On January 30, 2026, Tether—the company behind the dominant stablecoin USDT—released its 2025 financial results, revealing net profits exceeding $10 billion in what it called a record year for reserve growth and operational strength. Even with slightly lower earnings than the 2024 peak, the figures highlight how Tether has turned stablecoin demand into one of the most profitable businesses in the entire digital asset industry.

For anyone who has ever used USDT to trade, send money overseas, or simply hold value during crypto volatility, these numbers show just how central the stablecoin has become to everyday digital finance.

Why USDT Remains the Go-To Stablecoin Worldwide

USDT is a digital dollar that stays pegged close to $1, making it perfect for moving money quickly and cheaply across blockchains without the wild price swings of Bitcoin or Ethereum.

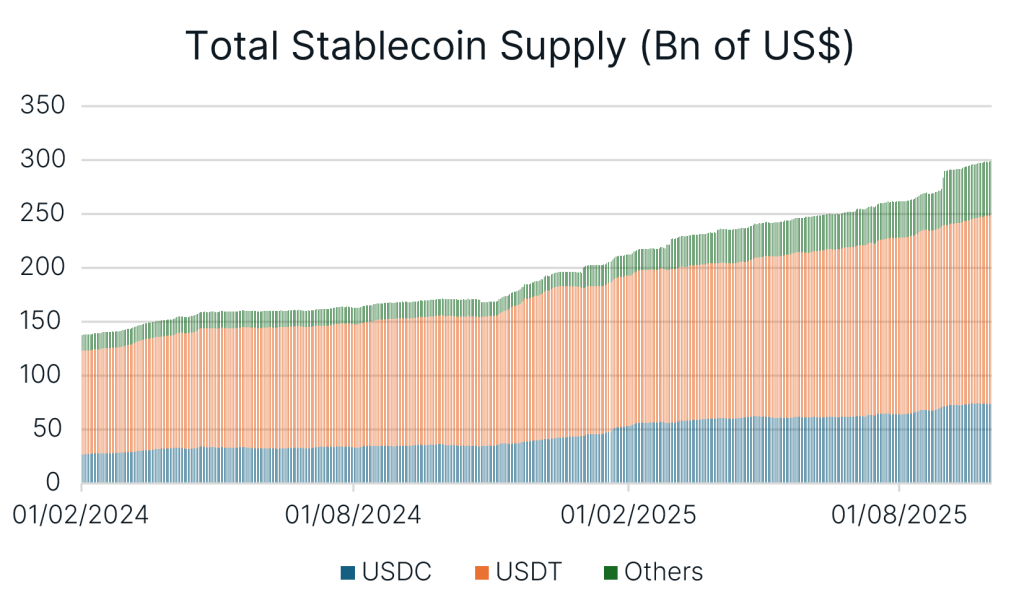

People use it for everything: trading on exchanges, paying freelancers internationally, participating in DeFi protocols, or protecting savings in countries with unstable local currencies. In 2025, USDT’s circulating supply surged by roughly $50 billion, reaching an all-time high of over $186 billion.

Inside the $10 Billion+ Profit Announcement

According to the Q4 2025 attestation prepared by independent auditor BDO, Tether generated more than $10 billion in net profit for the full year. The main drivers were:

- Interest earned on U.S. Treasuries and other safe investments

- Fees from issuing and redeeming USDT tokens

While profits were about 23% lower than the $13 billion record set in 2024, the 2025 result still ranks among the highest in the company’s history. Excess reserves reached $6.3 billion, meaning Tether holds significantly more assets than needed to back every USDT in circulation.

CEO Paolo Ardoino emphasized that reserves now include $141 billion in U.S. Treasuries, $17 billion+ in gold, and growing Bitcoin holdings—creating a diversified and robust backing.

How Tether Turns Reserves into Revenue

Unlike a traditional bank that lends out deposits, Tether invests user funds primarily in ultra-safe, short-term U.S. Treasuries. High interest rates in recent years turned these holdings into a powerful profit engine.

The company has also added gold and Bitcoin to the mix, balancing safety with some growth potential. This strategy has proven highly effective, especially as USDT issuance continues to grow rapidly in both developed and emerging markets.

Tether Statistics 2026: Secrets of Stablecoin Power • SQ Magazine

What This Means for Regular Users and the Crypto Ecosystem

Strong profits and transparent reserves give users confidence that USDT will remain reliable even during market turbulence. For everyday people using USDT on exchanges, wallets, or payment apps, these results signal stability and operational maturity.

On a larger scale, Tether now holds more U.S. Treasuries than many sovereign nations, illustrating how stablecoins have become a meaningful part of global finance.

What’s Next for Tether in 2026 and Beyond

With USDT adoption still accelerating and reserves performing well, many analysts expect Tether to deliver another strong year in 2026. The company is also exploring tokenized real-world assets and other innovations that could open new revenue opportunities.

For anyone who uses or follows stablecoins, Tether’s 2025 results are a clear reminder: the quiet infrastructure powering much of crypto is not only surviving—it’s thriving in a big way.