In late 2025, one bold investor made headlines in the crypto world by snapping up another $35 million worth of Ethereum, pushing their total holdings to a staggering $1.83 billion. What makes this move stand out? It’s powered by smart use of leverage on Aave, a leading DeFi platform, allowing massive exposure without needing billions upfront.

This story shows how everyday DeFi tools can scale big bets—but it also highlights the careful balance required in volatile markets.

The Investor Behind the Massive ETH Position

The player here is Trend Research, a Hong Kong-based firm. On December 29, 2025, they added about 11,520 ETH (worth roughly $35 million) through withdrawals from Binance. This brought their total to over 601,000 ETH, valued at approximately $1.83 billion at the time.

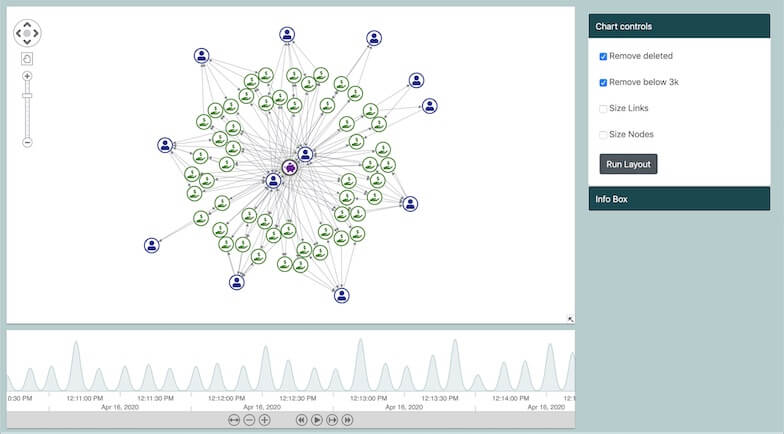

On-chain data from Lookonchain and Arkham Intelligence tracked the activity, revealing an average buy price around $3,265 per ETH.

