Think of your crypto investments as a well-balanced meal—too much of one thing leaves you unsatisfied, but the right mix nourishes growth. Entering 2026, with Bitcoin’s halving echoes still rippling and global adoption accelerating, savvy investors are eyeing diverse assets. BlockDAG brings cutting-edge speed, Polkadot fosters connections, XRP streamlines payments, and Aave powers lending. Together, they could form a resilient portfolio against market swings, but let’s break it down to see where each shines.

BlockDAG: The Fast-Track Blockchain Challenger

BlockDAG is shaking up the crypto scene with its Directed Acyclic Graph (DAG) technology, which ditches traditional blocks for a web-like structure that handles transactions lightning-fast—up to 10,000 per second without the usual bottlenecks. Launched in late 2025, it’s already raised eyebrows with a presale that’s nearing its end, positioning it as a high-growth contender for everyday users tired of slow networks like Bitcoin.

As of January 2026, its presale price sits at $0.003, with plans for a $0.05 listing soon, potentially leading to massive returns. Analysts forecast it could hit $0.048 by year-end, driven by its focus on scalability and low fees, making it ideal for dApps and DeFi. For beginners, it’s like upgrading from a bicycle to a sports car in the world of blockchain—efficient and exciting for long-term holds.

BlockDAG to Launch on Major Exchanges After Unprecedented Presale …

What makes it portfolio-worthy? Its potential for 2000x ROI stems from strong community backing and tech that solves real problems, like congestion in older chains. If you’re diversifying, BlockDAG adds that innovative edge, especially as markets reward projects with practical utility.

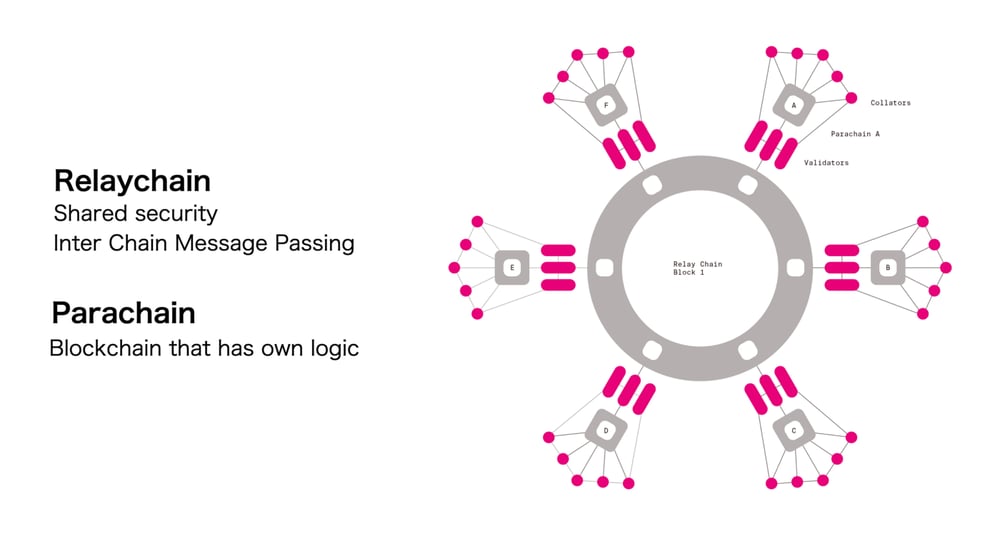

Polkadot: Bridging the Blockchain Divide

Polkadot acts as the ultimate networker in crypto, linking different blockchains so they can share data and assets seamlessly. Founded by Ethereum co-creator Gavin Wood, it’s all about interoperability—imagine it as a universal translator for the fragmented world of digital ledgers. In 2026, with upgrades like Polkadot 2.0 rolling out, it’s poised to handle more parachains (specialized sub-networks) efficiently.

Current price hovers around $2, but predictions suggest a climb to $2.89 minimum, with some eyeing $3.56 by 2030 thanks to its new supply cap and JAM protocol transition. For average investors, it’s straightforward: if you own assets on multiple chains, Polkadot makes moving them easy, reducing costs and hassle.

An Overview of the Polkadot Blockchain

Why include it in your 2026 mix? The halving event in March could spark a boom, halving rewards and boosting scarcity. It’s a stable pick for those wanting exposure to Web3 without betting on a single horse, offering growth through ecosystem expansion.

XRP: The Cross-Border Payment Powerhouse

XRP, powered by Ripple, is designed for speedy international transfers, cutting out banks’ delays and fees. It’s like Venmo on steroids for global finance, settling payments in seconds. Amid 2026’s regulatory thaw—especially with potential U.S. clarity—XRP is rebounding from legal battles, trading near $2 with eyes on higher grounds.

Forecasts vary wildly: bullish voices from Standard Chartered see it soaring to $8, fueled by ETF approvals and institutional use, while cautious ones warn of dips to $0.20 if hurdles persist. Everyday folks can relate—it’s practical for remittances or business payments, not just speculation.

Good For Those Who Saw the Potential of XRP From the Start. The …

In a portfolio, XRP adds utility-focused stability. With predictions of $2.40 to $8 by year-end, it’s a hedge against inflation and a bet on fintech evolution. If global trade amps up, XRP could be your reliable performer.

Aave: Revolutionizing Decentralized Lending

Aave is a DeFi star, letting users lend and borrow crypto without middlemen, using smart contracts for security. Think of it as a peer-to-peer bank where you earn interest on deposits or take flash loans instantly. As DeFi matures in 2026, Aave’s V3 upgrades enhance cross-chain lending, making it more accessible.

Prices could range from $165 to $346, averaging $239, as adoption grows with lower gas fees and better integrations. For non-experts, it’s simple: park your stablecoins to earn yields, or borrow against holdings without selling—perfect for passive income.

What is AAVE?

It fits portfolios by providing yield generation, balancing riskier bets. With targets up to $360 in optimistic scenarios, Aave appeals to those seeking steady returns in volatile times.

Crafting a Balanced 2026 Crypto Strategy

These four—BlockDAG for innovation, Polkadot for connectivity, XRP for payments, and Aave for yields—create a diversified powerhouse. Allocate based on risk: 30% in high-growth like BlockDAG, 25% in connectors like Polkadot, 25% in utilities like XRP, and 20% in DeFi like Aave. This spread mitigates downsides while capturing upsides from trends like tokenization and Web3.

How to Diversify Your Crypto Portfolio: Complete Guide 2026

Remember, crypto’s thrill lies in research—monitor regulations and tech updates. In 2026’s evolving landscape, this quartet could turn modest investments into meaningful gains, but always invest what you can afford to lose. Dive in thoughtfully, and watch your portfolio thrive.