Whisper this to your wallet: What if the money in your pocket could zip around the globe in seconds, immune to wild swings, and power an economy bigger than most countries? That’s the allure of stablecoins, those digital anchors tied to real-world assets like the U.S. dollar. As we hit 2026, fresh forecasts paint a jaw-dropping picture—stablecoin transactions exploding to $56 trillion by 2030, while the market itself balloons toward $3 trillion or more. Buckle up as we unpack this surge, minus the jargon, and see why it could reshape how you save, spend, and send cash.

Demystifying Stablecoins: Your Everyday Digital Dollar

Picture stablecoins as the reliable sidekick to Bitcoin’s thrill ride—they’re cryptocurrencies designed to hold steady value, often pegged 1:1 to fiat like the USD. USDC, issued by Circle, is a prime example: fully backed by reserves and audited regularly, making it a go-to for traders and everyday users avoiding crypto’s ups and downs.

These tokens shine in real-life scenarios, like quick cross-border payments or earning yields in DeFi apps. With over 200 billion in circulation today, they’re already handling billions in daily trades, proving they’re more than a fad. For newcomers, think of them as Venmo on steroids—fast, borderless, and often cheaper than bank wires.

USDC stablecoin firm Circle to go public via SPAC at $4.5 bn …

The 2026 Snapshot: A Market Primed for Takeoff

Fast-forward to now: The stablecoin arena has swelled to around $280 billion in issuance, up from $200 billion at the year’s start. USDC alone commands a hefty share, with its transparent reserves drawing in institutions wary of past scandals.

