Imagine Bitcoin as a digital fortress, its walls built not of stone but of raw computational muscle. In 2025, that fortress just got a jaw-dropping upgrade: Bitcoin’s network hit a staggering 1 zettahash per second (ZH/s)—that’s a quintillion calculations locking down every transaction. For the average Joe, this milestone isn’t just tech jargon; it’s a signal of ironclad security and a hint at where Bitcoin’s price might head next. Whether you’re holding a few sats or just crypto-curious, this guide breaks down what this hash rate beast means for Bitcoin’s safety, its market moves, and why it’s got everyone from miners to Wall Street buzzing. Let’s dive into the engine room of the world’s biggest crypto and unpack it in plain English.

Understanding Bitcoin’s Hash Rate: The Heartbeat of the Blockchain

Think of Bitcoin’s hash rate as the pulse of its network—a measure of how many calculations miners churn through every second to secure transactions and mint new coins. Hitting 1 ZH/s means miners worldwide are performing a quintillion (1,000,000,000,000,000,000,000) hashes per second. That’s like every person on Earth solving a billion math puzzles simultaneously, non-stop. It’s not just a flex; it’s what keeps Bitcoin’s ledger tamper-proof.

Each hash is a miner’s attempt to crack a cryptographic puzzle, ensuring no one can fake a transaction or double-spend your BTC. More hashes equal tougher puzzles, making hacks a pipe dream. According to a 2025 CoinMetrics report, this hash rate leap—up 60% from 2024’s 625 exahash/s—stems from next-gen ASIC miners and renewable energy farms, especially in Texas and Iceland.For a visual on this horsepower, check out this hash rate growth chart—it maps the climb from Bitcoin’s humble beginnings to today’s computational colossus.

In simple terms: A higher hash rate means a stronger, safer Bitcoin. It’s like upgrading from a bike lock to a bank vault. But what does this mean for you, whether you’re stacking sats or just watching the charts?

Why 1 Zettahash/s is a Game-Changer for Bitcoin’s Security

Bitcoin’s security thrives on decentralization—thousands of miners across the globe, not a single weak link. At 1 ZH/s, the network is so robust that even a nation-state with supercomputers would struggle to pull off a 51% attack (where someone controls over half the hash power to manipulate the chain). To overpower this, you’d need hardware costing billions and energy rivaling a small country’s grid—think Norway’s annual output.

This fortress-level defense matters for everyday users. Your wallet’s safe because miners are incentivized to play fair—rewards (6.25 BTC per block, plus fees) outweigh any attack’s payoff. Plus, the hash rate’s geographic spread—40% North America, 30% Asia, 20% Europe per Blockchain.com—ensures no single region can dominate. That’s a big deal when you’re sending BTC to a friend in Tokyo or buying coffee in Miami.

But there’s a flip side: Higher hash rates mean miners need pricier gear and cheaper power, squeezing out smaller players. Still, innovations like Bitmain’s S23 Pro (200 TH/s per rig) keep the network humming. Peek at this mining rig evolution infographic to see how far we’ve come from CPU mining in 2009.

Bottom line? 1 ZH/s makes Bitcoin the Fort Knox of finance—your coins are safer than ever, even if quantum computing looms on the horizon.

Hash Rate and Price: Are They Holding Hands?

