Deep in the underbelly of the digital world, where Bitcoin’s transparent ledger meets shadowy criminal intent, a nine-year shadow operation quietly funneled billions in dirty money. That all changed in late November 2025, when a swift, cross-border raid in Zurich pulled the plug on Cryptomixer—a notorious crypto tumbler that had laundered over $1.4 billion in illicit Bitcoin. This isn’t just another bust; it’s a wake-up call showing how Europe’s united front is turning the tide against crypto-fueled crime.

Unmasking Cryptomixer: The Silent Engine of Crypto Crime

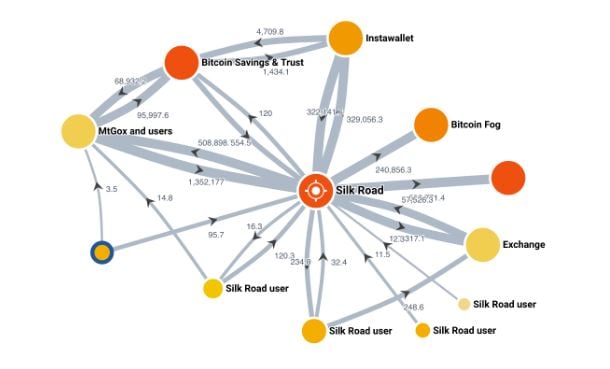

For nearly a decade, starting in 2016, Cryptomixer operated like a ghost in the machine. Accessible on both the regular web and the dark web, it promised users “privacy” by pooling their Bitcoin deposits with others, shuffling them around for random periods, and spitting out “clean” coins to new addresses. In reality, this tumbling process severed the blockchain’s traceable links, letting criminals cash out without a trail.

Investigators estimate it processed more than €1.3 billion ($1.4 billion) in Bitcoin tied to everything from ransomware extortion to darknet drug sales and weapons trafficking. “This wasn’t a fly-by-night scheme,” notes cybercrime consultant David Sehyeon Baek. “Its massive volume came from ransomware crews, fraud rings, and underground markets all betting on it as their go-to wash station.” By blending legit users with crooks, it blurred lines, but blockchain sleuths like Chainalysis had long flagged it as a red-hot risk.

What made Cryptomixer so sticky for bad actors? Bitcoin’s public ledger is a double-edged sword—great for transparency, terrible for hiding hacks or heists. Mixers like this one stepped in as the perfect middleman, charging a small fee to erase origins and dodge tools like forensic tracing that agencies use to follow the money.

The Raid That Lit Up the Dark Web

The hammer fell between November 24 and 28, 2025, in a high-stakes operation dubbed “Operation Shadow Wash.” Swiss police in Zurich, backed by German federal agents and Europol’s cyber experts, stormed data centers and seized the heart of the beast: three humming servers, the cryptomixer.io domain, over 12 terabytes of transaction logs, and a whopping €25 million ($27 million) in Bitcoin.

Eurojust, the EU’s judicial coordination hub, greased the wheels for this seamless takedown, proving that when borders blur for crime, they can unite against it too. The seized data isn’t just trophies—it’s a goldmine. Those 12TB include user lists, flow patterns, and wallet IDs that could unravel dozens of linked schemes, from Eastern European fraud farms to ransomware ops in Asia.

This wasn’t luck; it stemmed from months of grinding intel. Europol’s Innovation Lab used AI to sift dark web chatter, while firms like Elliptic mapped on-chain flows back to real-world busts. In one fell swoop, Europe’s latest crackdown didn’t just pause a ring—it froze its arteries.

Why This Bust Hits Harder Than Before

Europe’s crypto crackdowns aren’t new—remember the 2023 ChipMixer shutdown that clawed back billions? But Cryptomixer’s fall feels seismic because it exposes a maturing playbook. Regulators aren’t swinging blindly anymore; they’re wielding data-driven precision, fueled by MiCA’s anti-laundering mandates that demand exchanges flag mixer-tainted coins.

For the everyday Bitcoin holder, this means cleaner waters. Legit traders worried about “guilt by association” can breathe easier, as delisted mixers force even shady players toward traceable paths. Yet experts like Baek warn: “Criminals adapt fast. Expect a surge in decentralized mixers or cross-chain hops to places like privacy coins.” Darknet buzz is already shifting to backups, but the data haul from this raid could preempt that.

Globally, it’s a ripple: U.S. agencies, who chipped in intel, might tighten their own mixer bans, echoing sanctions on Tornado Cash. As Europol’s report underscores, crypto crime hit €15 billion in 2024 alone—stopping one hub like this could save millions in victim restitution.

Lessons for the Little Guy in a Big Bad Blockchain World

If you’re a regular Joe stacking sats or just curious about crypto, this story’s got takeaways sharper than a private key. First, skip the mixers—they’re now neon signs for scrutiny. Opt for regulated exchanges with built-in compliance, like those waving MiCA badges.

Second, arm yourself with basics: Use hardware wallets for storage, enable multi-sig for big moves, and peek at tools like Chainalysis’ reactor demos to see how traces work. This bust reminds us: Bitcoin’s strength is its openness, but that invites watchdogs too.

Finally, it’s proof positive that good guys are catching up. What started as wild-west finance is evolving into a guarded garden—safer for you, thornier for thieves.

Looking Ahead: A Cleaner Crypto Horizon?

The Cryptomixer curtain call isn’t the end—it’s a chapter in Europe’s escalating war on digital dirty money. With seized intel feeding probes worldwide, expect more collars: from ransomware decoders to darknet dealers. But as platforms innovate faster than regulators, the chase continues.

For now, celebrate the win. A $1.4 billion beast is down, wallets are safer, and the message is loud: In Europe’s backyard, crime doesn’t pay—in Bitcoin or otherwise. Stay vigilant, trade smart, and watch how this bold move reshapes the blockchain’s battle lines.

Based on reports from Europol, Reuters, and CoinDesk as of December 7, 2025.