Picture this: A sleek online dashboard lights up with staggering numbers—thousands of dollars flowing in daily from cryptocurrency mining, all while you sip coffee at home. Platforms like FY Energy paint this dream vividly in 2025, touting eye-watering figures that seem almost too good for everyday investors. But behind the flashy promises lies a harsher reality that many discover too late.

As crypto enthusiasm surges, so do cautionary tales. This isn’t about dismissing opportunities outright; it’s about peeling back the layers to see what’s really at stake when extraordinary claims meet fine-print realities.

What FY Energy Promises—and What It Actually Delivers

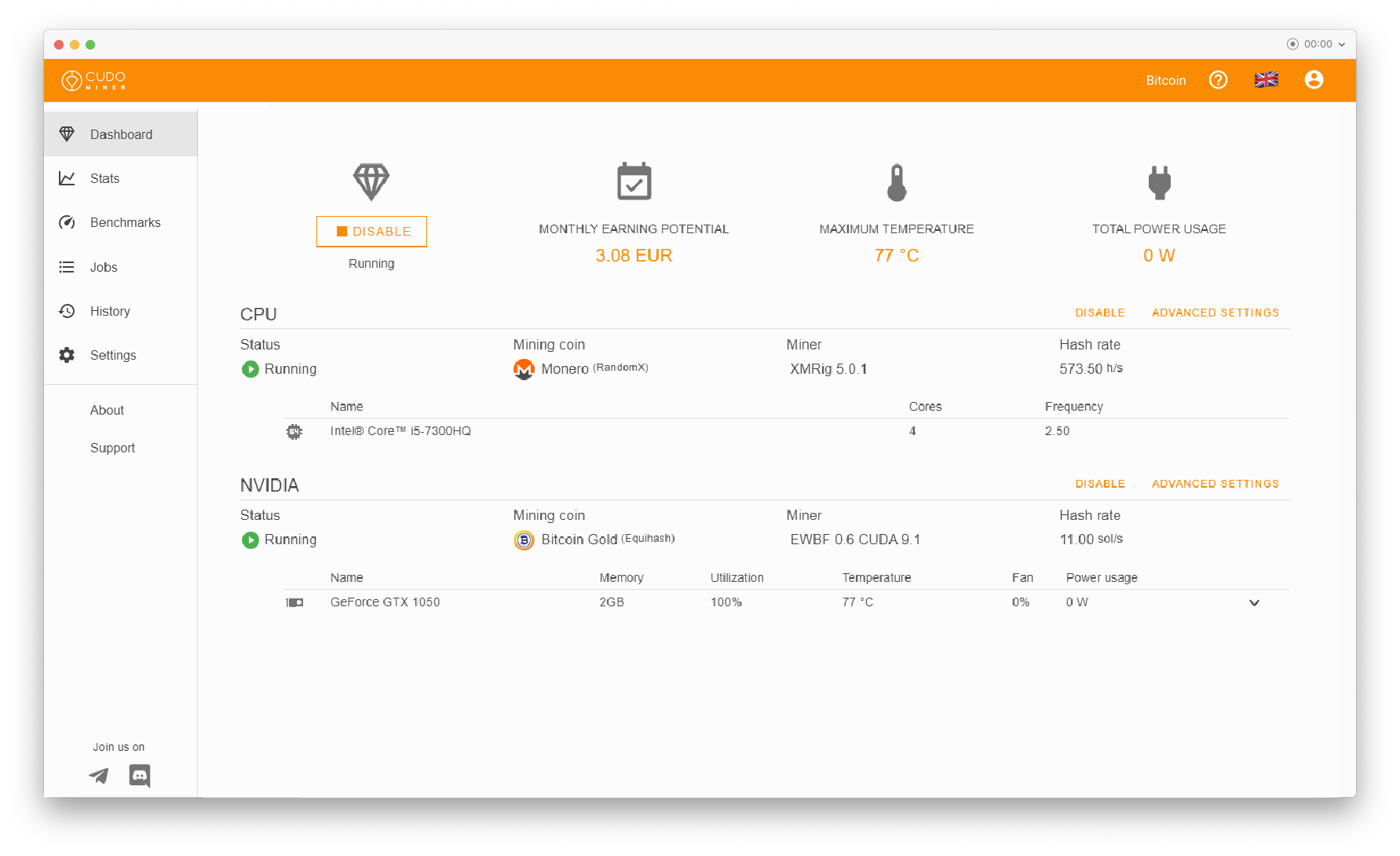

FY Energy positions itself as a user-friendly cloud mining service, claiming U.S. registration and a FinCEN MSB license. Users sign up, often starting with a small trial bonus, then choose contracts that supposedly yield massive daily returns based on rented hashing power.

The hook? Projections of enormous earnings, sometimes scaling to figures that defy market logic. Yet, independent analyses and user reports paint a different picture, with complaints of withdrawal issues and unsustainable models.

Why Such High Earnings Claims Raise Eyebrows

No legitimate mining operation can lock in fixed massive daily payouts. Cryptocurrency rewards fluctuate with factors like Bitcoin’s price, network difficulty, and energy costs. Promises of consistent high returns often signal trouble.

Guaranteed Returns: A Classic Warning Sign

Authorities like the FTC warn that any investment guaranteeing profits, especially in crypto, is a red flag. Scammers thrive on this tactic, as noted in FTC consumer alerts emphasizing that “only scammers will guarantee profits or big returns.”

Referral Bonuses and Multi-Level Incentives

Heavy emphasis on recruiting others for commissions can resemble Ponzi structures, where payouts depend on new deposits rather than actual mining.

The Hidden Risks in Contracts You Might Overlook

Contracts often bury critical details in the fine print, leading to surprises down the line.

Withdrawal Hurdles and Extra Fees

Many users report smooth small withdrawals initially, but larger ones trigger demands for additional payments or “tasks.” This mirrors patterns in broader cloud mining frauds documented by sources like Chainalysis and CoinLaw.

:max_bytes(150000):strip_icc()/GettyImages-103405221-8696f029989f4b7bb3270a18ac983aaa.jpg)

Lack of Verifiable Operations

Claims of vast data centers lack independent proof. Real providers share transparent details; opacity here fuels skepticism.

Mining Scam Survival Guide: 7 Common Traps and How to Avoid Them

Practical Steps to Protect Yourself in Cloud Mining

If exploring similar platforms, prioritize safety over hype.

Research Thoroughly Before Committing

Check independent reviews on sites like Trustpilot or Reddit, and verify licenses directly with regulators. Avoid rushing into “limited-time” offers.

Start Small and Withdraw Early

Test with minimal amounts and attempt withdrawals promptly to gauge reliability.

Use Secure Personal Storage

Move any earnings to your own hardware wallet quickly, keeping control in your hands.

Spread Your Investments Wisely

Never concentrate everything in one platform or coin—diversification helps manage risks.

Final Thoughts: Balancing Opportunity and Caution

In 2025’s crypto landscape, cloud mining can offer convenience for some, but platforms pushing unrealistically high daily earnings often come with steep hidden risks. Reports from bodies like the FTC and industry watchers underscore that extraordinary promises rarely hold up without extraordinary evidence.

Approach with eyes wide open: Educate yourself, invest only what you can afford to lose, and lean on verified facts over flashy dashboards. True financial growth in crypto comes from informed, patient steps—not overnight windfalls.