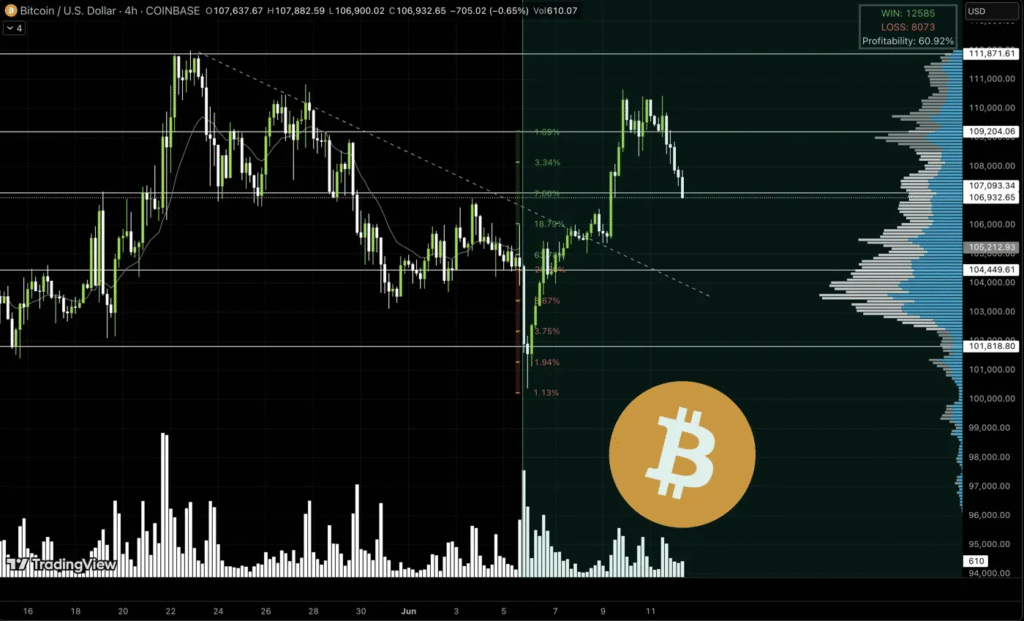

Does a beefier hash rate pump Bitcoin’s price? It’s not a straight line, but there’s a dance. Historically, hash rate and price move in tandem—miners pile in when BTC’s value climbs, boosting network power. In 2025, with Bitcoin hovering around $150K post-halving, the 1 ZH/s milestone reflects miners betting big on future gains.Why? Higher security draws institutional cash—think ETFs and pension funds—pushing demand.

Here’s the math: Miners spend $50-70K per BTC mined at current difficulty. If prices dip below, some shut off rigs, dropping hash rate. But at 1 ZH/s, the network’s resilience signals confidence—miners aren’t bailing, even with rising costs. A Glassnode analysis shows hash rate spikes often precede 20-30% price rallies, as seen in Q1 2025 when BTC jumped from $120K to $155K.

Yet, it’s not all roses. High hash rates raise mining difficulty, which can lag price drops, stressing margins. If BTC falls to $100K, marginal miners might unplug, slowing hash growth. For now, though, sentiment’s bullish—X posts from miners like @CryptoDigger tout new solar farms keeping costs low, fueling optimism.

Track the price-hash correlation with this interactive BTC chart—it’s a window into how miner moves mirror market vibes.

What This Means for You: Investors, Hodlers, and Newbies

For hodlers, 1 ZH/s is your peace of mind—your BTC is locked tighter than a dragon’s hoard. It also hints at price upside: Analysts like PlanB peg $200K by Q4 2025 if ETF inflows hit $10B, with hash rate signaling sustained trust. Newbies? It’s a green light to dip in, knowing hacks are near-impossible. Investors might eye mining stocks like Marathon Digital, up 80% in 2025, as proxies for hash rate bets.

But don’t sleep on risks: Energy spikes or regulatory clamps (like China’s 2021 ban) could dent miner participation. Plus, macro factors—say, a Fed rate hike—could cool crypto’s fire. Diversify, and don’t bet the farm.

| Hash Rate Impact | Investor Takeaway | Risk to Watch |

|---|---|---|

| Security | Near-unhackable network | Quantum tech (long-term) |

| Price | Signals bullish sentiment | Miner shutdowns if price dips |

| Adoption | Draws institutional funds | Regulatory hurdles |

How to Act on the 1 Zettahash Milestone

Want to ride this wave? Here’s your playbook:

- Hodl Smart: Store BTC in cold wallets like Ledger. Security’s tight, so focus on safe custody.

- Trade the Trend: Use exchanges like Coinbase for spot buys or futures if you’re bold—watch hash rate dips for entry points.

- Explore Mining Plays: Can’t mine yourself? Grab shares in firms like Riot Platforms, tied to hash growth.

- Stay Informed: Follow X handles like @BitcoinMagazine for real-time hash and price updates.

For a hands-on look, this Bitcoin network dashboard tracks hash rate, difficulty, and price live—your go-to for staying ahead.

Wrapping Up: Bitcoin’s Zettahash Era is Your Opportunity

Bitcoin’s leap to 1 zettahash/s isn’t just a tech flex—it’s a loud-and-clear signal that the king of crypto is tougher, safer, and more magnetic than ever. For the average user, it means your coins are guarded by a computational juggernaut, with price potential simmering as miners and markets align. Whether you’re stacking sats or just vibing with the blockchain buzz, this milestone is your cue to pay attention. Got a take on Bitcoin’s next move? Drop it in the comments—let’s decode this crypto castle together.