Picture this: the crypto world buzzing with record highs just months ago, only for holiday cheer to turn into widespread worry as prices tumble sharply. In the final quarter of 2025, Bitcoin plunged over 22%, dragging the entire market down and evaporating more than $1 trillion in value—echoing the gut-wrenching drops seen during the 2018 bear market.

Bitcoin Crash 2025, The Crypto Cycle Repeats: A Road Map

The Sharp Drop That Shocked Investors

Bitcoin kicked off Q4 2025 on a high note, briefly touching around $126,000 in October. But momentum faded fast, with the price sliding to about $87,000 by Christmas. That’s a roughly 22% loss for the quarter, marking Bitcoin’s weakest year-end performance since the brutal 2018 crash (source: Coinglass data reported by CryptoRank and TheCryptoBasic).

This wasn’t just a small dip— it broke Bitcoin’s usual pattern of strong Q4 gains, where the average return since 2013 has been over 77%.

CoinStats – Bitcoin Price Just Had Its Worst Q4 Since 201…

How the Broader Crypto Market Felt the Pain

The fallout spread far beyond Bitcoin. Total crypto market capitalization crashed from over $4.1 trillion earlier in the year to around $2.9 trillion, a staggering $1+ trillion wipeout. Altcoins suffered even more, with many dropping 30-50% as panic selling kicked in.

This kind of broad liquidation reminded veterans of 2018, when fear gripped the market and values plummeted across the board.

Crypto News Today: Crypto Market Cap Drops to Eight-Month Low as …

What Triggered the 2025 Q4 Sell-Off?

Several factors piled up to fuel the decline. Overheated leverage from the summer rally led to massive liquidations—over $20 billion in positions wiped out. Demand cooled after the October peak, with retail traders taking profits and institutions pausing big buys.

Macro pressures, like shifting global interest rates and risk-off sentiment in traditional markets, added fuel. On-chain data showed “demand exhaustion” as a key driver (source: CryptoQuant reports).

Crypto Market Hit Hard in 2025 Liquidation Wave, but Is a Rebound …

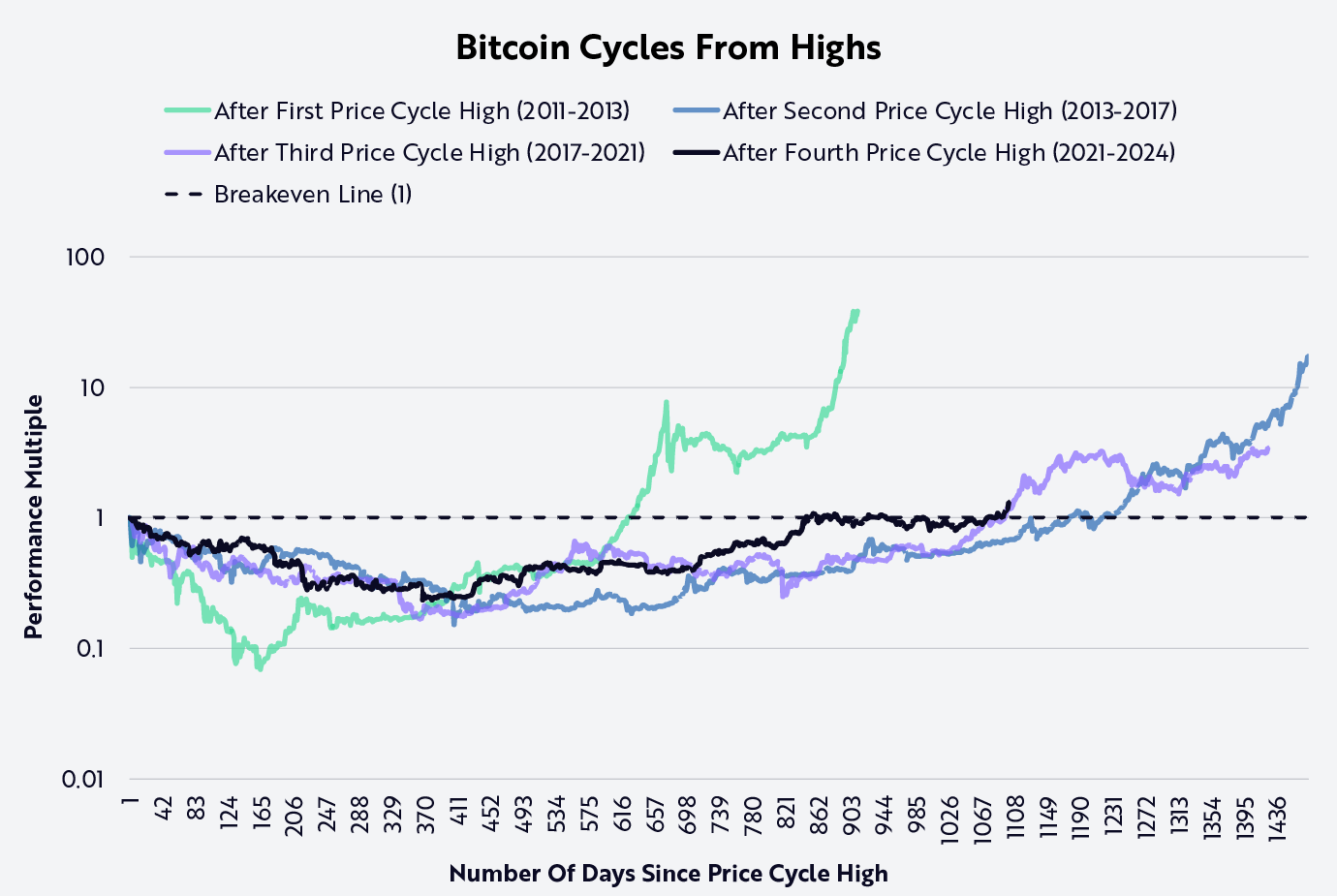

Echoes of 2018: Similarities and Differences

The 2018 Q4 saw Bitcoin lose over 42%, plunging into a prolonged crypto winter. This time, the drop is milder at around 22-23%, but the sudden shift from euphoria to fear feels familiar.

One big difference: institutions are more involved now, with spot Bitcoin ETFs holding steady despite outflows in some funds. Long-term holders aren’t dumping as aggressively (source: Glassnode and Grayscale Research insights).

Bitcoin Cycles, Entering 2025

Sentiment Hits Rock Bottom

The Crypto Fear and Greed Index plunged into “extreme fear” territory during the quarter, reflecting widespread pessimism among traders. Low volatility in late December offered little relief, as prices hovered in a tight range.

Yet history shows these fear extremes often mark turning points for savvy buyers.

Live Crypto Fear and Greed Index (Updated: Dec 24, 2025)

Reasons for Hope in 2026

Past Q4 losses have often led to strong rebounds. After similar dips in 2018 and 2022, Bitcoin surged in the following quarters—sometimes by 70% or more in Q1 alone.

With leverage mostly cleared out and fundamentals like ETF adoption still growing, many analysts see this as a healthy reset rather than the start of a deep bear market.

November 2025 Crypto Market Report: Bitcoin Price Analysis …

What This Means for Everyday Crypto Holders

For regular investors, sharp drops like this test patience but highlight crypto’s volatility. The 2025 Q4 slump wiped out gains for many, but it also created lower entry points.

Staying informed, avoiding heavy leverage, and focusing on long-term trends can help navigate these swings. As the market matures, such corrections may become opportunities for the next upward cycle.