Picture this: It’s January 2026, and Washington is buzzing with a bill that could finally give America’s crypto industry the clear rules it has desperately needed for years. Senator Tim Scott, the powerful chair of the Senate Banking Committee, is leading the charge to pass comprehensive digital asset market structure legislation. This isn’t just another piece of paperwork—it’s a potential game-changer that aims to protect everyday investors, keep cutting-edge blockchain innovation right here in the U.S., and even strengthen national security against misuse of digital currencies.

With a key committee markup set for January 15, 2026, the stakes feel higher than ever. This push comes after months of tough negotiations, building on the House’s earlier work with the Digital Asset Market Clarity (CLARITY) Act. Let’s break down what this means in simple terms.

Why This Bill Matters Right Now

For too long, crypto has operated in a gray zone. The U.S. has relied on “regulation by enforcement,” where agencies like the SEC go after companies case by case. That approach has driven many startups and talent overseas, hurting American jobs and leadership in a technology that’s exploding globally.

Senator Scott argues this new framework will flip the script. It seeks to clearly define which digital assets count as securities (overseen by the SEC) and which are commodities (handled by the CFTC). This clarity could unlock more institutional money, boost confidence for regular people investing in Bitcoin or Ethereum, and make sure the U.S. stays the “crypto capital of the world.”

