It’s a head-scratcher for many: one company sits on over 713,000 Bitcoin—roughly 3.4% of all that will ever exist—yet reports a staggering $12.4 billion quarterly net loss. Strategy (formerly MicroStrategy, ticker MSTR) made headlines in early February 2026 with its Q4 2025 earnings, showing massive Bitcoin holdings alongside eye-watering red ink. This isn’t a sign of collapse; it’s the result of a bold, long-term bet on Bitcoin combined with new accounting rules that force unrealized price drops onto the books right away.

For everyday investors and crypto watchers, this paradox highlights how Strategy turns volatility into strategy. Here’s a clear breakdown of how the company amassed such a huge stash, why the loss appeared, and what it means moving forward—explained simply, with facts from official reports and market data.

Strategy’s Bitcoin Treasury: Building the World’s Largest Corporate Stack

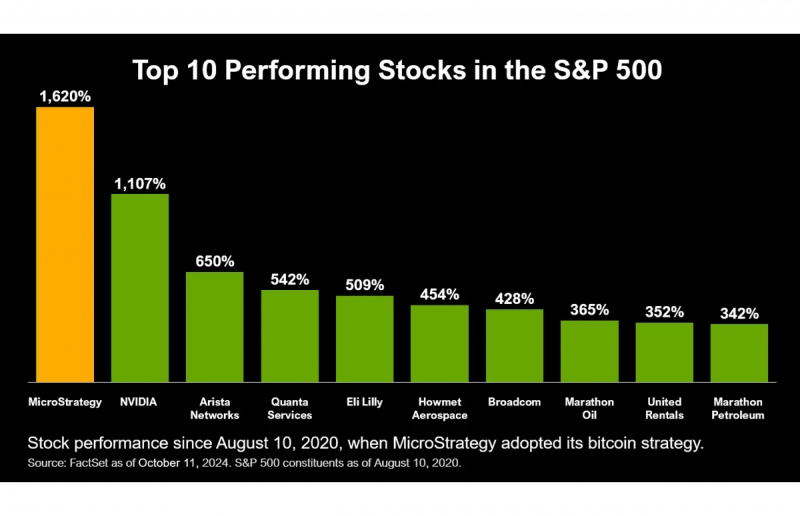

Strategy pioneered the corporate Bitcoin treasury model back in 2020, treating Bitcoin as a primary reserve asset instead of cash. By February 1, 2026, it held 713,502 BTC, acquired at an average cost of about $76,052 per coin for a total investment of roughly $54.26 billion.

This makes Strategy the biggest corporate Bitcoin holder, outpacing even major ETFs in sheer volume. Recent buys—like 41,002 BTC added in January 2026 alone—show the company doubling down during dips, funded through stock sales, convertible debt, and other capital raises (totaling $25.3 billion in 2025).

The goal? Increase “Bitcoin per share” over time, creating what executives call a “digital fortress” for long-term value.

