Picture this: You’re checking your crypto wallet on a quiet evening in 2026, and XRP has skyrocketed past expectations, turning modest holdings into life-changing gains—all thanks to a perfect storm of regulatory wins and market cycles. While that dream fuels endless online debates, the reality is more nuanced.

XRP, the token powering Ripple’s fast cross-border payment network, has captivated investors for years. As we close out 2025 with XRP hovering around $1.85–$1.90, bold claims of $100 by 2026 are making waves. This article dives into the key drivers—Bitcoin’s halving cycle and the resolved SEC lawsuit—to separate hype from grounded possibilities.

The SEC Lawsuit Resolution: A Game-Changer for XRP

After a grueling five-year battle, Ripple and the SEC reached a settlement in 2025, with a reduced $50 million penalty and both sides dropping appeals. This outcome provided much-needed regulatory clarity, confirming XRP is not a security in retail transactions.

The impact was immediate: XRP surged to new highs earlier in the year, spot XRP ETFs launched (attracting billions in inflows), and institutional interest grew. Analysts note this clarity removed a major overhang, paving the way for broader adoption in payments (sources: CoinDesk and Bloomberg reports, 2025).

Bitcoin Halving’s Ripple Effect on Altcoins Like XRP

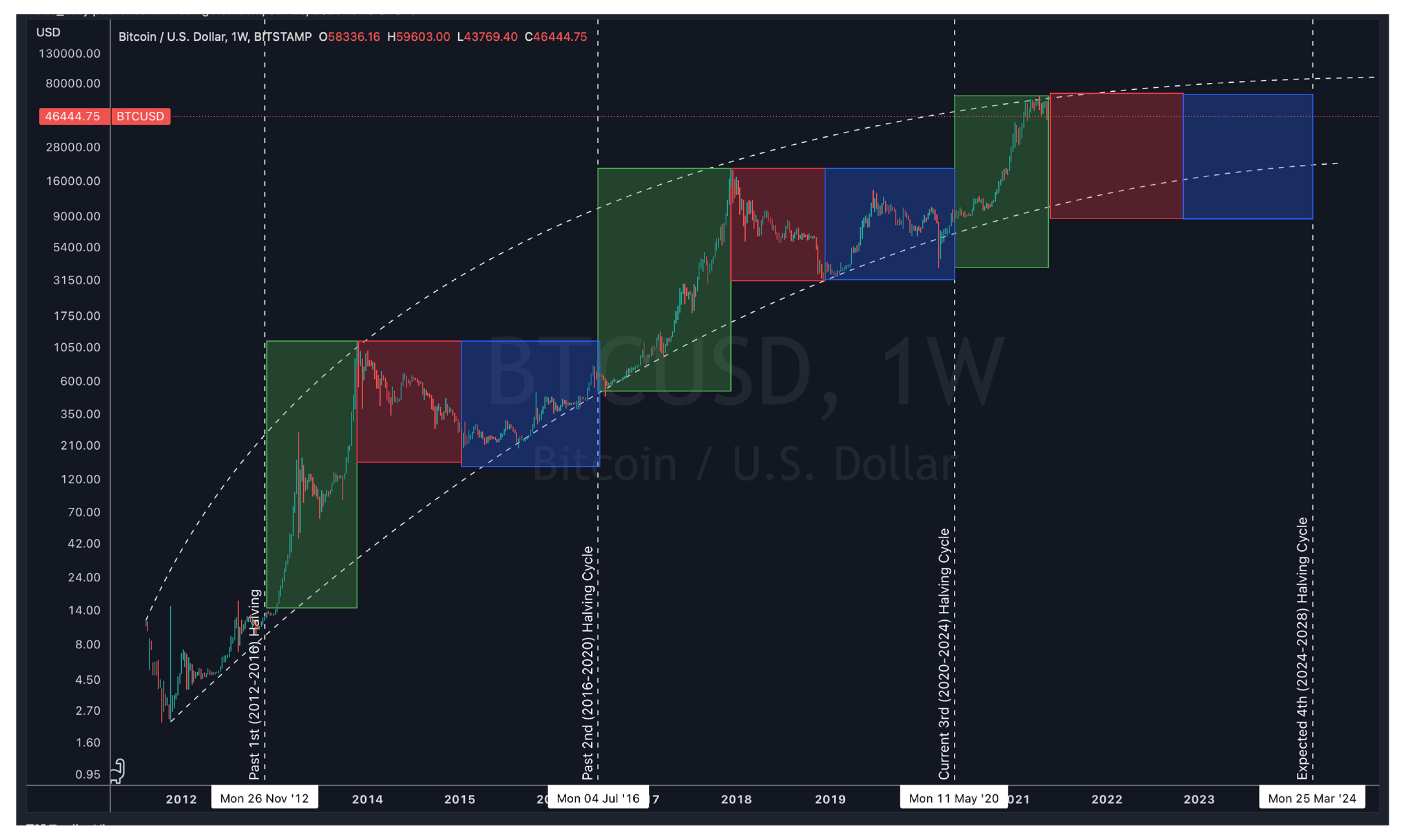

Bitcoin’s 2024 halving reduced new supply, historically sparking bull runs 12–18 months later—pointing to potential peaks in 2026. When Bitcoin rallies, capital often flows into altcoins, creating “alt seasons.”

XRP has benefited from this cycle before, outperforming during post-halving surges. With Bitcoin consolidating in late 2025, experts anticipate renewed momentum in 2026 could lift altcoins, amplified by XRP’s unique payment utility (historical cycle analysis from Grayscale Research and CoinCodex, 2025).

What Experts Are Saying About XRP in 2026

Predictions for 2026 vary widely, reflecting optimism from institutional catalysts and caution from market realities.

Bullish Outlooks

- Standard Chartered’s Geoffrey Kendrick forecasts $8 by end-2026, driven by ETF inflows and adoption.

- Some analysts see $5–$10, citing Ripple’s partnerships and RLUSD stablecoin growth.

Conservative Forecasts

- Platforms like CoinCodex and Changelly predict $1.80–$3, emphasizing volatility.

- Average consensus hovers around $2–$4 (aggregated from Binance, LiteFinance, and Coinpedia, late 2025).

Why $100 by 2026 Feels Like a Long Shot

A $100 price would demand a market cap of $6–$10 trillion (with 60–100 billion tokens), dwarfing today’s entire crypto market (~$3 trillion) and rivaling global stock markets.

While utility in cross-border payments could drive demand, achieving this in one year requires unprecedented adoption. Most experts view $100 as a distant, multi-decade possibility—if at all—rather than a 2026 reality (market cap analysis from CoinMarketCap and analyst reports, 2025).

Realistic Factors That Could Boost XRP in 2026

Look for these developments:

- Strong ETF inflows and treasury company buying.

- Expanded RippleNet usage for real-world settlements.

- Positive macro conditions aligning with halving cycles.

Balanced risks include broader market corrections or slower adoption.

Final Thoughts: Exciting Potential, But Grounded Expectations

XRP enters 2026 with stronger fundamentals than ever—thanks to SEC clarity and halving tailwinds. While $100 remains highly improbable, meaningful gains to $5+ are within reach for optimistic scenarios.

For everyday investors, focus on fundamentals over moonshot hype. XRP’s story is about efficient global payments, not overnight riches—stay informed and manage risks wisely.

- Standard Chartered Bank (2025 XRP forecast).

- Grayscale Research (2026 Digital Asset Outlook).

- CoinCodex, Changelly, and LiteFinance price models (2025–2026).