The cryptocurrency market just went through a brutal shake-up, with Bitcoin tumbling to around $83,500 and triggering over $1.7 billion in liquidations across exchanges. This wasn’t a slow bleed—it was a fast, painful cascade that caught thousands of leveraged traders by surprise and reminded everyone how quickly confidence can flip in crypto.

The Spark: What Pushed Bitcoin Down to $83,500?

In late January 2026, Bitcoin broke below key support levels near $85,000, sliding as low as roughly $81,000–$83,000 on major platforms before a partial bounce. Data from sources like Yahoo Finance and CoinGlass show this drop erased billions in market value and coincided with heavy selling pressure.

Several real-world factors piled on: uncertainty over U.S. economic policy, outflows from Bitcoin spot ETFs, and a general flight from risky assets amid broader market jitters.

How Liquidations Work (and Why They Snowball)

Liquidations occur when traders borrow funds to bet bigger (leverage) and the price moves against them too far. Exchanges force-sell the position to recover the loan, which adds more downward pressure and triggers even more liquidations.

In this case, CoinGlass reported around 270,000 traders liquidated in 24 hours, with long positions (bets on rising prices) taking almost all the hits—over 90% of the total. Bitcoin alone saw hundreds of millions wiped out, followed by Ethereum and others.

It’s like a chain reaction: one big drop forces sales → price falls more → more forced sales → panic spreads.

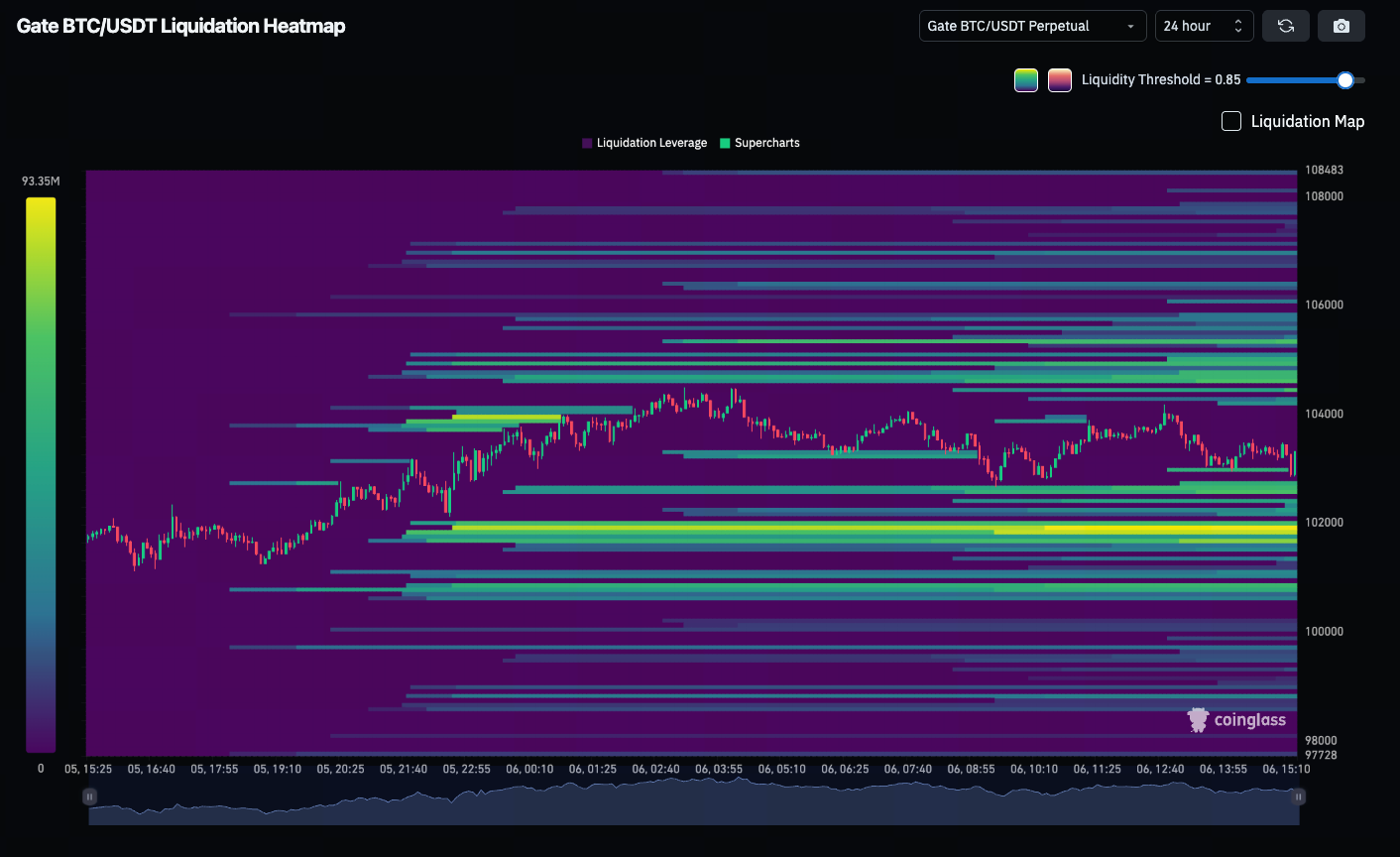

Liquidation Heatmaps: Visual Clues to the Damage

Traders often watch liquidation heatmaps from platforms like CoinGlass to spot clusters of vulnerable positions. These colorful grids highlight price levels where large forced sales could occur, acting like warning signs for potential cascades.

