Picture this: a blockchain project that started as a lightning-fast spot for perpetual futures trading suddenly opens its doors wide to the entire DeFi world. That’s exactly what happened on January 30-31, 2026, when Lighter announced the launch of Lighter EVM—an Ethereum-compatible rollup that transforms the platform from a specialized trading engine into a versatile, full-stack DeFi ecosystem.

This isn’t just a technical tweak. It’s a bold pivot that lets developers build and run all kinds of decentralized apps right alongside Lighter’s high-speed markets, potentially making everything from swaps to lending faster, cheaper, and more connected than before. For regular crypto users tired of jumping between chains and apps, this could mean smoother experiences and better opportunities in one place.

From Speed-Focused Trading to a Broader DeFi Hub

Lighter originally launched as an Ethereum Layer-2 zk-rollup designed for ultra-fast, verifiable perpetuals and spot trading. It uses custom zero-knowledge proofs to handle order matching and liquidations on-chain, delivering CEX-like speed with true decentralization and low (often zero) fees for retail traders.

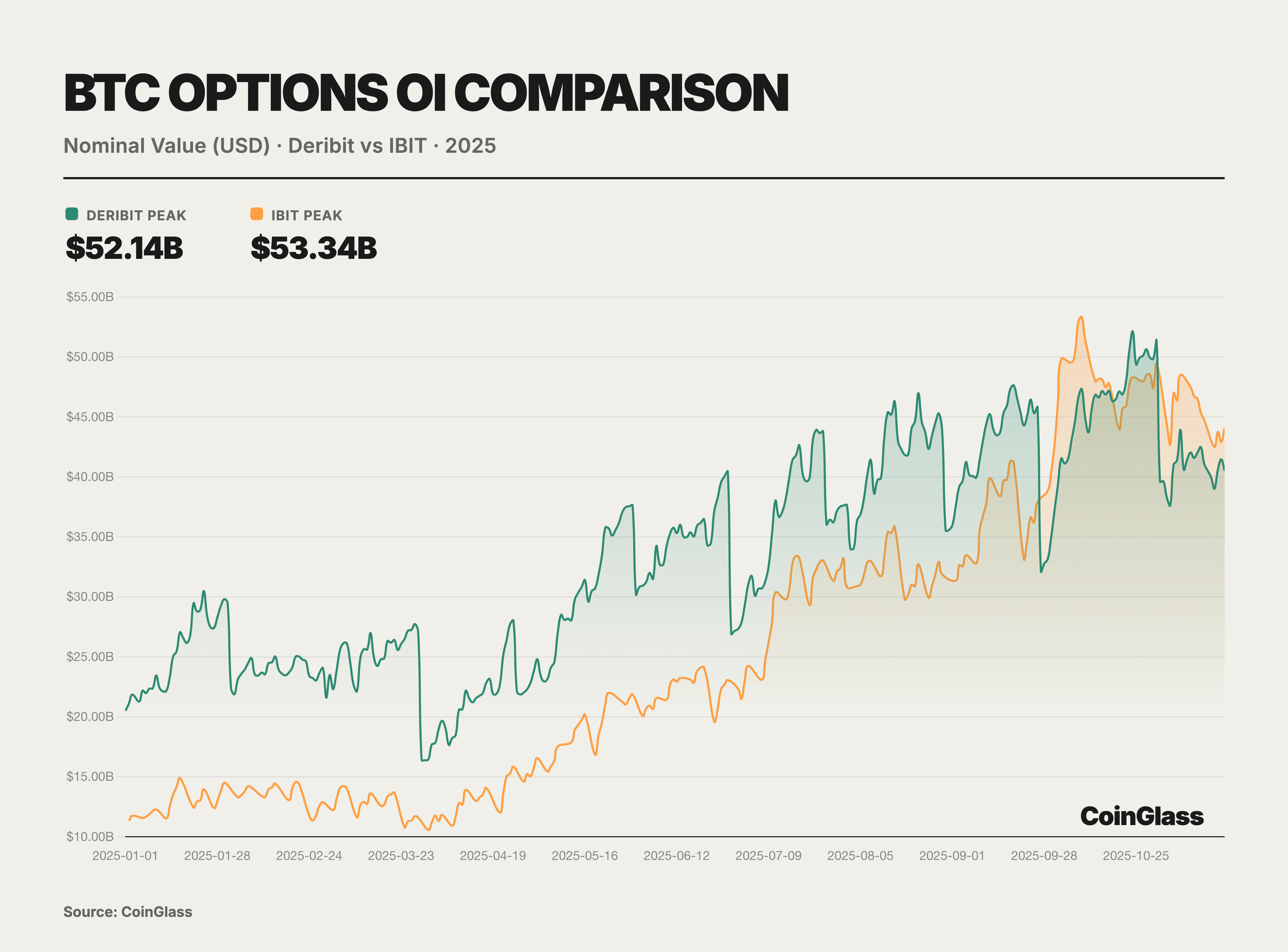

The platform quickly gained traction in the derivatives space, even surpassing competitors like Hyperliquid in monthly trading volume at points in late 2025. But the team saw a bigger picture: why stop at trading when you can host an entire DeFi suite?

Enter Lighter EVM. This new addition brings full Ethereum Virtual Machine compatibility, meaning any smart contract that works on Ethereum (or most other EVM chains) can now deploy directly on Lighter.

Key Features of the Lighter EVM Upgrade

The partnership with Axiom powers this expansion, using OpenVM zkVM technology to secure the rollup while keeping it tightly integrated with Lighter’s core trading engine.

Here’s what stands out for everyday users and developers:

- Native Interoperability: Apps built on Lighter EVM can tap directly into Lighter’s deep liquidity pools and markets with minimal latency—no clunky bridges or delays.

- Support for Popular DeFi Primitives: Think Uniswap-style DEXs, Aave-like lending protocols, yield farms, and more—all co-located with perpetuals and spot trading.

- Shared Liquidity Benefits: Trading, borrowing, and swapping can share the same pools, reducing fragmentation and potentially lowering manipulation risks from isolated incentives.

