Have you ever watched Solana (SOL) or XRP swing 10-20% in a single day and wondered what’s really driving those wild rides? In early 2026, both tokens have shown sharp ups and downs amid broader market caution, liquidation events, and shifting investor sentiment. At the same time, a newer fintech-crypto project called Digitap has rolled out a key Solana integration in its banking app, sparking fresh discussions about utility, speed, and how everyday platforms might influence token behavior. This article breaks down the main reasons behind SOL and XRP’s price turbulence in simple terms, then explains how Digitap’s recent update fits into the bigger picture—without hype, just clear facts for anyone curious about crypto’s daily rollercoaster.

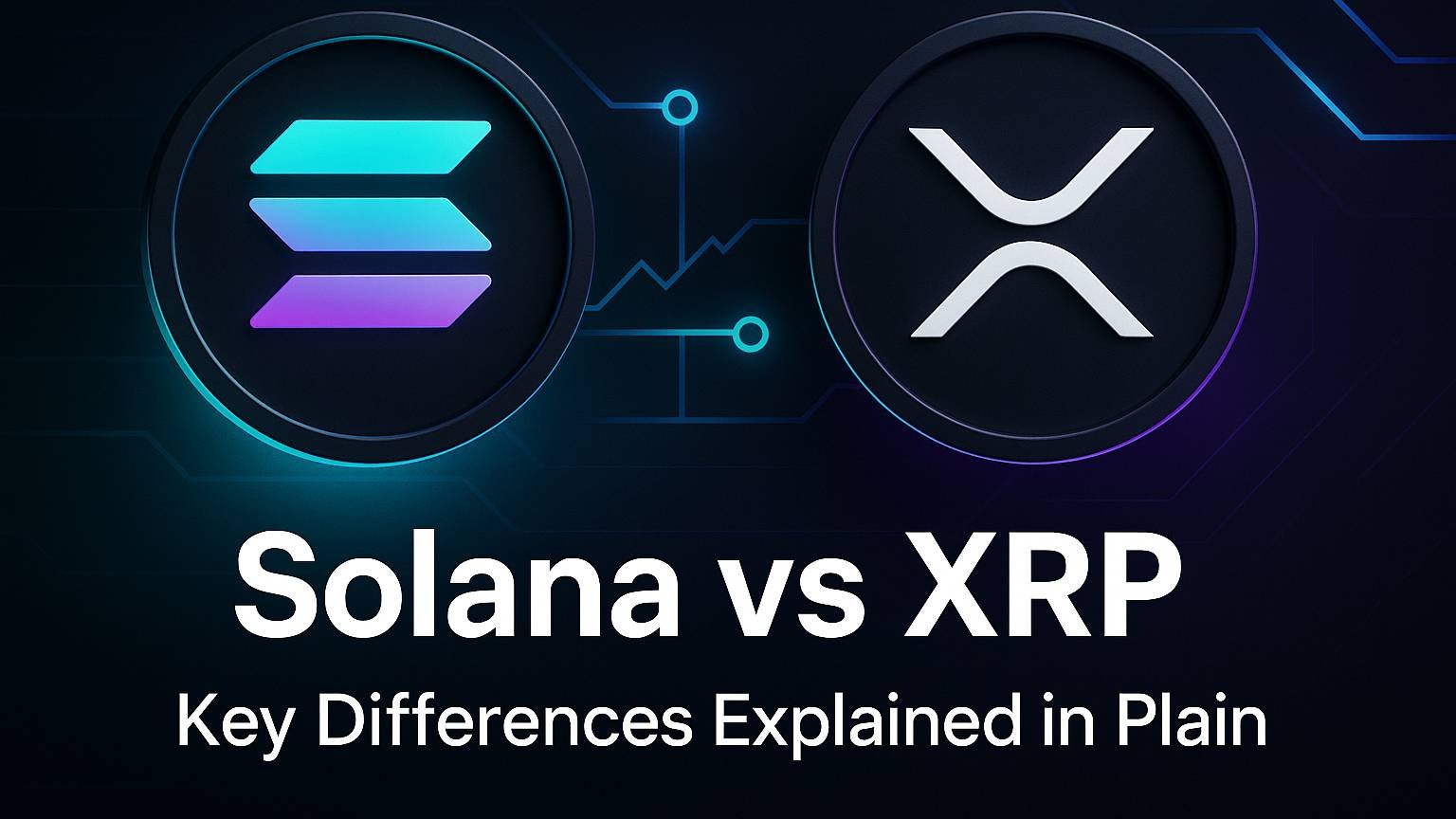

XRP & SOL 60D Volatility Breaks 100%: How BTC, DOGE Stack

This historical 60-day volatility chart shows how SOL and XRP often spike higher than major coins like Bitcoin, highlighting their amplified price swings.

