Picture this: You’re scrolling through your crypto app, watching prices bounce like a ping-pong match, when suddenly a newcomer promises to shake things up with tech that could outpace the old guards. That’s the vibe around BlockDAG right now, as its much-hyped launch edges closer, with whispers of a $0.40 starting point stealing the spotlight from veterans like Zcash and Chainlink. In a market where privacy coins and data oracles are battling for relevance, this fresh entrant is turning heads. We’ll unpack why BlockDAG’s debut is buzzing, how Zcash is holding its ground in the privacy wars, and what Chainlink’s steady oracle game means for the bigger picture—all without the jargon overload.

Unpacking BlockDAG: The Hybrid Tech Turning Heads

BlockDAG isn’t your typical blockchain—it’s a blend of directed acyclic graph (DAG) and proof-of-work (PoW) that aims to fix the speed and scalability headaches plaguing older networks. Think of it as a supercharged version of traditional blockchains, allowing multiple blocks to process simultaneously without the usual bottlenecks. As of early 2026, its presale has raked in over $441 million, with the final phase wrapping up on January 26. Market analysts are eyeing a launch price between $0.38 and $0.43, far above its current presale tag of $0.003, hinting at massive early gains for holders.

What sets it apart? Unlike linear chains, BlockDAG’s structure could handle thousands of transactions per second, making it a potential darling for real-world apps like payments or DeFi. Institutional backing has poured in $86 million, signaling confidence from big players who see it as a 2026 breakout. If you’re new to crypto, imagine it as upgrading from a single-lane road to a multi-lane highway—faster commutes for your digital dollars.

BlockDAG Price Prediction – Next 100X Crypto?

Zcash: The Privacy Pioneer Facing Market Twists

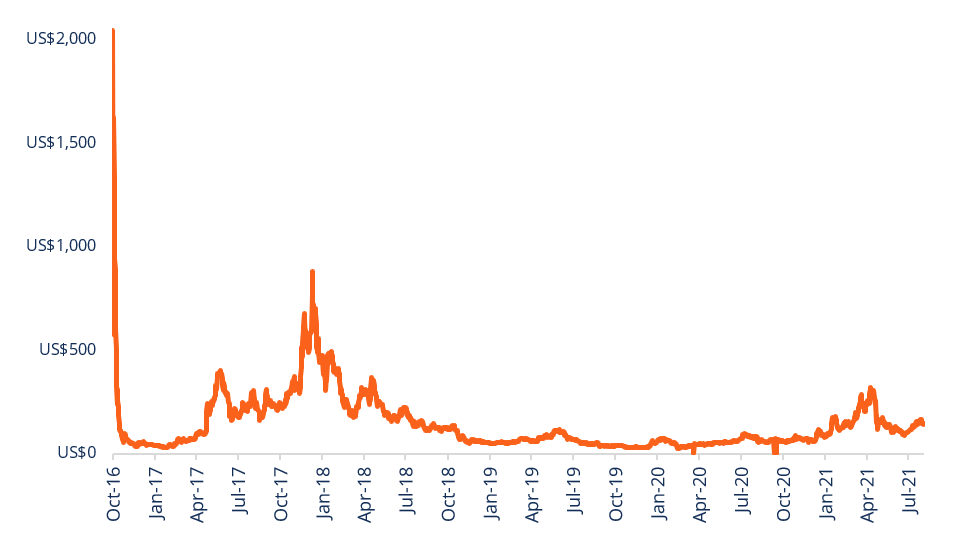

Shift gears to Zcash, the coin that’s all about keeping your transactions under wraps. Launched back in 2016, it uses zero-knowledge proofs (fancy math that proves a transaction happened without revealing details) to offer optional privacy—unlike Bitcoin, where everything’s public. Right now, in January 2026, ZEC is trading around $388 to $444, but it’s taken a hit, dipping into a 30% breakdown zone after breaking below $381. Analysts are mixed: some predict a climb to $600 by year-end, driven by growing demand for private finance, while others warn of downside risks to $253 if sentiment sours.

For everyday folks, Zcash is like a digital cash envelope—great for shielding your spending from prying eyes, whether it’s online shopping or donations. But recent drama, like the core team’s split to form a new wallet called cashZ, has stirred the pot, emphasizing cypherpunk roots over corporate vibes. In a world obsessed with data privacy, Zcash remains a go-to, but competition from coins like Monero keeps it on its toes.

