Imagine piecing together a puzzle where each part represents a different strength in the crypto world—speed, swaps, scalability, and stability. As 2026 unfolds with clearer regulations and institutional money pouring in, building a smart portfolio means picking assets that complement each other. BlockDAG offers breakthrough tech for growth, SUI brings lightning-fast transactions, UNI powers decentralized trading, and TRON handles entertainment and dApps. This mix could shield against volatility while chasing gains, but let’s explore how each slots in for everyday investors eyeing the future.

BlockDAG: The High-Growth Innovator

BlockDAG stands out as a next-gen Layer-1 blockchain using DAG technology to process thousands of transactions per second, sidestepping the clogs that plague older networks. With its presale wrapping up soon at $0.003 and a confirmed $0.05 launch price on February 10, 2026, it’s drawing crowds for potential massive returns—think 16x just from listing. Already raising over $441 million, it’s not hype; it’s backed by EVM compatibility for easy app building and a focus on real-world use like DeFi and NFTs.

For someone dipping toes into crypto, BlockDAG is like that promising startup stock—risky but rewarding if it scales. Predictions for 2026 see it climbing to $0.048 or higher, fueled by scarcity and community mining tools. In a portfolio, it adds the excitement of innovation, balancing steadier picks with upside potential.

BlockDAG to Launch on Major Exchanges After Unprecedented Presale …

Keep in mind, its success hinges on adoption post-launch, but early signs point to it outshining slower rivals in a maturing market.

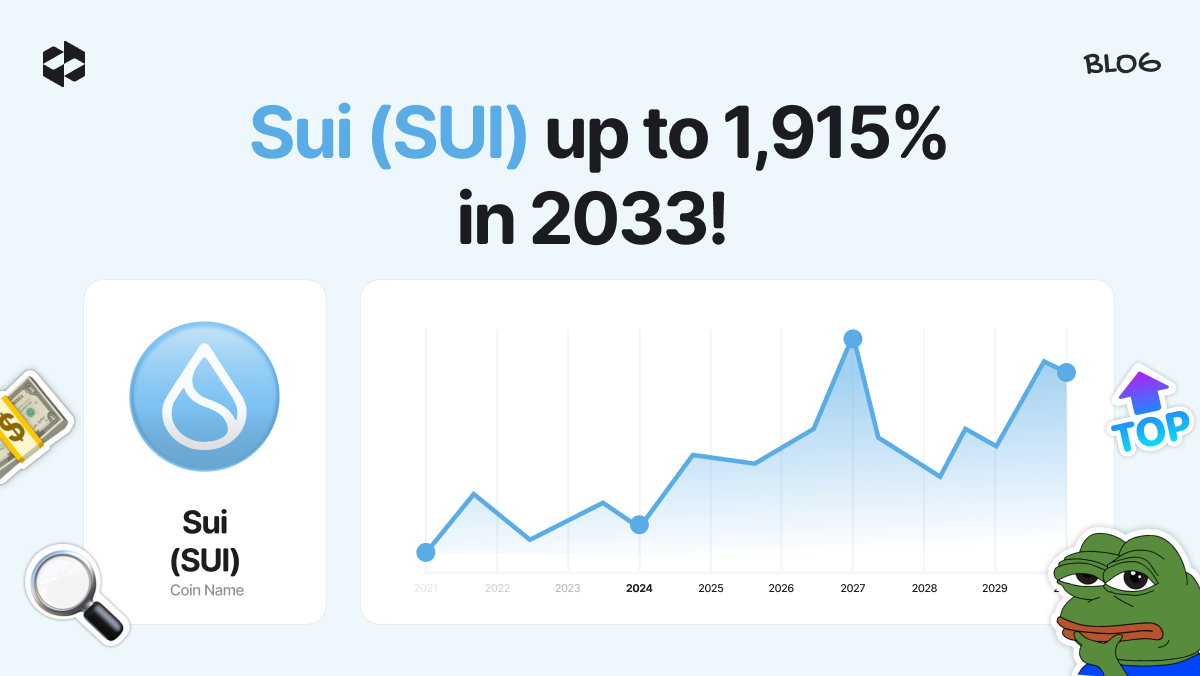

SUI: The Speed Demon for Everyday Transactions

SUI is a high-performance blockchain designed for quick, cheap transfers, making it perfect for games, social apps, and payments. Built on Move language for security, it’s already handling millions of transactions daily without the fees that bite on Ethereum. As of early 2026, it’s trading around $1.30, with forecasts suggesting a range from $1.24 to $1.76 by year-end, driven by upgrades like Mysticeti for even faster speeds.

Picture SUI as the express lane in traffic—ideal for users who want seamless experiences without waiting. In your 2026 lineup, it fits as the utility player, supporting real-world adoption amid stablecoin booms and institutional ETFs. Optimistic views peg it at $1.42 short-term, but long-term growth could hit $10 if interest rates drop and alt seasons kick off.

SUI price prediction 2025, 2026–2040

It’s a solid mid-risk choice, especially as crypto integrates more with daily life.

UNI: The DeFi Gateway for Swaps and Governance

UNI, the token behind Uniswap, lets users trade assets directly without banks, while holders vote on platform changes. As DeFi rebounds in 2026 with better regulations, UNI’s role in automated markets grows. Currently around $5.50, predictions vary: from $5.37 to $11.13 short-term, with some eyeing $10 by year-end as trading volumes rise.

Think of UNI as your all-access pass to decentralized finance—simple swaps for beginners, governance for engaged users. It slots into portfolios as the trading hub, benefiting from AI integrations and tokenization trends. In bullish scenarios, it could reach $50 by 2030, but 2026 targets hover at $7.80 average, assuming steady adoption.

Uniswap (DEX) – Exchanges | IQ.wiki

Its strength lies in community-driven evolution, making it a resilient pick amid market shifts.

TRON: The Entertainment and dApp Backbone

TRON focuses on content sharing and decentralized apps, with low fees and high throughput for streaming, gaming, and USDT transfers. Founded by Justin Sun, it’s a go-to for stablecoin flows. Trading near $0.30 now, 2026 outlooks range from $0.29 to $0.42, with moon scenarios up to $1.31 if market caps swell.

Like a versatile media player, TRON handles fun and finance without fuss, appealing to creators and users alike. In portfolios, it’s the stable anchor, thriving on transaction volumes in a pro-crypto policy era. Bearish floors sit at $0.20, but averages around $0.35 make it a low-volatility bet.

abstract futuristic technology background of TRON TRX Price graph …

Its edge? Strong ties to real-world use cases, ensuring longevity beyond hype cycles.

Building Your Balanced 2026 Crypto Mix

With the crypto market eyeing transformative growth—thanks to institutional eras, Bitcoin highs, and reduced volatility—these four create synergy: BlockDAG for innovation, SUI for speed, UNI for trading, TRON for reliability. Suggest allocating 35% to high-potential like BlockDAG, 25% to SUI for utility, 20% to UNI for DeFi exposure, and 20% to TRON for steadiness. This diversification minimizes risks while tapping into sectors like RWAs and AI.

Stay vigilant on macro factors like rate cuts and regulations—crypto’s path isn’t straight, but informed choices can turn curiosity into confidence.

Ways to Diversify Your Crypto Portfolio & Minimize Risk …

Whether you’re starting small or scaling up, this setup invites exploration in 2026’s promising landscape.