What Makes Cryptocurrencies Like SOL and XRP So Volatile?

Volatility means big, fast price changes—often much larger than traditional stocks or currencies. SOL and XRP tend to move more dramatically than Bitcoin because of smaller market sizes, higher leverage in trading, and specific news triggers.

For Solana, network upgrades, developer activity, and retail enthusiasm can push prices up quickly, but any hint of outages (even past ones) or broader risk-off sentiment leads to sharp drops. Recent data shows SOL facing increased short positions and negative funding rates in derivatives markets, amplifying downward pressure during weak periods (source: Coinglass derivatives metrics, early February 2026 reports).

XRP’s story ties closely to regulatory headlines. Ongoing developments around Ripple’s legal matters, potential clarity from laws like the CLARITY Act, or institutional flows create binary outcomes—big jumps on positive news, steep falls on uncertainty or delays.

Both tokens also suffer from lower liquidity compared to Bitcoin, meaning smaller trades can cause outsized moves. When fear dominates (as seen in low Fear & Greed Index readings), leveraged positions get liquidated in cascades, worsening swings.

XRP Hits a Wall, Solana Slips, and Pump Puffs Its Chest: Analysis …

A daily price chart example for XRP captures the kind of sudden spikes and drops driven by news and trading activity.

Key Factors Driving SOL Volatility in 2026

Solana remains one of the fastest Layer-1 blockchains, attracting high transaction volumes in DeFi, gaming, and payments. But that speed comes with risks:

- Leverage and Liquidations — High open interest in perpetual futures means small price moves trigger mass liquidations, creating feedback loops.

- Market Sentiment Shifts — When broader crypto risk appetite fades (e.g., Bitcoin corrections), SOL often underperforms due to its growth-oriented positioning.

- Competition and Upgrades — While features like the Alpenglow upgrade promise better performance, any delays or competition from other chains can spark sell-offs.

Analysts note SOL’s wide price forecast ranges ($120–$800 in some AI models) highlight this dual nature—huge upside potential paired with elevated drawdown risk (source: AI price model compilations, January 2026).