Zcash – Overview, Origins, Features, How To Mine

Chainlink: The Oracle Bridge Keeping DeFi Honest

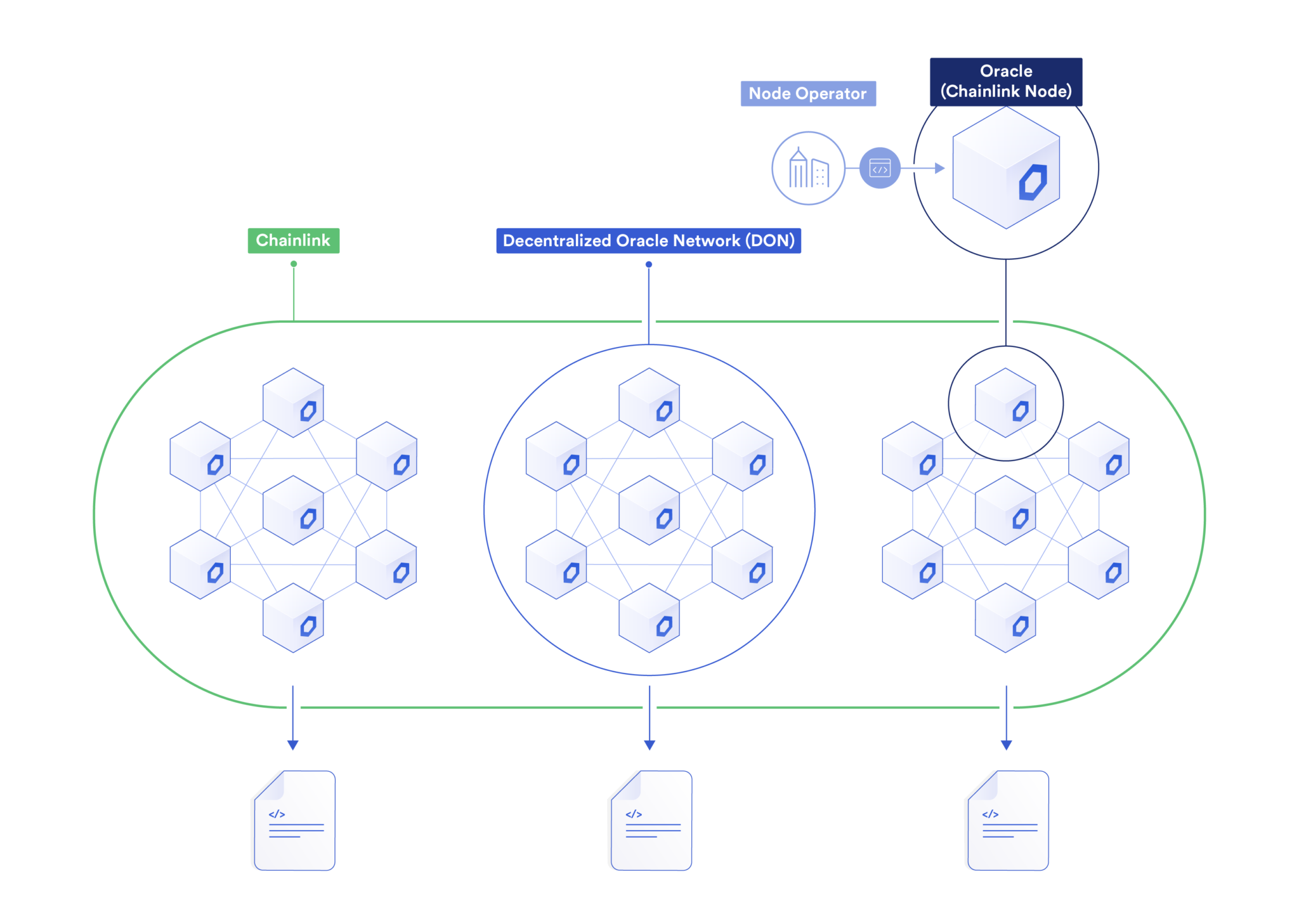

Now, let’s talk Chainlink, the unsung hero feeding real-world data into smart contracts. It’s not a privacy coin or a payment token—it’s an oracle network that pulls info like stock prices or weather updates into blockchains, ensuring DeFi apps run smoothly without fakes. As of now, LINK hovers at about $13.15, with modest ups and downs; it’s up slightly in the last day but flat week-over-week. Looking ahead, forecasts for 2026 range from $13.22 to $27.79, betting on its role in expanding ecosystems like Ethereum and Arbitrum.

Simply put, Chainlink is the trustworthy middleman in crypto’s wild west. Without it, your yield farm might rely on bogus data, leading to losses. Recent integrations, like with on-chain casino Vault777 for verifiable randomness, show its versatility. For non-experts, think of it as the GPS for smart contracts—guiding them with accurate, tamper-proof info to avoid crashes.

What Is Chainlink? A Technical Deep Dive (Advanced) | Chainlink Blog

Why BlockDAG Steals the Show Amid Zcash and Chainlink Stability

In this trio, BlockDAG’s launch hype contrasts with Zcash’s privacy battles and Chainlink’s reliable but steady grind. While Zcash grapples with price volatility and internal shifts, and Chainlink chugs along as DeFi’s backbone, BlockDAG promises innovation with its DAG-PoW hybrid, potentially blending speed, security, and scalability in ways the others don’t. Early adopters could see 16x returns if it hits that $0.05 post-presale mark before climbing higher. It’s like comparing a sleek electric car to trusted sedans—exciting potential versus proven tracks.

But crypto’s unpredictable: Zcash might surge if privacy regs tighten, and Chainlink could boom with more DeFi adoption. BlockDAG’s edge? Community-driven governance and rapid presale success, positioning it as a fresh alternative for those tired of the same old volatility.

Looking Ahead: Opportunities and Cautions for Crypto Newbies

As 2026 unfolds, keep an eye on these players. BlockDAG’s January launch could spark a rally, especially with $15 billion valuation whispers. Zcash offers solid privacy plays, potentially hitting $650 if trends hold, while Chainlink’s integrations might push it to $38 highs. For regular investors, start small, diversify, and remember: Crypto’s thrilling, but research beats hype every time. Whether you’re in for privacy, data reliability, or speed, this space keeps evolving—stay curious and informed.