Picture this: In a world where your phone’s AI assistant feels smarter every day and digital currencies power everyday transactions, one venture capital powerhouse just loaded up with enough cash to fuel the next wave of innovations. Andreessen Horowitz, or a16z as it’s commonly known, announced a massive $15 billion-plus fundraising haul on January 9, 2026—right as the tech sector shakes off past uncertainties and charges forward. This isn’t just about big money; it’s a signal that crypto and other cutting-edge tech are evolving from wild experiments to reliable building blocks for the future.

Breaking Down the Billion-Dollar Bet

At the heart of this raise is a strategic spread across multiple funds, each targeting areas poised for explosive growth. The firm’s Growth fund alone snagged $6.75 billion, aimed at scaling up promising startups into industry giants. Then there’s $1.7 billion each for Apps and Infrastructure, focusing on software that powers everything from social apps to cloud systems. Bio + Health got $700 million for advancements in medicine, while American Dynamism pulled in $1.176 billion to boost sectors like defense and manufacturing. Rounding it out, $3 billion goes to other venture plays.

This haul represents over 18% of all venture capital raised in the U.S. in 2025, underscoring a16z’s heavyweight status in the investment world. For the average person, think of it like this: These funds are like seeds planted in fertile soil, potentially growing into technologies that make healthcare cheaper, AI more helpful, and online security tighter.

Andreesen Horowitz (a16z) SF Office in San Francisco (Divco West …

Crypto Strategies: From Hype to Heavyweight

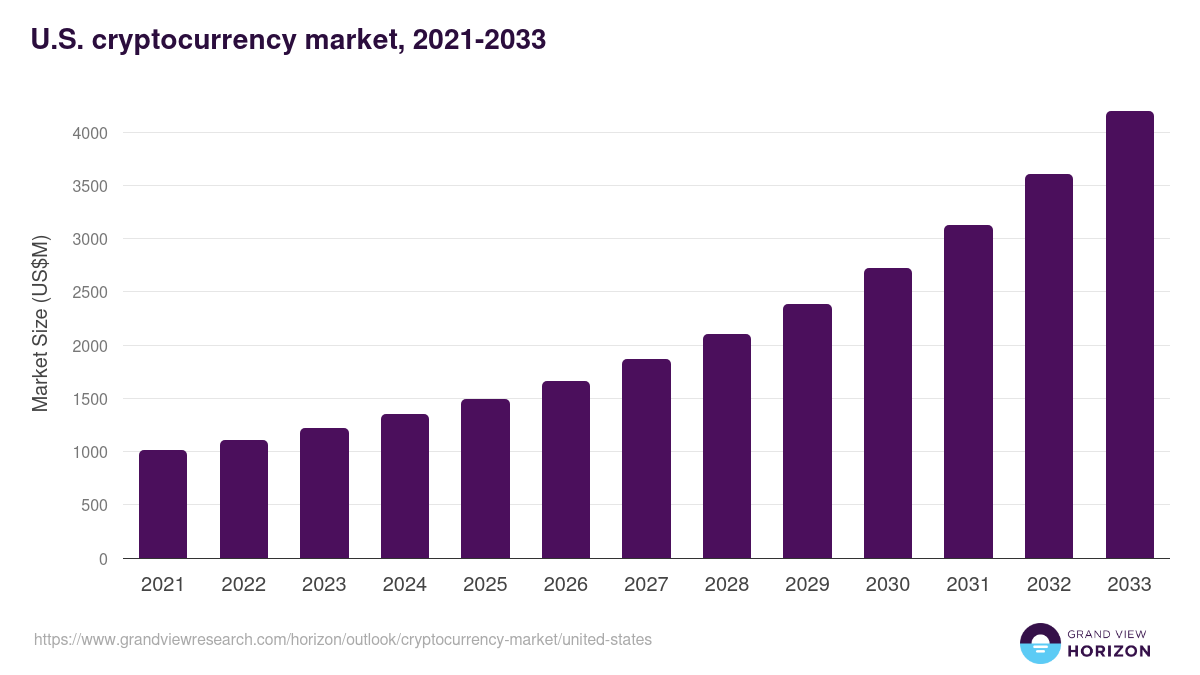

Crypto isn’t getting its own dedicated slice this time, but it’s woven deeply into a16z’s vision. Since 2018, the firm has poured over $7 billion into blockchain and crypto projects, backing big names like Coinbase, Solana, and Uniswap. Now, as strategies mature, a16z sees 2026 as a year where crypto shifts beyond just tokens—focusing on prediction markets, cryptographic proofs, and privacy tools that could make global finance more secure and open.

Why the maturity? Recent investments, like a $15 million stake in Babylon to turn Bitcoin into collateral, show a push toward practical uses. For everyday readers, this means crypto could soon handle things like cross-border payments without the volatility scares of the past, making it as straightforward as using a debit card.

The United States Cryptocurrency Market Size & Outlook, 2033

The Broader Impact: Fueling American Innovation

Co-founder Ben Horowitz frames this raise as a patriotic play: “Ensuring America wins the next 100 years of technology.” With global rivals like China ramping up in AI and tech, a16z is betting big on U.S.-led breakthroughs in biology, defense, education, and entertainment. This comes amid a 2025 VC boom, where North American startups raked in $280 billion, much of it in AI.

For the non-expert, it’s exciting because these investments could trickle down to real-life perks—like AI agents that manage your finances autonomously or biotech fixes for common health issues. But it’s not without risks; venture capital is speculative, and not every bet pays off.

Andreessen Horowitz says it will donate to political candidates

What’s Next in 2026 and Beyond

Looking ahead, a16z highlights privacy-preserving tech as a 2026 pillar, arguing it’s key for crypto to go mainstream in finance. The firm also eyes AI-crypto combos, like autonomous agents transacting on blockchains. With regulatory winds shifting favorably in the U.S., this could accelerate adoption.

In a nutshell, this fundraising isn’t just numbers on a page—it’s a roadmap for tech’s next chapter. Whether you’re a casual investor or just someone who loves gadgets, keeping an eye on a16z’s moves could clue you in to tomorrow’s big trends. As the firm puts it, it’s time to build for a flourishing future.

Crypto & Blockchain Venture Capital – Q1 2025 | Galaxy