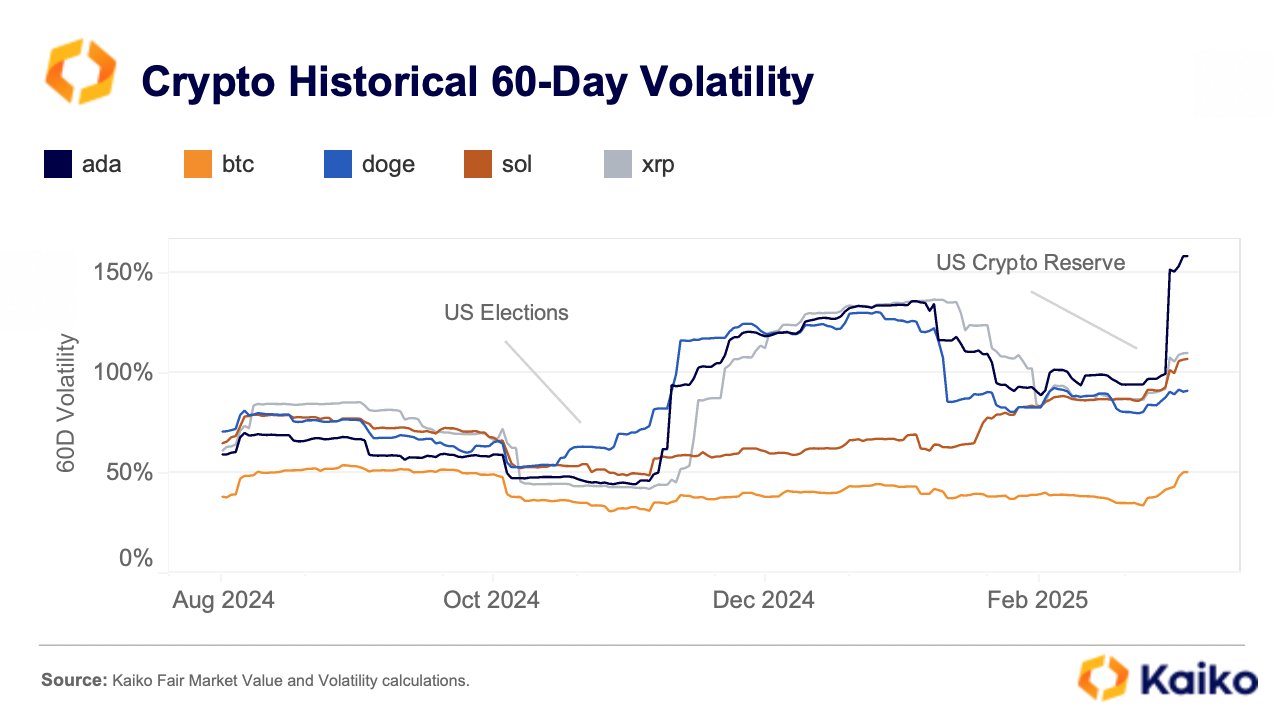

Can the Solana crypto price Hold the Line Around $100 or Is a …

This longer-term SOL/USDT chart from Binance illustrates the rollercoaster pattern, with peaks followed by deep corrections typical of altcoin volatility.

Why XRP Experiences Similar (But Different) Swings

XRP’s volatility stems more from external catalysts than pure tech factors:

- Regulatory Sensitivity — News on SEC cases, global adoption, or payment partnerships can cause 20%+ moves in hours.

- Institutional Flows — ETF speculation or bank integrations drive rallies, but reversals hit hard when momentum stalls.

- Supply Dynamics — Large holdings by Ripple and escrow releases influence perceived scarcity.

Combined with general altcoin beta (amplifying Bitcoin’s moves), XRP often sees exaggerated reactions to macro events like rate expectations or market fear.

Ripple Celebrates A Decisive Legal Victory Over The SEC – Cointribune

Illustrative artwork depicting Ripple’s legal battles with the SEC, a frequent trigger for XRP’s sharp price movements.

