Forget the headlines screaming about Bitcoin’s wild swings—2025 has been a year where the original Layer 1 didn’t just survive; it redefined what “digital gold” means in a world of flashy rivals. With BTC hovering around $92,000 as December kicks off, it’s up roughly 74% from January lows, fueled by post-halving scarcity and ETF frenzy. But Bitcoin isn’t alone in the Layer 1 arena. Ethereum’s DeFi fortress, Solana’s speed demon, and Cardano’s steady climber are all vying for the crown. If you’re a regular investor wondering which chain could supercharge your portfolio, this breakdown cuts through the noise: real numbers, real stories, and zero fluff.

Bitcoin’s 2025 Rollercoaster: From Halving Hype to $120K Peaks

Bitcoin kicked off 2025 like a rocket, smashing past $100K in Q1 on the back of the April 2024 halving’s lingering buzz. That event slashed mining rewards to 3.125 BTC per block, tightening supply just as Wall Street piled in via spot ETFs. By September, BTC touched an all-time high of $115,970, a 30% yearly gain that left fiat holders green with envy.

What kept the momentum? Institutional cash—ETFs alone sucked in billions, turning BTC from speculative toy to treasury staple. Miners adapted too, with firms like Marathon ramping up hash power to 28.7 EH/s despite thinner rewards. Sure, there were dips: a May pullback to $105K amid profit-taking, but BTC bounced back, eyeing $130K by year-end per bullish forecasts.

Messari’s State of Crypto 2025 report nails it: Bitcoin’s “scarcity narrative” drove 40% of Layer 1 inflows this year, outpacing even AI-hyped tokens. For everyday holders, that’s meant steady staking yields around 4-5% via wrapped BTC on DeFi platforms—turning HODLing into actual income.

Ethereum: The DeFi Giant Still Standing Tall

Ethereum, the OG smart contract king, started 2025 strong with a $371B market cap and $70.6B TVL, commanding over 50% of DeFi’s locked value. But it wasn’t all smooth: ETH dipped 25% mid-year amid L2 scaling debates, trading at $4,273 by fall. Rollups like Optimism and Arbitrum saved the day, boosting TPS to 40K theoretically while keeping base-layer security intact.

The real win? Real-world assets (RWAs). Ethereum tokenized $11B in bonds and funds by Q4, per Messari, drawing BlackRock and Fidelity into the fold. Gas fees? Down 60% thanks to blob transactions from Dencun upgrade, making it wallet-friendly for normies swapping NFTs or lending stables.

Yet, challengers nipped at its heels. Ethereum’s energy use—still 99% greener than proof-of-work but higher than rivals—drew eco-critics. Still, with 35M ETH staked, it’s the Layer 1 for builders who want reliability over raw speed.

Solana: Speed Queen or Hype Machine?

Solana exploded in 2025, flipping BNB for 5th place with a $263 ATH and 150% YTD surge. Why? Blistering 65K TPS via Proof-of-History, handling 100M daily txns—think TikTok-fast trades without the lag. DeFi TVL hit $11.5B by November, fueled by DEXes like Jupiter and memecoin mania.

Phantom wallet downloads outpaced social apps, signaling mass appeal for retail users zapping USDC for coffee. But outages? Two in Q2, thanks to that single-shard design—critics called it “centralized speed.” Messari flags it as a risk, but Solana’s 263% app revenue capture ratio says users don’t care.

For you? If you’re into high-volume plays like perps trading, Solana’s your jam—fees under $0.01 beat ETH’s occasional spikes.

Cardano: The Patient Underdog’s Quiet Climb

Cardano played the long game in 2025, up modestly but with zero drama. ADA’s Ouroboros PoS guzzled just 0.5479 kWh per txn—greener than Polkadot’s yearly 0.8 GWh. TVL? Over $250M across 110+ dApps, focusing on enterprise stuff like supply chains in Africa.

A November split from a buggy txn? Fixed in hours, proving resilience. Adoption lagged—only 2K daily wallets vs Solana’s half-million—but peer-reviewed upgrades like formal verification won over devs wary of Solana’s crashes. Messari praises its “academic rigor” for RWAs, eyeing $1.50 ADA if TVL doubles.

It’s not sexy, but for risk-averse folks building voting apps or microfinance, Cardano’s your steady eddy.

Head-to-Head: Which Layer 1 Wins 2025?

No single champ—it’s about your vibe. Bitcoin’s the safe store-of-value bet, up 30%+ with ETF tailwinds. Ethereum dominates DeFi (93B TVL), but Solana steals speed crowns (11.5B TVL, 100M txns/day). Cardano? The eco-warrior for patient plays.

