Imagine swapping your favorite cryptocurrencies without middlemen, and now, picture those swaps actually putting money back into your pocket as a token holder. That’s the fresh reality hitting the crypto world with Uniswap’s latest governance win—a bold move that’s got everyone from casual traders to big investors buzzing about the future of decentralized finance.

What is Uniswap and Why Does It Matter?

Uniswap is like the bustling street market of the crypto universe, but online and without bosses telling you what to do. It’s a decentralized exchange (DEX) built on blockchain technology, mainly Ethereum, where anyone can trade tokens directly from their wallet. No need for banks or sign-ups—just connect, swap, and go. Since launching in 2018, it’s handled trillions in trades, making it a go-to spot for discovering new coins or dodging high fees on traditional platforms.

What sets Uniswap apart? It’s community-owned through its UNI token, which lets holders vote on big decisions. This democratic vibe has turned it into a powerhouse, processing more volume than some centralized exchanges. For everyday folks dipping into crypto, Uniswap means freedom: trade memes, stablecoins, or blue-chip assets anytime, anywhere.

Uniswap v2 Mainnet Launch

Breaking Down the UNIfication Proposal

The UNIfication proposal isn’t just another update—it’s a overhaul designed to make Uniswap stronger and more rewarding. Approved on December 26, 2025, with overwhelming support (over 125 million yes votes), it tackles long-standing debates in the community. Think of it as Uniswap leveling up from a free-for-all tool to a self-sustaining machine that benefits everyone involved.

The Massive UNI Token Burn

At the heart of this is a whopping burn of 100 million UNI tokens, worth around $590 million at current prices. Burning means permanently removing tokens from circulation, like shredding money to make the rest scarcer and potentially more valuable. This retroactive burn estimates what could have been destroyed if fees had kicked in earlier, covering years of missed opportunities from massive trading volumes.

Why burn? It reduces supply, which could drive up UNI’s price if demand stays steady. For holders, it’s like getting a slice of the platform’s success without lifting a finger. As per governance discussions, this sets the stage for ongoing burns tied to real activity, turning UNI into a token that accrues actual value over time.

Crypto Blood: Over 80 Royalty-Free Licensable Stock Illustrations …

Turning On Protocol Fees

No more free rides—at least not entirely. The proposal flips the “fee switch” on for Uniswap’s core versions (v2 and select v3 pools on Ethereum mainnet, with expansions planned). Previously, all swap fees went to liquidity providers (those who supply tokens to make trades possible). Now, a small portion—think 0.05% or less—gets redirected to the protocol itself.

These fees aren’t pocketed by devs; they’re funneled into buying and burning more UNI tokens. Plus, innovations like Protocol Fee Discount Auctions let users bid to skip fees temporarily, with proceeds also burning UNI. Even Unichain, Uniswap’s own speedy layer-2 network, will route its sequencer fees (after costs) straight to burns. It’s a clever loop: more trades mean more fees, more burns, and happier holders.

Uniswap Protocol Fee Report – Gauntlet

How This Changes the Game for Crypto Users

For the average person trading crypto, this could mean better deals and a healthier ecosystem. Liquidity providers might see boosted returns from captured “MEV” (that sneaky value from transaction ordering), estimated at $0.06 to $0.26 extra per $10,000 traded. Users get a smoother experience too, as Uniswap Labs drops its interface fees to zero, making the app, wallet, and API completely free.

On the market side, expect volatility. UNI’s price might spike from the supply crunch, but it’s not guaranteed—crypto’s wild. Long-term, though, this aligns incentives: more platform use equals more token value. It could attract institutions looking for sustainable DeFi plays, potentially growing the whole space. Just remember, while exciting, always do your own research before jumping in.