Introducing Digitap: A Bridge Between Crypto and Everyday Banking

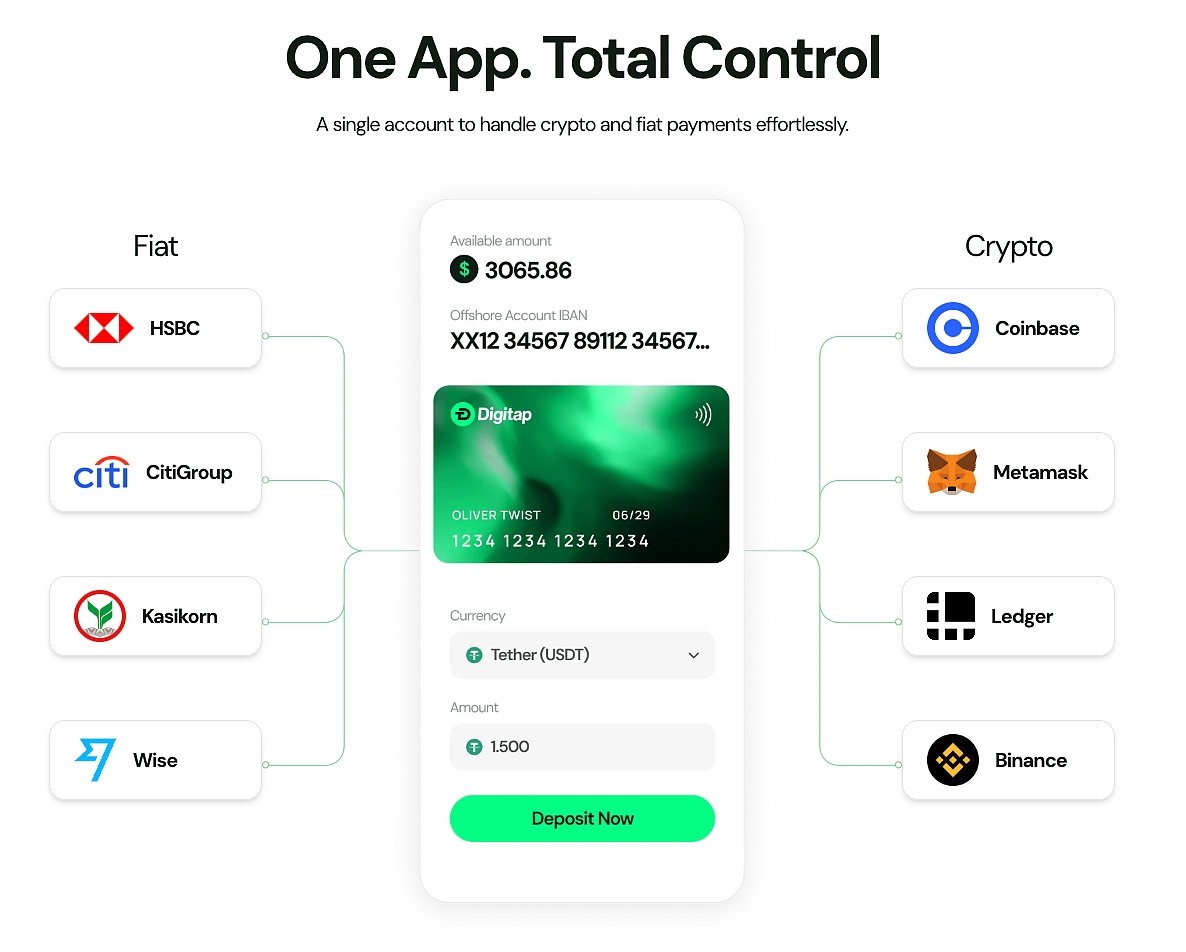

Digitap is building an “omni-bank” mobile app that merges traditional banking tools (like multi-currency accounts, global transfers, and debit cards) with crypto features (wallets, swaps, and direct blockchain support). Its goal: make digital assets usable for real-life spending without constant manual conversions.

The platform supports deposits in fiat and crypto, offers Visa-backed debit cards for tap-to-pay at millions of merchants, and emphasizes low fees for cross-border payments. Users can hold stablecoins and major tokens while earning yields or automating transfers.

Digitap ($TAP) to Smash $2.00 as Bear Market Intensifies: Best …

A conceptual view of Digitap’s all-in-one app interface, showing seamless connections between fiat banks, crypto wallets, and payment options.

Digitap’s Recent Solana Integration: What It Actually Does

In recent weeks, Digitap announced its Solana integration is live. This means users can now deposit SOL, USDT, and USDC directly from the Solana network into their Digitap wallets.

Why does this matter?

- Speed and Cost — Solana’s near-instant finality and tiny fees make topping up accounts practical for frequent use.

- Easier Onboarding — No need for complex bridges; Solana ecosystem users fund their banking profile seamlessly.

- Broader Utility — It positions Digitap as a multi-chain hub (with Ethereum and Bitcoin integrations planned), potentially increasing real-world adoption of tokens like SOL.

Solana Wallet App | SOL Wallet For Desktop And Mobile | Atomic Wallet

An example of a crypto wallet dashboard supporting Solana deposits, similar to Digitap’s integrated banking-wallet experience.

How Platform Integrations Like This Could Influence Future Volatility

While short-term price swings come from trading dynamics, long-term utility from projects like Digitap may reduce extreme volatility by driving consistent demand. When people use SOL for fast, cheap deposits into banking apps, it creates organic buying pressure beyond speculation.

That said, crypto remains risky—prices can drop sharply regardless of fundamentals. Always research thoroughly, use only what you can afford to lose, and consider diversification.

Understanding Solana: A Beginner’s Guide to the High-Performance …

A graphic overview of Solana’s key strengths like high speed and low fees, which make integrations like Digitap’s particularly appealing.

Final Thoughts

SOL and XRP’s volatility in 2026 boils down to leverage, news sensitivity, liquidity differences, and market mood swings—common traits for altcoins chasing growth. Digitap’s Solana integration shows an exciting direction: turning fast blockchains into everyday financial tools rather than just speculative assets.

For regular users, this evolution could mean smoother crypto experiences ahead. Keep an eye on how real-world integrations develop—they often tell more about a token’s staying power than daily charts alone. Stay informed, trade responsibly, and enjoy the journey through crypto’s evolving landscape.