Here’s the snapshot from 2025 metrics:

| Layer 1 | Market Cap (Dec 2025) | TVL | YTD Performance | TPS (Avg) | Best For |

|---|---|---|---|---|---|

| Bitcoin | ~$1.8T | $6.4B | +74% | 7 | Store of value, hedging |

| Ethereum | $371B | $70.6B | -25% (mid-year) | 15-30 | DeFi, RWAs, NFTs |

| Solana | $150B+ | $11.5B | +150% | 65K | High-speed trading, memes |

| Cardano | $25B | $250M+ | +20% | 1K | Enterprise, sustainability |

(Data via CoinGecko, DeFiLlama, and Messari Q4 2025)

Bitcoin leads inflows (40% of L1 total), but Solana’s user growth (500K daily wallets) hints at retail takeover.

What’s Next? Your Playbook for Layer 1 Gains

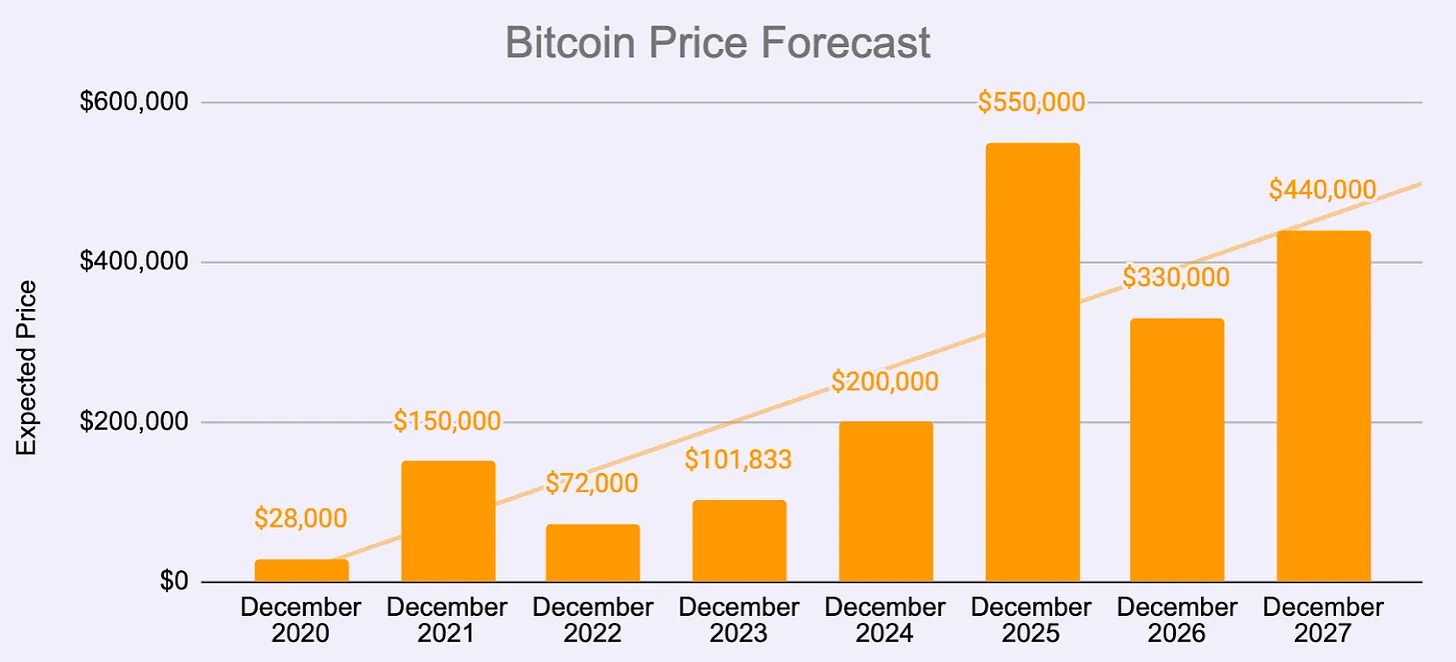

2025 showed Layer 1s aren’t zero-sum—Bitcoin’s halving scarcity lifted all boats, with Messari forecasting $4T total crypto cap by 2030 on RWA and AI waves. Risks? Regulation (watch SEC vs. Coinbase) and volatility—BTC could dip to $70K if rates spike.

Pro tip: Diversify across 2-3. Stake ETH for 4% yields, trade SOL perps, HODL BTC as inflation hedge. In a year of ETF billions and green chains, the real winner? You, staying informed.

(Updated December 9, 2025 – Fresh off Messari Theses and TVL spikes)