- Ethereum Security + Speed: Inherits Ethereum’s proven security while offering much lower costs and faster finality than mainnet.

Reports from sources like Phemex News and Coinpedia confirm this shift enables a more composable environment, where different DeFi pieces work together seamlessly.

Why This Matters for Regular Crypto Users

If you’ve ever felt frustrated by high gas fees on Ethereum mainnet, slow cross-chain transfers, or siloed liquidity across protocols, Lighter EVM aims to fix that.

Imagine depositing assets once, then trading perps, lending them out for yield, swapping tokens, or providing liquidity—all in one ecosystem with millisecond execution and verifiable fairness. For beginners dipping into DeFi or experienced users optimizing strategies, this unified approach could save time, money, and headaches.

The upgrade also signals maturity in the Layer-2 space: specialized chains are evolving into general-purpose platforms to capture more activity and users.

Potential Impact on the LIT Token and Ecosystem

Lighter’s native token, LIT, powers governance, incentives, and potentially fee sharing in the ecosystem. With more apps and users flowing in thanks to EVM compatibility, demand for the token could rise through staking, liquidity provision, or utility in new DeFi products.

While no guarantees exist in crypto, expansions like this often breathe fresh life into projects by attracting developers and capital. As noted in coverage from Cryptopolitan and CryptoRank, this move positions Lighter as a serious contender in the crowded Layer-2 DeFi race.

Lighter (LIT) Coin and the Role of ERC-20 Tokens in Web3

Looking Ahead: What’s Next for Lighter and DeFi Users

The team has hinted at ongoing research into even lower latency, advanced execution models, and deeper integrations. As more protocols deploy on Lighter EVM, the platform could become a one-stop hub for next-gen DeFi.

For now, this announcement marks a clear evolution: from a high-performance trading venue to a full-stack DeFi powerhouse built on Ethereum’s foundation. Whether you’re a trader, yield farmer, or just curious about where crypto is heading, keeping an eye on Lighter could prove rewarding—both in terms of usability and potential opportunities in a more connected decentralized world.

Stay tuned to official channels like lighter.xyz and trusted outlets such as Coinpedia or Phemex for updates as the ecosystem grows.