This Means for the Future of Corporate Bitcoin Adoption

Strategy’s move could inspire other companies. By showing how to hold massive Bitcoin positions while maintaining liquidity, it sets a blueprint for institutional adoption. More firms are exploring Bitcoin treasuries, viewing it as a hedge against inflation and a high-growth asset (source: BitGo’s guide on corporate Bitcoin strategies).

With this new flexibility, Strategy is better equipped than ever to continue its “accumulation machine” in 2026 and beyond—potentially timing larger purchases when Bitcoin prices offer the best value.

Bitcoin Treasury Adoption: A Strategic Guide for Corporate Leaders …

In a world where Bitcoin’s supply is fixed at 21 million coins, companies like Strategy are leading the charge in treating it as digital gold. This latest strategy tweak? It’s not slowing down—it’s fueling the next phase of growth.