What if a cyber thief could sneak into a high-stakes trading account, pump up a obscure token’s price, and walk away with clean cash—all while the world’s biggest crypto exchange watches? That’s not a plot from a thriller; it’s the real drama that unfolded in early January 2026, when a hacker commandeered a market maker’s Binance accounts in a clever bid to wash dirty money. This incident spotlights the shadowy side of crypto trading, where liquidity providers become unwitting tools for crime, and sharp-eyed traders can flip the script for profit. We’ll dive into the details, unpack the tactics, and explore why this matters in a market that’s both booming and vulnerable.

The Bold Breach: How the Hacker Infiltrated Binance Accounts

Market makers are the unsung heroes of crypto exchanges—they buy and sell assets constantly to keep prices stable and trading smooth. But in this case, one became a hacker’s gateway. Around New Year’s Day 2026, an unknown attacker gained unauthorized access to a market maker’s Binance profiles, which held millions in funds for providing liquidity. The breach likely exploited weak security, such as compromised credentials or phishing, a common ploy in crypto hacks where attackers trick users into revealing login details.

Once inside, the hacker didn’t just grab and run. Instead, they targeted a low-liquidity token called $BROCCOLI (ticker: 714), using the accounts’ heft to manipulate the market. This wasn’t a smash-and-grab; it was a calculated move to blend illicit funds into legitimate trades, making them harder to trace. Cybersecurity firm Chainalysis reports that such account takeovers surged 25% in 2025, with exchanges like Binance often in the crosshairs due to their massive user base.

Binance Issues Critical Security Warning in Wake of Recent …

Unraveling the Laundering Play: Pumps, Dumps, and Self-Trades

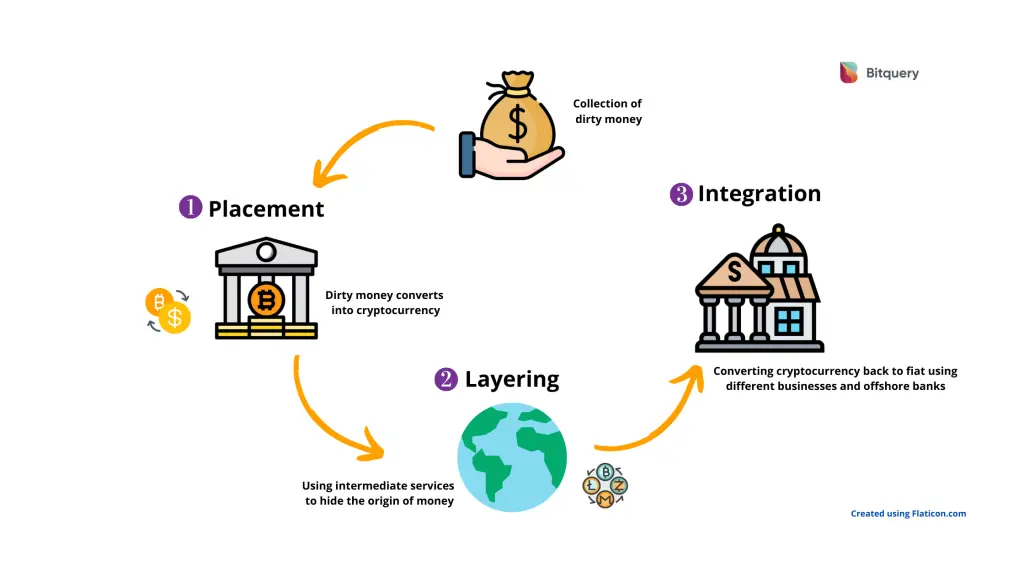

Laundering in crypto is like hiding needles in a haystack—mix dirty money with clean transactions until it’s indistinguishable. Here, the hacker employed “self-trading,” buying and selling the same asset between controlled accounts to artificially inflate volume and price. They combined spot market buys (direct asset purchases) with perpetual futures longs (bets on price rises), creating a pump that spiked $BROCCOLI’s value in a thinly traded environment.

Why this token? Low liquidity means small trades can cause big swings, perfect for masking transfers. The goal: convert stolen funds into other assets or fiat without raising red flags. But Binance’s risk controls eventually kicked in, freezing suspicious activity and spoiling the plan. According to Reuters’ past investigations, hackers have long favored Binance for similar schemes, laundering billions through layered trades. This incident echoes broader trends, where North Korean groups like Lazarus have routed hacked crypto through exchanges to obscure origins.

Money laundering through cryptocurrencies

The Unexpected Twist: A Trader’s Million-Dollar Counterplay

Not every story ends with the bad guy winning. Enter trader Vida (@Vida_BWE on X), who spotted the anomaly through custom alerts monitoring price divergences between spot and perpetual markets. As the hacker pumped $BROCCOLI, Vida jumped in, riding the artificial surge before flipping to a short position—betting on a crash—just as the fake bids vanished.

The result? Vida pocketed around $1 million in profits, turning the hacker’s scheme into their own windfall. This “front-running” highlights how vigilant users can outsmart manipulators in real time. On X, the tale went viral, with posts praising Vida’s order-book savvy and quick execution in a market prone to volatility. It’s a reminder that while hacks grab headlines, community watchdogs often steal the show.

Binance’s Stance: Defenses, Denials, and Ongoing Scrutiny

Binance, the globe’s top crypto platform by volume, has faced heat for lax controls in the past. In 2023, it pleaded guilty to U.S. charges of failing to prevent money laundering, paying a $4.3 billion fine and installing monitors. In this breach, the exchange’s systems detected the irregularity, halting trades and limiting damage—though the hacker still caused chaos.

Company reps have pushed back against accusations, emphasizing improved AI-driven monitoring that flags unusual patterns like sudden pumps in illiquid tokens. Yet, a November 2025 ICIJ report revealed Binance handled over $900 million from North Korean hacks earlier that year, raising questions about persistent vulnerabilities. For users, this means two-factor authentication and hardware wallets are must-haves to avoid similar fates.

Cryptocurrency Money Laundering Explained – Bitquery

Why This Matters: Crypto’s Growing Pains and User Risks

This isn’t an isolated blip—2025 saw a record $15.8 billion in illicit crypto flows, reversing years of decline, per TRM Labs. Hacks like this expose how exchanges, despite beefed-up security, remain prime targets for launderers exploiting high-volume tools like market making.

For everyday folks dipping into crypto, it underscores the need for caution: Stick to reputable platforms, enable all security features, and watch for odd market moves. Regulators are stepping up too, with calls for stricter KYC (know-your-customer) rules to deter such crimes. As blockchain evolves, so do the threats—but so does the tech to fight back.

Looking Forward: Lessons from the $BROCCOLI Fiasco

In the end, this breach serves as a wake-up call for tighter safeguards across the board. Whether you’re a casual investor or a pro trader, staying informed could mean the difference between loss and gain. With crypto’s value soaring, expect more sophisticated attacks—but also smarter defenses. Keep your eyes on the order books; the next big story might unfold right there.