Imagine a world where a social media company, best known for its outspoken platform, suddenly becomes one of the biggest players in the cryptocurrency space—holding enough Bitcoin to rival some nations’ reserves. That’s exactly what unfolded in late 2025 with Trump Media & Technology Group, as Bitcoin prices climbed steadily through the third quarter and beyond.

What Sparked the Late 2025 Bitcoin Momentum?

Bitcoin’s performance in Q3 2025 built on earlier gains, trading in a stable range around $108,000 to $118,000, supported by growing institutional interest and favorable policies. By December, however, momentum picked up again, with prices hovering near $87,000–$90,000 amid renewed corporate buying activity.

This environment encouraged companies to view Bitcoin not just as a speculative asset, but as a reliable store of value—similar to gold but with modern advantages like easy divisibility and global transfer.

Trump Media’s Bold Move into Bitcoin

Trump Media & Technology Group (DJT), the company behind Truth Social, made headlines in December 2025 by adding 451 Bitcoin at a cost of approximately $40.3 million. This purchase pushed their total holdings to 11,542 BTC, crossing the $1 billion valuation threshold at the time.

According to on-chain analytics from firms like Arkham Intelligence and Lookonchain, this was part of a longer-term strategy that saw Trump Media accumulate significant crypto assets throughout the year.

Why Companies Like Trump Media Are Embracing Bitcoin Treasuries

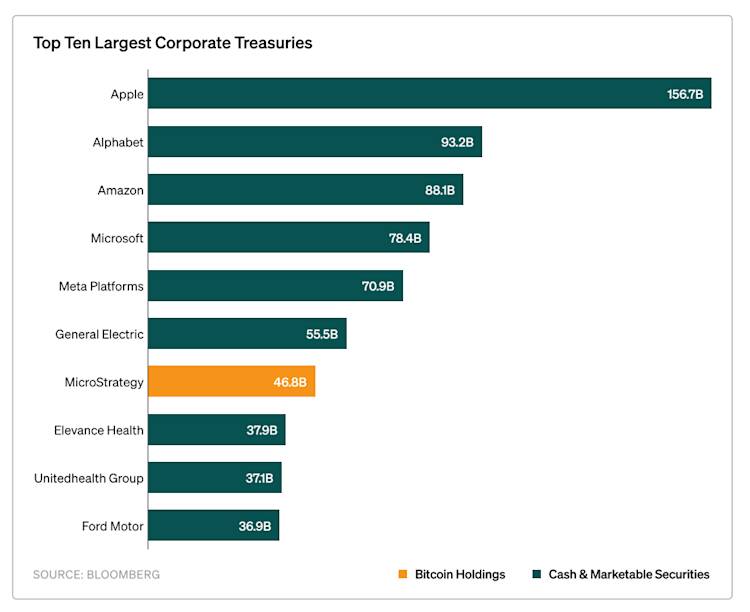

Many businesses are now holding Bitcoin on their balance sheets to hedge against inflation and currency devaluation. Pioneer companies like MicroStrategy (now Strategy) demonstrated how this approach can protect and even grow corporate wealth during volatile times.

Trump Media’s decision aligns with this trend, diversifying beyond social media into digital assets. As reported by Bitcoin Magazine and CoinDesk, such moves signal confidence in Bitcoin’s long-term role in corporate finance.

The Impact on DJT Stock and Investor Interest

The announcement coincided with volatility in DJT shares, which saw rallies tied to broader company developments, including merger talks. While stock prices fluctuated, the Bitcoin holdings added a new layer of intrigue for investors watching corporate crypto adoption.

This strategy highlights how everyday companies are adapting to a digital economy, potentially offering shareholders indirect exposure to Bitcoin’s growth.

Looking Ahead: What This Means for Everyday Investors

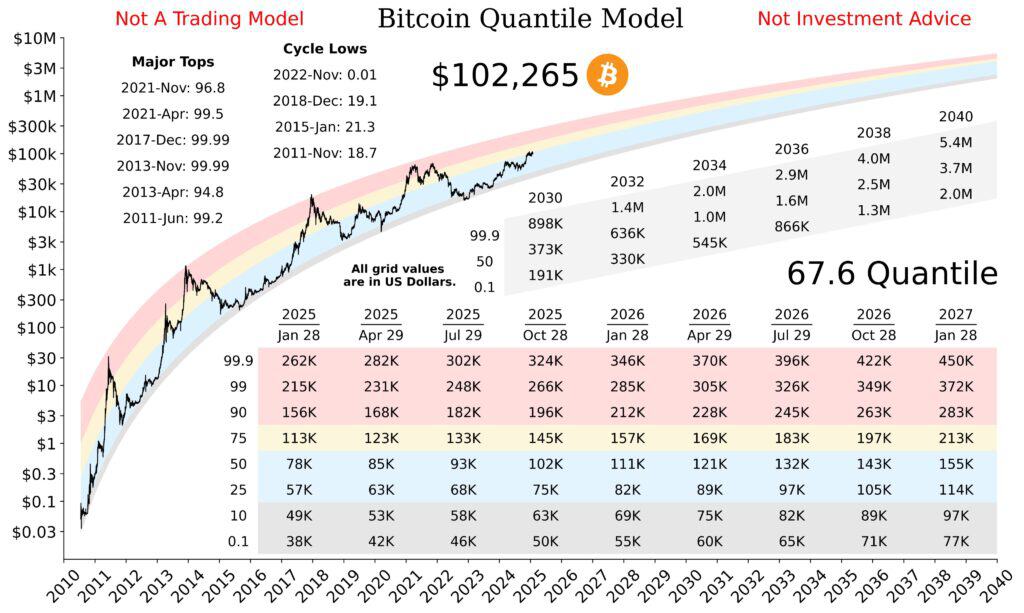

Stories like Trump Media’s illustrate Bitcoin’s evolving status—from niche investment to mainstream corporate tool. For ordinary people, it raises interesting questions: Could more companies follow suit, driving further demand? And how might this influence Bitcoin’s price in the coming years?

As always, cryptocurrency involves risks, including price swings and regulatory changes. Yet, the growing list of corporate adopters suggests a maturing market that’s capturing wider attention.

Sources: Insights drawn from reports by CoinDesk (December 24, 2025), Bitcoin Magazine (December 22, 2025), Arkham Intelligence on-chain data, and Crypto Briefing.