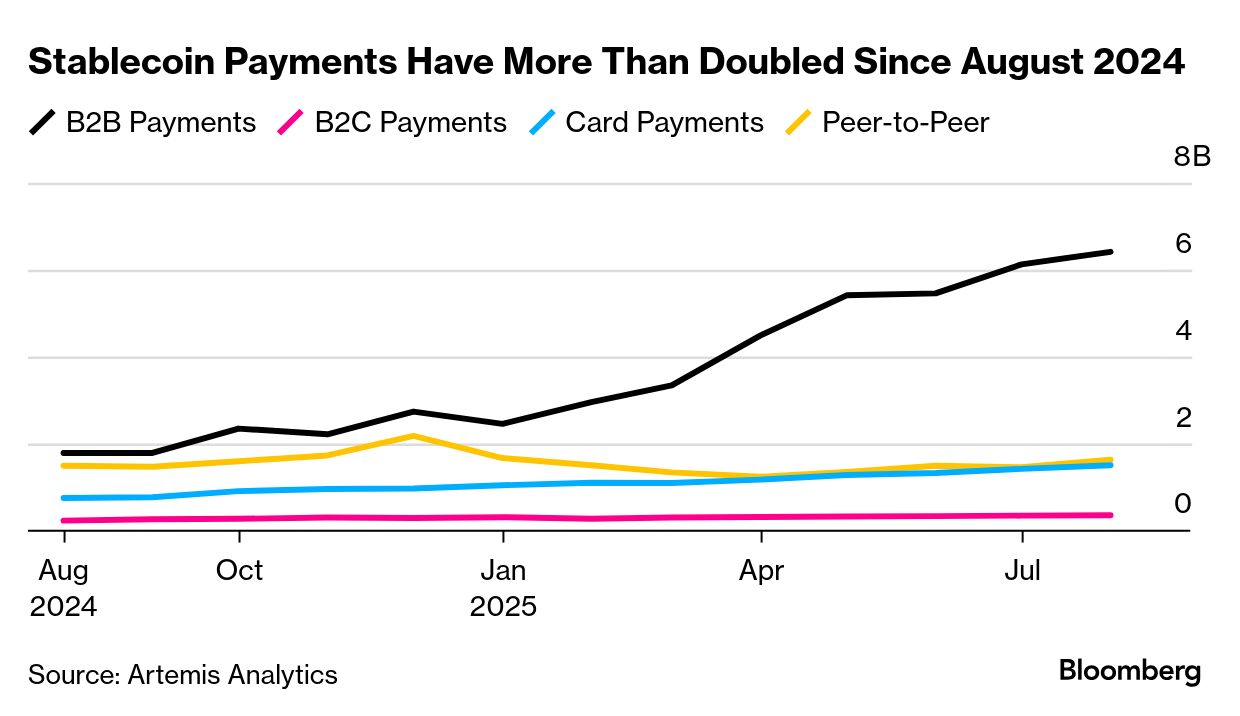

This growth isn’t random—it’s fueled by clearer U.S. regulations post-2024, boosting confidence. Daily payment volumes have jumped 70% in recent months, signaling a shift from speculation to practical use in remittances and e-commerce. If you’re dipping into crypto, this stability makes stablecoins a safe entry point, like training wheels for the blockchain world.

Skyrocketing Projections: Trillions on the Horizon

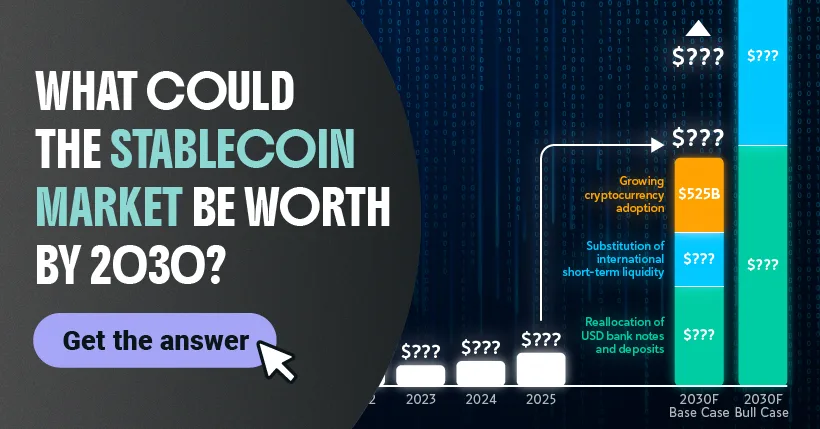

Here’s where it gets exciting: Analysts foresee the stablecoin market hitting $3 trillion by 2030, a tenfold leap from today. Even bolder? Bloomberg predicts transaction volumes soaring to $56.6 trillion annually, rivaling major payment networks.

Citi’s base case eyes $1.9 trillion in issuance, with a bull scenario at $4 trillion, driven by broader adoption. The U.S. Treasury Secretary upped his forecast to $3 trillion, citing tech advancements and global demand. These numbers aren’t pie-in-the-sky; they’re backed by trends like stablecoins capturing 5-10% of cross-border flows, potentially worth $2-4 trillion.

Visualized: Stablecoin Market Size Forecast into 2030

Key Engines Driving the Expansion

What’s sparking this fireball? First, cost savings—stablecoins slash fees for international transfers, appealing to businesses and migrants alike. Speed is another winner: Settlements happen in minutes, not days.

Regulatory green lights, especially in the U.S., are paving the way for banks to dive in, blending traditional finance with blockchain. Add in emerging markets’ hunger for stable dollars amid local currency woes, and you’ve got a recipe for boom. EY-Parthenon estimates highlight how efficiency could redirect trillions from outdated systems.

Stablecoin Use for Payments Jumps 70% Since US Regulation – Bloomberg

Hurdles on the Path: Not Without Bumps

Of course, it’s not all smooth sailing. Risks like hacking or reserve mismanagement loom, though stricter audits are helping. Global regs vary wildly, potentially slowing growth in some spots.

Critics worry about over-reliance on a few issuers, but diversification—like state-backed options—is emerging. Staying informed means watching for balanced sources, as media biases can hype or downplay the tech’s potential.

Envisioning 2030: A Transformed Financial Landscape

By decade’s end, stablecoins could be as common as credit cards, enabling seamless global trade and financial inclusion for billions. For you, it might mean earning interest on idle cash or sending funds abroad without the hassle.

This evolution promises a more equitable system, but smart choices—like diversifying holdings—remain key. As projections align from Citi to Bloomberg, one thing’s clear: The stablecoin wave is building, ready to reshape money as we know it.