How Aave Leverage Makes This Possible

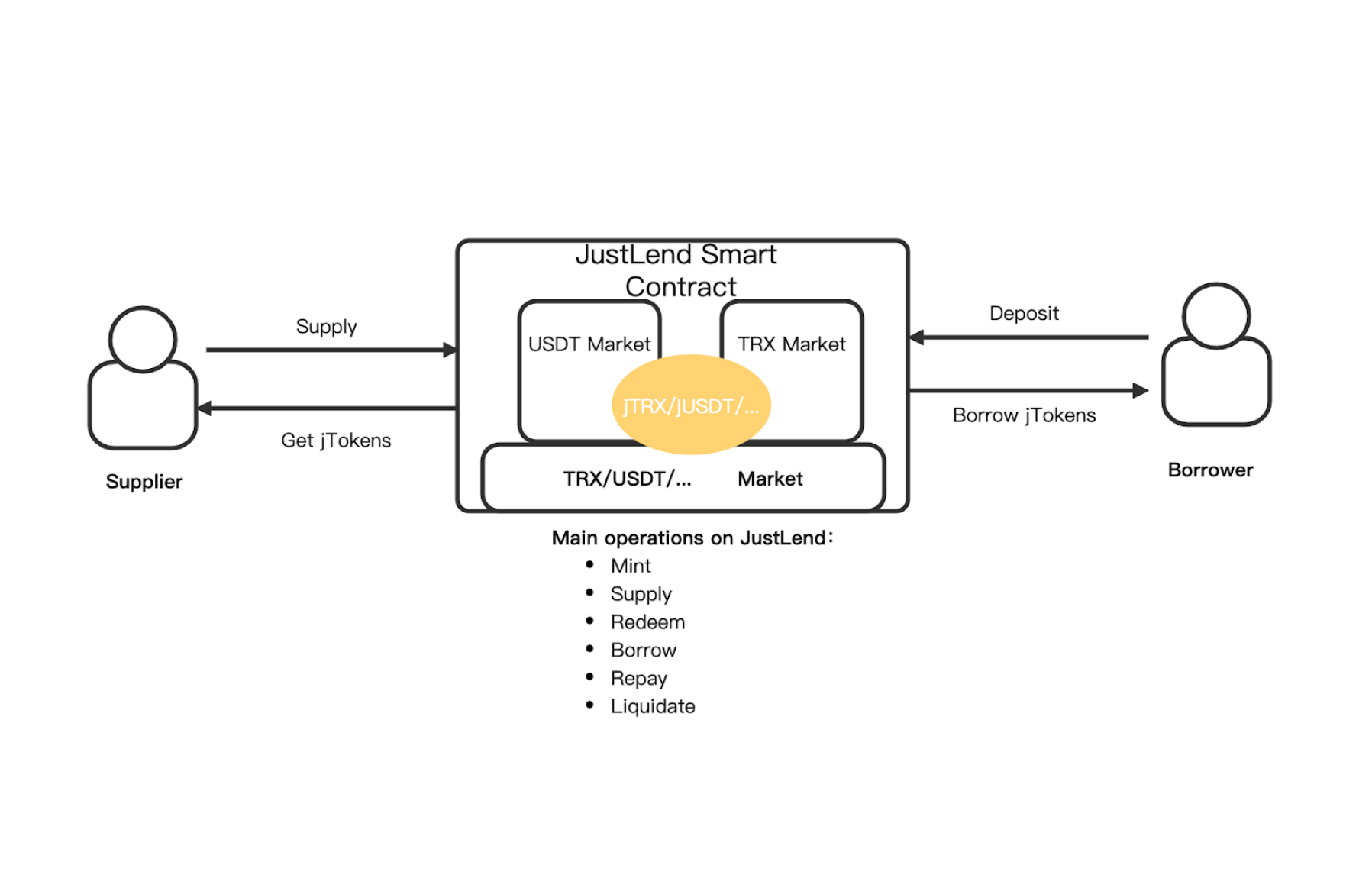

Aave is a decentralized lending protocol where users deposit assets as collateral to borrow others. Trend Research deposits ETH (or wrapped ETH) on Aave, then borrows stablecoins like USDT—totaling a record $958 million.

They use those borrowed stablecoins to buy more ETH on exchanges like Binance, withdraw it, and often redeposit part of it back on Aave to unlock even more borrowing power. This creates a leveraged loop, amplifying exposure.

According to Cointelegraph and Lookonchain reports from December 29, 2025, this strategy has built roughly 2x leverage overall.

Step-by-Step Breakdown of the Strategy

- Deposit ETH as collateral on Aave.

- Borrow stablecoins (up to a safe loan-to-value ratio, often around 80% for ETH).

- Swap or use the stablecoins to purchase more ETH.

- Withdraw the new ETH and repeat partially to increase collateral.

This recursive approach scales positions efficiently, but requires monitoring health factors to avoid liquidation.

Why Go Leveraged? The Bullish Outlook

Trend Research’s founder has publicly stated they’re “bullish on 2026,” citing potential tailwinds like on-chain financial growth, lower rates, and supportive policies. They view short-term dips as buying opportunities, ignoring “fluctuations of a few hundred dollars.”

This conviction drives the leveraged accumulation, aiming to maximize upside in a expected rally.

The Risks You Can’t Ignore

Leverage boosts gains but also losses. If ETH prices drop sharply, the position’s health factor could fall below 1, triggering automatic liquidation—selling collateral to repay debt.

Industry reports, including from Chainalysis and the Financial Stability Board, note that leveraged DeFi positions contribute to market volatility and cascading liquidations in downturns.

Smart contract risks and interest rate changes add layers of caution.

What This Means for Everyday Crypto Users

While institutional-scale moves like this grab attention, the core tools—Aave’s borrowing and on-chain transparency—are open to anyone. Smaller users can try similar (but much safer) strategies with modest amounts.

Always start small, monitor closely, and never borrow more than you can handle losing.

Key Takeaways from This Leverage Play

In 2025’s maturing DeFi landscape, stories like Trend Research’s demonstrate leverage’s power for amplified bets on assets like ETH. Backed by real on-chain data from sources like Lookonchain, it underscores conviction amid uncertainty.

Yet, as experts remind, leverage is a tool—not a guarantee. Sustainable crypto strategies blend opportunity with strong risk management for the long haul.