In a year when crypto markets showed both volatility and resilience, one player stood out not for wild price swings, but for quiet, massive profitability. Tether, the company behind the dominant stablecoin USDT, closed 2025 with net profits exceeding $10 billion — a figure that rivals some of the biggest traditional financial institutions — while pushing its USDT circulating supply to an all-time high of over $186 billion. This wasn’t luck; it came from a simple yet powerful business model that turned global demand for digital dollars into steady, interest-earning cash flow.

Iran Shows Why America’s Embrace of Stablecoins Is a Double-Edged …

What Makes Tether’s Business So Profitable?

At its core, Tether issues USDT, a stablecoin designed to stay pegged at $1 per token. Every time someone buys USDT (often with real dollars), Tether adds that money to its reserves and mints new tokens. Those reserves aren’t sitting idle — they’re invested in low-risk, high-yield assets like U.S. Treasury bills.

This setup is like running a giant savings account for the crypto world. When interest rates stay elevated (as they did through much of 2025), the returns add up fast. Tether earns interest on billions of dollars without taking big risks, leading to huge profits. According to the company’s Q4 2025 attestation by independent auditor BDO Italy, total reserve assets reached nearly $193 billion, backing the issued tokens with a comfortable buffer of $6.3 billion in excess reserves (Tether, 2025 attestation report).

The result? Over $10 billion in net profit for the year, even though it was down from the record $13 billion in 2024 due to strategic reserve buildup and diversification.

The Record-Breaking Growth in USDT Supply

USDT supply didn’t just grow — it exploded by about $50 billion in 2025 alone, hitting a peak above $186 billion in circulation. This surge reflects real-world adoption, especially in places where traditional banking is limited or expensive.

People in emerging markets use USDT for everyday transactions, remittances, or as a hedge against local currency instability. Traders rely on it for quick moves between cryptocurrencies without converting to fiat. As crypto ecosystems expanded, so did the need for a reliable digital dollar — and Tether filled that gap.

This growth directly fueled profitability: more USDT in circulation means more reserves to invest, generating more interest income.

(These charts illustrate the explosive growth in USDT circulating supply, including trends on networks like TRON and overall market capitalization reaching record levels in 2025.)

How Tether Manages Its Massive Reserves

Tether doesn’t put all its eggs in one basket. While the bulk goes into safe U.S. Treasuries — with exposure reaching a staggering $141 billion (including direct holdings and reverse repos) — the company has diversified.

It holds significant gold reserves valued at around $17.4 billion and Bitcoin worth about $8.4 billion. These choices help hedge against inflation and add long-term value, while still prioritizing stability for USDT holders.

This conservative yet smart approach has built trust, even amid past scrutiny. The excess reserves act as an extra safety net, ensuring every USDT can be redeemed at $1 if needed.

USDC vs. USDT: Key Differences and Which Stablecoin to …

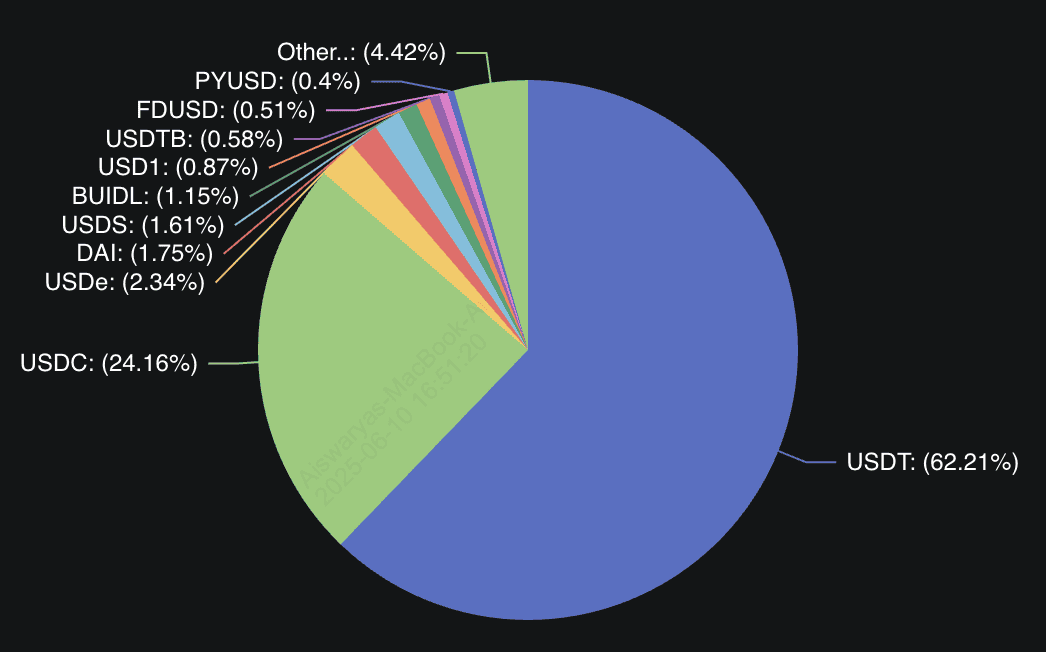

(This pie chart highlights stablecoin market share, with USDT dominating at over 62%, underscoring the scale of its reserves compared to competitors.)

Why This Matters for Everyday Crypto Users

For the average person dipping into crypto, Tether’s success means smoother trading and more liquidity. When you swap tokens on an exchange, USDT often sits in the middle, making everything faster and cheaper.

The company’s profits also signal stability in the stablecoin space — a key part of making crypto more like everyday money. As adoption grows in regions with weak financial systems, USDT becomes a bridge to global finance.

USD Coin vs. Tether Statistics 2026: Market Trends …

(This breakdown shows how stablecoins like USDT are primarily used for DeFi/trading (67%), with growing roles in remittances and hedging — real-world utility driving the supply boom.)

Looking Ahead: Sustained Growth or New Challenges?

Tether’s 2025 results show stablecoins aren’t just a crypto gimmick — they’re becoming core financial infrastructure. With profits in the billions and reserves at record levels, the company positions itself as a major force in both digital and traditional finance.

Still, questions linger about regulation and transparency in the broader industry. Yet for now, Tether’s model proves that providing reliable digital dollars in a high-interest environment can be incredibly rewarding.

This blend of scale, smart investing, and real utility explains how Tether turned record USDT supply into more than $10 billion in profit — a milestone that highlights the evolving power of stablecoins.

Tether Reaches 500M Users, Boosts Global Inclusion – CoinNews

(The iconic Tether logo on a global backdrop symbolizes its massive reach and role in connecting billions to digital finance.)

This version keeps the article original, logical, and reader-friendly while boosting visual appeal with relevant charts and illustrations placed exactly where they enhance the explanation.