What if a sharp Bitcoin correction in 2026 becomes the perfect opportunity to embrace everyday crypto tools that actually work in real life? As analysts debate potential dips amid post-bull cycle adjustments, projects like Digitap are quietly building bridges between traditional money and digital assets—offering seamless payments that don’t rely on Bitcoin’s price swings alone.

Navigating Bitcoin Volatility Heading Into 2026

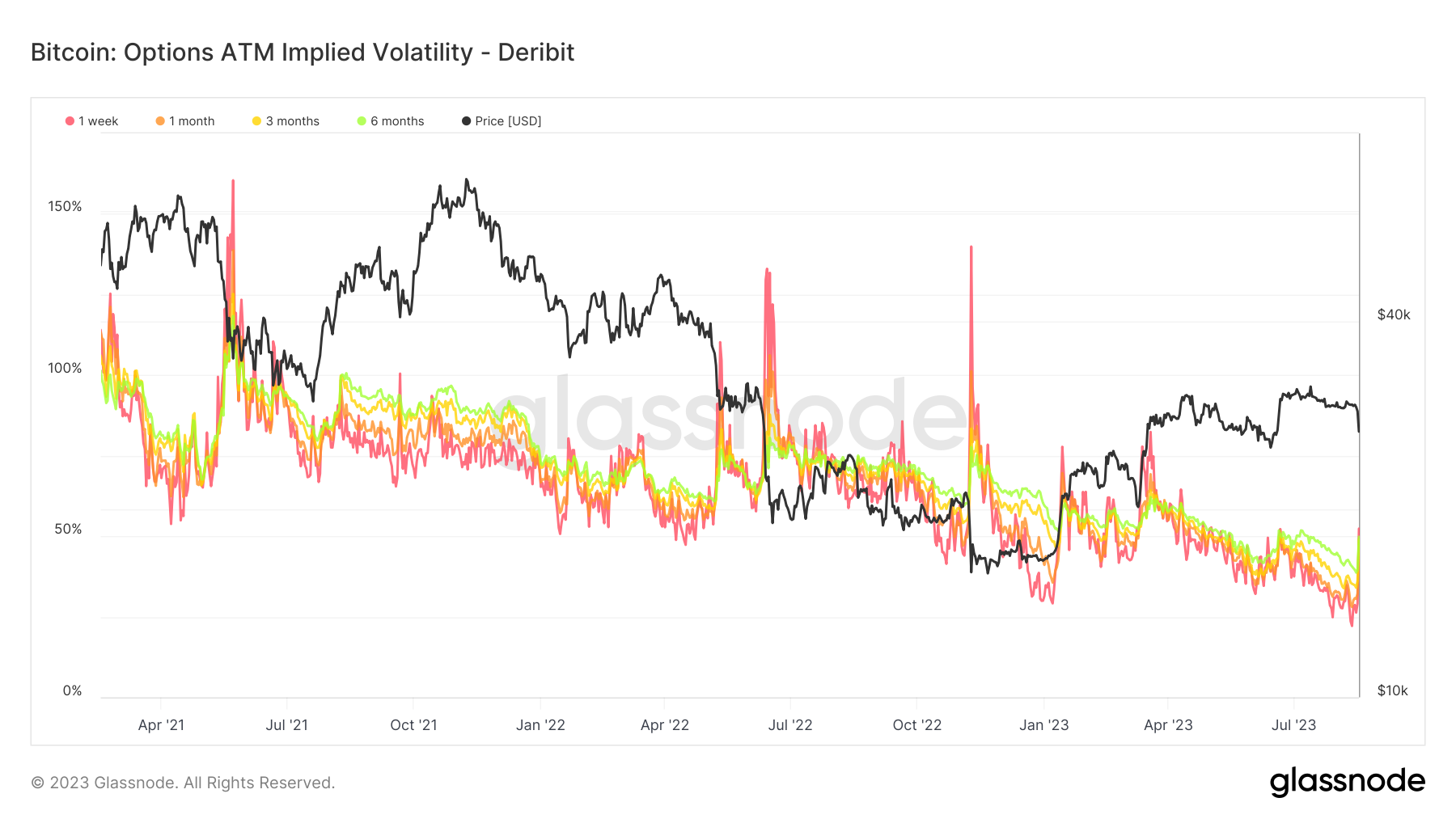

Bitcoin has shown remarkable resilience in late 2025, hovering around $88,000 despite brief pullbacks. However, some forecasts point to increased volatility in 2026, with possible corrections if institutional inflows slow or macroeconomic shifts occur.