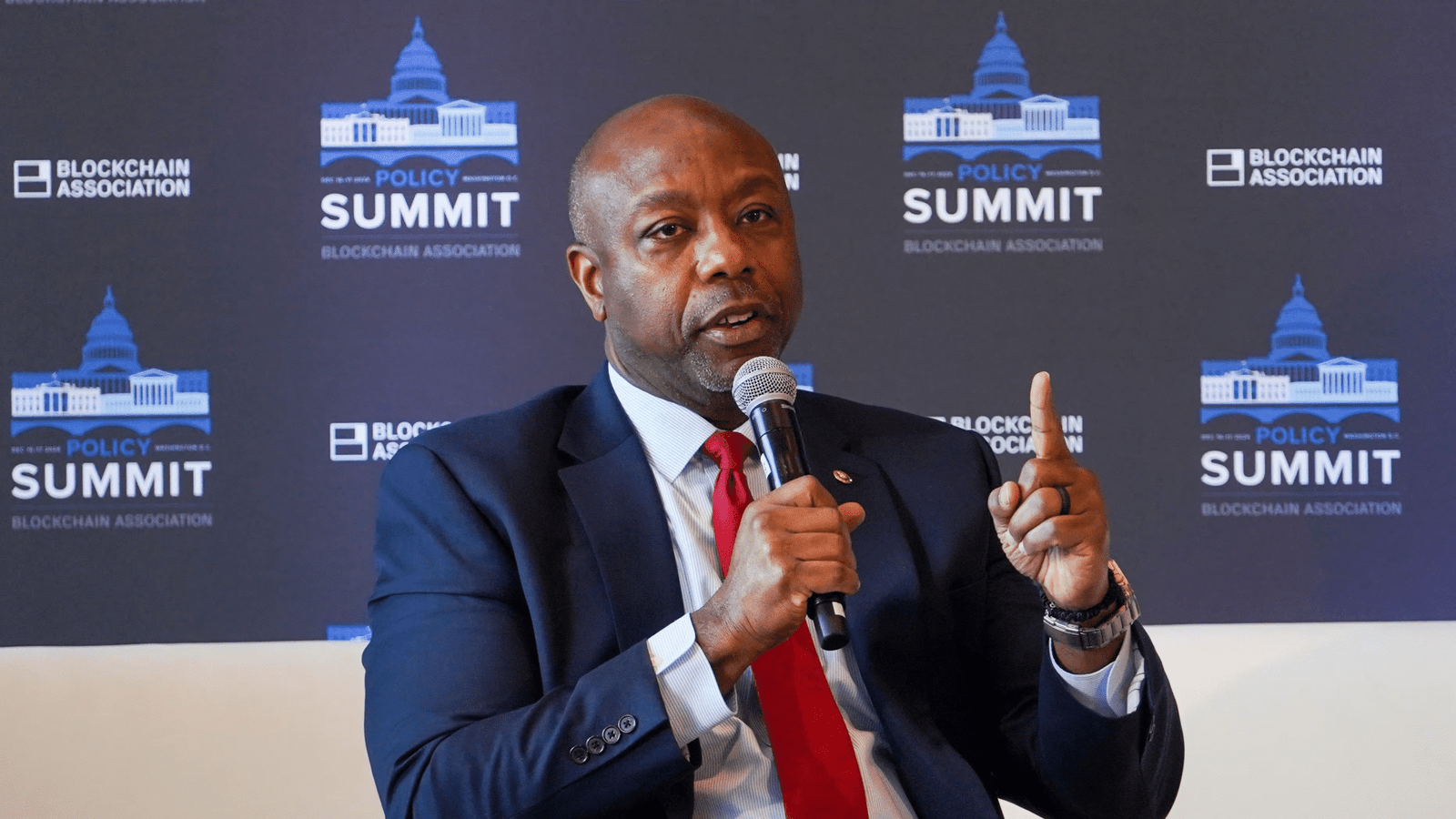

As Scott himself stated in recent announcements, the legislation is about “protecting Main Street retail investors, ensuring future innovation happens in the United States, and safeguarding national security for all Americans” (U.S. Senate Banking Committee, January 9, 2026).

Here’s a visual of Senator Tim Scott in action during key financial discussions:

The Core Goals: Innovation, Protection, and Security

Boosting Innovation and Keeping Jobs at Home

The bill focuses on creating “clear rules of the road” so companies can build and grow without fear of sudden crackdowns. Supporters say this will attract more investment, create jobs in blockchain tech, and prevent the U.S. from falling behind places like Singapore or Dubai.

Think of it like updating traffic laws for self-driving cars—without rules, everyone drives chaotically and innovation stalls. With clear guidelines, the road opens up.

Protecting Everyday Investors (Main Street)

One big emphasis is shielding regular folks from scams and risky platforms. The proposal includes stronger safeguards against fraud, better transparency, and rules to stop bad actors from exploiting the system. This matters because crypto isn’t just for tech experts anymore—millions of Americans hold digital assets in their retirement accounts or apps.

Strengthening National Security

Crypto’s borderless nature makes it useful for everything from remittances to… illicit activities if unchecked. The bill pushes for better protections against money laundering, sanctions evasion, and other threats, ensuring digital finance doesn’t undermine U.S. interests.

This visual captures the blend of traditional U.S. power and emerging crypto tech:

Us capitol building with stock market data and financial graphs overlay at night 4k video

Where Things Stand: The January 15 Markup

As of mid-January 2026, the Senate Banking Committee is gearing up for a crucial markup on January 15. This is where lawmakers propose changes, debate, and vote on the bill text. Scott has made it clear he’s moving forward—even if full bipartisan agreement isn’t there yet—because “it’s time to get on the record and vote.”

The process builds on earlier bipartisan talks, though some sticking points remain around stablecoin rules and DeFi oversight. If it clears committee strongly, the bill heads to the full Senate floor, potentially reaching President Trump’s desk soon after.

Industry watchers note high optimism: White House crypto advisor David Sacks has called it a step toward “landmark” legislation.

What This Could Mean for You

If you’re new to crypto, this bill could make things safer and more straightforward. Clearer rules might mean more trusted platforms, easier access through banks, and less wild price swings from regulatory surprises.

For businesses and developers, it signals America is serious about leading in blockchain—not chasing it.

Of course, nothing is guaranteed—politics can shift fast, especially with 2026 midterms on the horizon. But this moment feels like a real turning point.

Here’s a simple breakdown of key regulatory benefits:

Regulating Crypto: To Frame, Tame, Or Game The Ecosystem | S&P Global

In the fast-moving world of digital assets, Senator Tim Scott’s push stands out as a bold move toward balance: protecting people, fueling growth, and securing the future. Whether you’re a long-time holder or just curious, keep watching January 15—it could reshape how America embraces the next big financial revolution. Stay informed, invest wisely, and remember: in crypto, knowledge is your strongest asset.