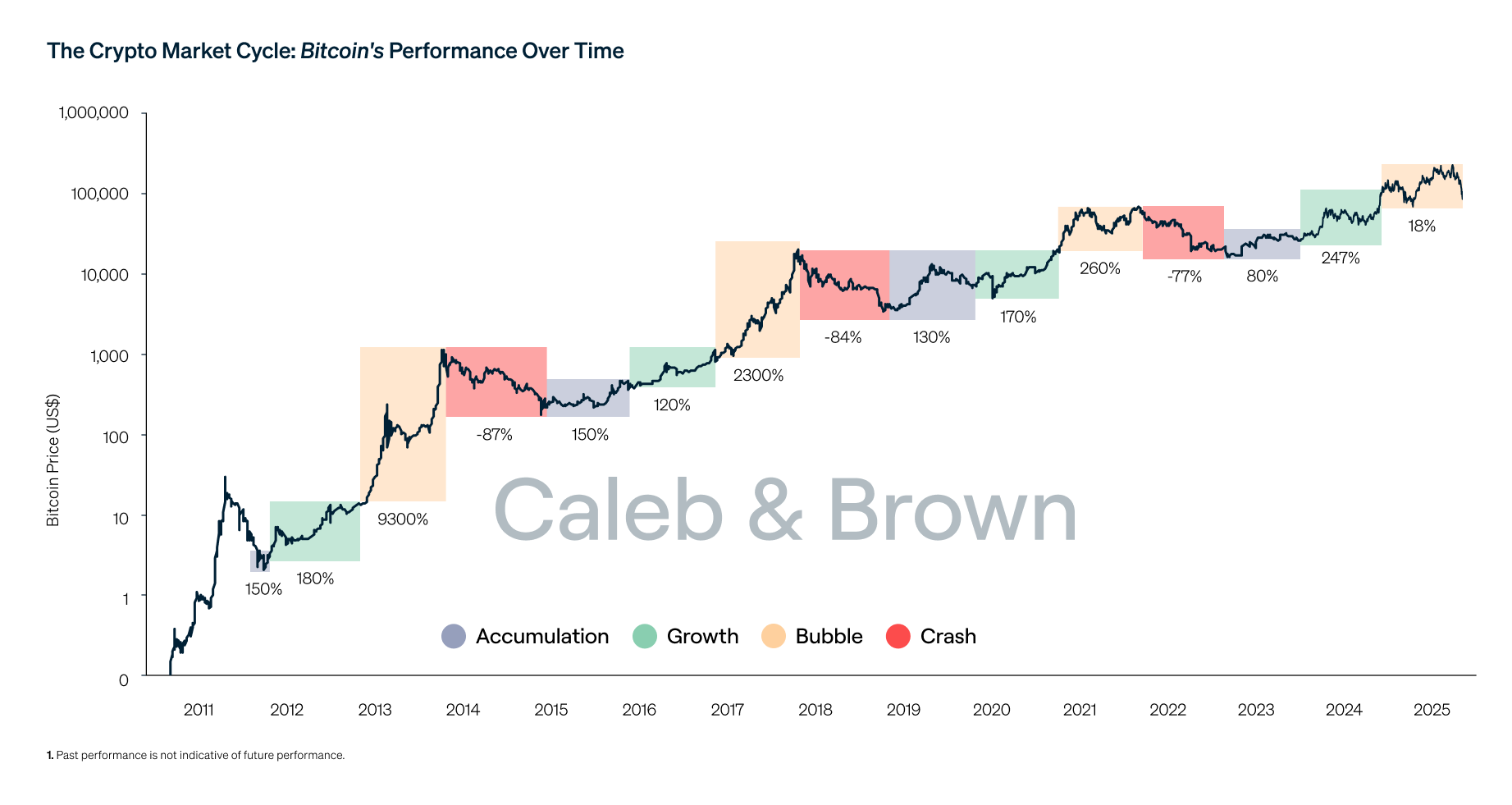

Bitcoin’s Market Cycle & Crypto Cycles Chart | Key Insights & Trends

What Experts Are Saying

Industry watchers are optimistic. CoinDesk reports the proposal transforms Uniswap by sharing fees with holders, a multi-year push finally realized. According to DL News, it’s a buyback program using revenue, which could reduce UNI’s supply significantly over time. Even governance forums like Uniswap Agora highlight the retroactive burn as a fair nod to early supporters.

From X (formerly Twitter), Uniswap Labs itself announced the on-chain execution, confirming zero interface fees and burns starting immediately. Analysts on platforms like CoinMarketCap note this shifts UNI toward deflationary tokenomics, potentially boosting its appeal in a maturing market.

In wrapping up, UNIfication isn’t just tech jargon—it’s a step toward making crypto work for everyday people. By burning tokens and activating fees, Uniswap is betting on growth that rewards its community. Whether you’re a newbie trader or a seasoned holder, this could be the spark that reignites interest in DeFi. Keep an eye on those charts; the burn has just begun.