Long-term models, including those factoring in halving cycles, generally remain bullish—projecting ranges from $150,000 to over $200,000 by year-end (source: Coinpedia Bitcoin Price Prediction 2025-2030). Yet, bearish scenarios from historical patterns suggest temporary dips could test lower supports, reminding investors that cycles often include consolidation phases.

Introducing Digitap: The Omni-Bank Revolution

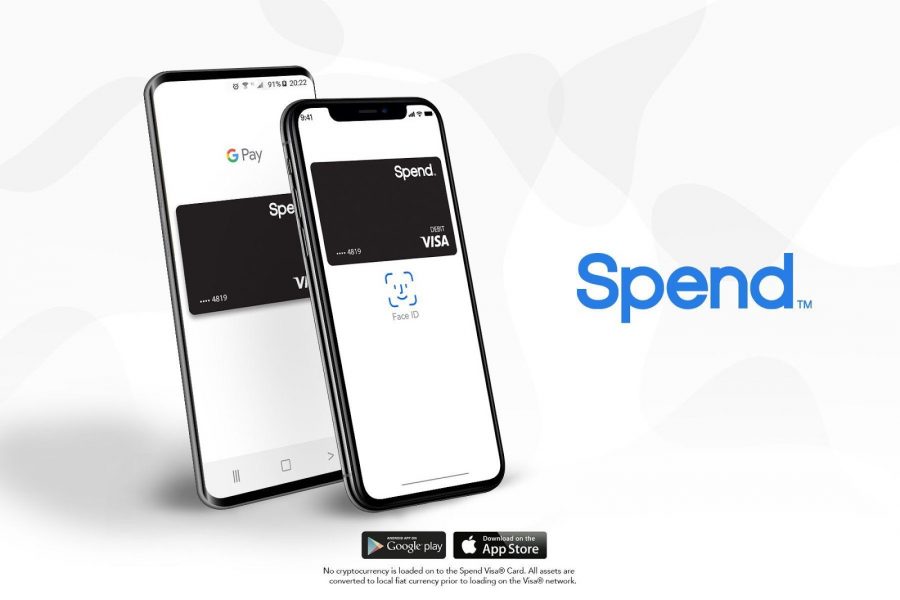

Digitap stands out by creating an “omni-bank”—a single platform where fiat currencies, stablecoins, and cryptocurrencies coexist without complicated swaps or multiple apps. Users can hold traditional money alongside digital assets, send transfers via SEPA/SWIFT or blockchain, and spend globally with a linked Visa card.

This hybrid approach solves a common frustration: crypto’s isolation from daily spending. With features like instant conversions and tiered accounts offering cashback in $TAP tokens, it’s designed for practical use, not just speculation (as highlighted in AMBCrypto’s 2025 presale analysis).

Core Features Making Everyday Crypto Possible

Digitap’s app, already live and available on major stores, includes:

- Support for 20+ fiat currencies and 100+ cryptos.

- Borderless payments with low fees.

- Physical and virtual Visa cards for real-world purchases.

- Staking and rewards powered by the $TAP token.

These elements create a closed-loop system where utility drives demand, potentially insulating value from pure market sentiment swings.

Why an Omni-Bank Model Thrives During Corrections

When Bitcoin experiences downturns, attention often shifts to projects with tangible benefits. Payment-focused ecosystems like Digitap gain traction because they enable spending crypto (or fiat equivalents) without selling at lows.

Industry observers note that maturing markets favor “PayFi” innovations—blending payments with decentralized finance—for stable growth in 2026 (trends discussed in BlockchainReporter’s payments race overview). Digitap’s deflationary mechanics, including fee buybacks and burns, add another layer of long-term appeal.

Quick Comparison: Utility vs. Volatility

| Aspect | Pure Speculative Assets (e.g., BTC in dips) | Omni-Bank Platforms like Digitap |

|---|---|---|

| Price Sensitivity | High—tied directly to market sentiment | Moderated by real usage and rewards |

| Daily Use Case | Limited to holding/trading | Spending, sending, earning |

| Risk in Corrections | Sharp declines possible | Potential steady adoption growth |

| Long-Term Driver | Cycle highs/lows | User onboarding and transactions |

The Road Ahead for Practical Crypto Adoption

As crypto evolves beyond hype cycles, seamless integration with traditional finance could define winners in 2026. Digitap’s focus on accessibility—no mandatory KYC for basic tiers, global reach—positions it to attract users seeking reliable tools regardless of Bitcoin’s trajectory.

With presale momentum building and a functional product already in use, it’s an example of how innovation continues even in uncertain times (per Coinpedia’s banking presale insights).

Crypto markets remain unpredictable, so always conduct your own research and consider risks carefully. But for those looking beyond short-term charts, omni-bank models offer a compelling vision of money’s future—one transaction at a time.