The $12.4 Billion Loss Explained: It’s Mostly “Paper” from Accounting Changes

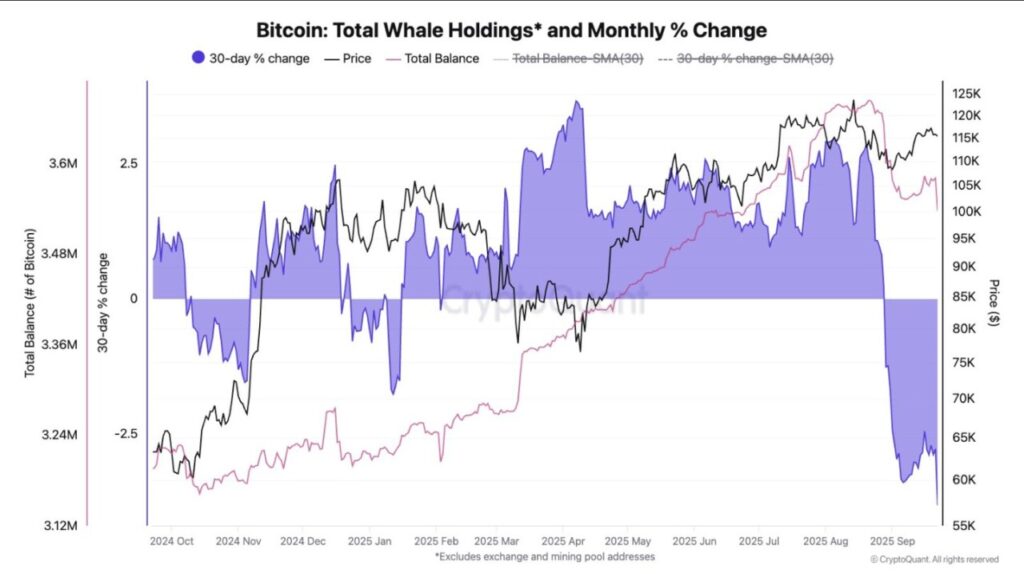

The headline-grabbing $12.4 billion net loss (or $42.93 per diluted share) for Q4 2025 stems almost entirely from Bitcoin’s price drop during the quarter. Bitcoin fell sharply from highs around $120,000–$126,000 in October to lower levels by year-end, triggering massive unrealized losses.

Key point: Starting in 2025, Strategy adopted fair value accounting for digital assets (per new U.S. rules). This means quarterly reports must mark holdings to current market prices, booking any drop as an immediate loss—even if no Bitcoin is sold.

In Q4 alone, this created about $17.4 billion in unrealized digital asset losses, driving the operating loss and flowing through to the $12.4 billion net figure. Previous years used a “cost-less-impairment” model that only recognized permanent declines, so losses looked smaller.

As Strategy’s official earnings release states, these are non-cash adjustments tied to market swings, not operational failures (Strategy Inc., February 5, 2026 earnings report).

How Strategy Keeps Buying Despite the Red Ink

The company doesn’t sell Bitcoin to fund purchases—instead, it raises fresh capital when stock or debt markets allow. In 2025, Strategy was the top U.S. public equity issuer, using proceeds to buy more BTC.

It also introduced tools like STRC (a variable-rate preferred stock acting as “digital credit”) to amplify exposure while managing liquidity. A $2.25 billion cash buffer covers interest and dividends for years ahead.

Executives emphasize a long horizon: Chairman Michael Saylor has called for holding through downturns, viewing temporary paper losses as part of building Bitcoin yield (growth in BTC holdings relative to shares).

Even with Bitcoin dipping below the average cost basis temporarily, the firm continued aggressive accumulation into 2026.

What This Means for Investors and the Bigger Picture

Strategy’s model ties its fate closely to Bitcoin’s price—stock moves often mirror BTC trends amplified by leverage. The $12.4 billion loss shocked markets and sent shares lower, but it’s not cash burned; it’s an accounting reflection of volatility.

For believers in Bitcoin’s long-term rise, this setup offers leveraged exposure without directly holding crypto. Critics point to risks like dilution from capital raises or extreme downside scenarios (e.g., a 90% BTC crash could strain debt coverage).

As of early February 2026, holdings remain intact at 713,502 BTC, with no sales reported. The company frames these periods as tests of conviction in its “indefinite Bitcoin horizon.”

Bottom Line: Patience in a Volatile Strategy

Strategy can hold—and keep growing—such a massive Bitcoin position because its playbook relies on capital markets access, not short-term profits from sales. The $12.4 billion loss is real on paper but driven by temporary price action under new fair value rules, not core business collapse.

Whether this approach pays off depends on Bitcoin’s future path. For now, it stands as a unique case study in corporate crypto adoption: bold, leveraged, and unapologetically long-term. If you’re watching crypto treasuries or MSTR stock, track Bitcoin trends closely—they dictate the story more than any quarterly report.