During this event, heatmaps lit up red around the $83,500–$85,000 zone, showing exactly where the heaviest long liquidations clustered as Bitcoin fell through.

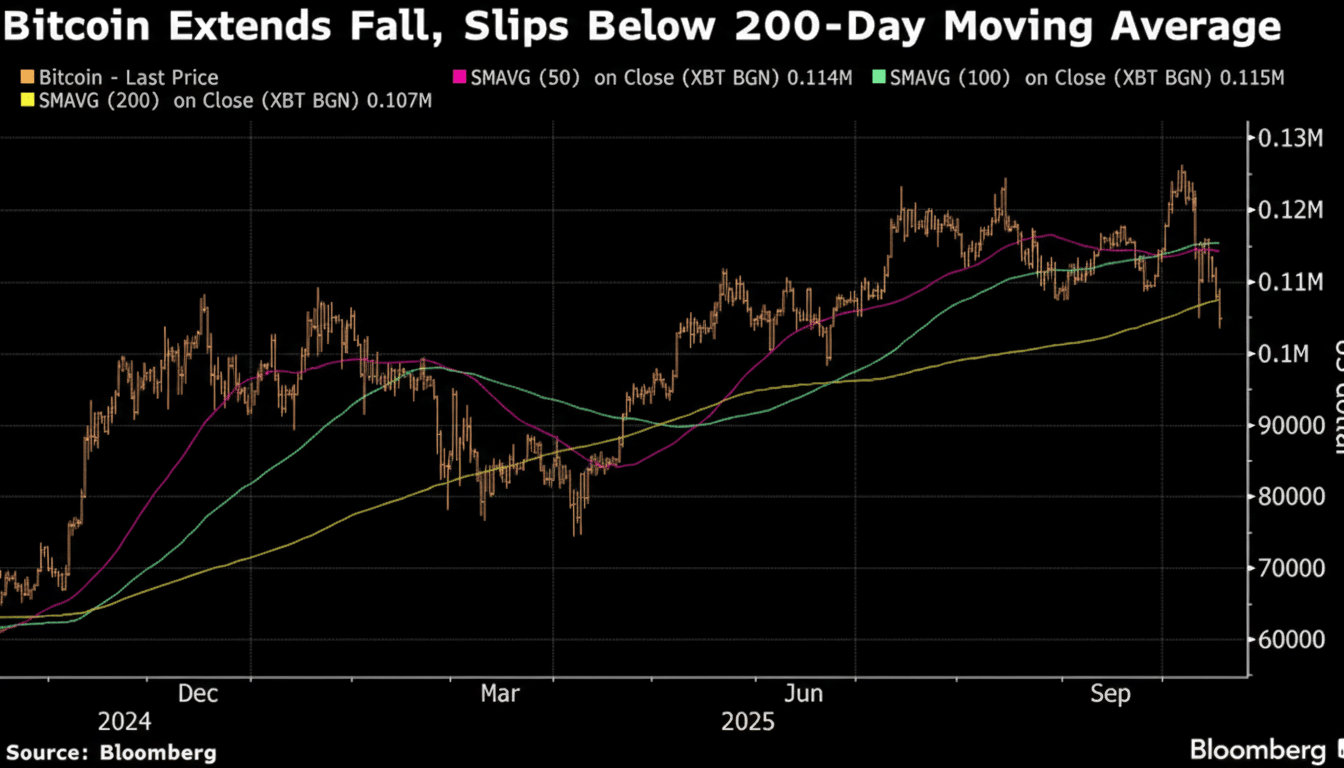

Is This Just Another Crypto Cycle Dip?

History shows these sharp corrections happen after big rallies—think 2021 or late 2025 peaks. Bitcoin has dropped 30–50% multiple times before rebounding stronger. While painful, this flush of over-leveraged positions often clears the way for healthier price action later.

Analysts from CoinDesk and similar outlets note that when sentiment hits “extreme fear” (as the Fear & Greed Index did here), it sometimes marks short-term bottoms.

Practical Takeaways for Everyday Crypto Users

If you’re new or casual:

- Skip high leverage—it’s exciting until it’s not.

- Think long-term rather than chasing quick trades.

- Only use money you won’t miss if things go south.

Bitcoin has survived far worse and still climbed to new highs over the years. Events like this liquidation surge test the market but rarely end the story. Keep watching key levels around $80,000–$85,000 for clues on what’s next—buyers could step in, or more volatility might follow. Stay calm, stay informed, and trade responsibly.