When a company decides to treat Bitcoin like gold in its vault, big moves follow. On December 22, 2025, Metaplanet shareholders gave a resounding yes to every proposal on the table, handing the team new tools to raise money smarter and keep stacking Bitcoin without hurting existing owners.

This unanimous backing clears the path for Japan’s leading corporate Bitcoin holder to chase ambitious goals, potentially reaching 21,000 BTC holdings next year while drawing in global investors.

What Happened at the Extraordinary Meeting

Shareholders gathered for the Extraordinary General Meeting (EGM) and approved all five proposals without dissent. These changes rework how Metaplanet handles its capital, making it easier to pay dividends, buy back shares, and issue new types of stock.

Key updates include creating Class A (MARS) preferred shares with adjustable monthly dividends and Class B (MERCURY) shares aimed at big overseas institutions. According to reports from CryptoNinjas and CoinPedia on December 22, 2025, this setup lets the company raise funds tied directly to its Bitcoin growth while keeping common shares stable.

Metaplanet’s President Lays Out Plan To Acquire 210,000 Bitcoin By …

Why Preferred Shares Change the Game

Preferred shares act like a hybrid between stocks and bonds—they often pay steady dividends and get priority over regular shares. For Metaplanet, this means attracting patient money from institutions that want reliable income plus exposure to Bitcoin’s upside.

The approvals reduce reliance on issuing more common shares, which can dilute value for everyday investors. Instead, new capital can flow straight into buying more Bitcoin. Market reaction was swift: shares jumped over 4% that day, closing around 451 JPY, per CoinGape and Yahoo Finance data.

:max_bytes(150000):strip_icc()/Preferred-Stock-Final-0b2696b31b744e33b21c40ac913daf0f.jpg)

:max_bytes(150000):strip_icc()/Term-Definitions_preference-shares-718c73612ed149c181dd3a098ee9f438.jpg)

Current Holdings and the Road Ahead

Metaplanet currently holds 30,823 BTC, worth about $2.75 billion, making it Asia’s largest corporate holder and fourth globally, according to Bitcoin Treasuries and company analytics as of late 2025.

Earlier plans outlined accumulating up to 21,000 BTC by the end of 2026, though recent aggressive buys have already surpassed initial milestones. With fresh funding flexibility, management can now accelerate purchases, especially if Bitcoin prices dip or institutional interest grows.

Institutional Confidence Boosts Momentum

Even before the vote, heavyweights showed support. Norges Bank Investment Management—the world’s largest sovereign wealth fund—voted yes on all proposals, as reported by CoinDesk in December 2025. This endorsement highlights how Metaplanet’s approach appeals to traditional big money seeking Bitcoin exposure without direct custody hassles.

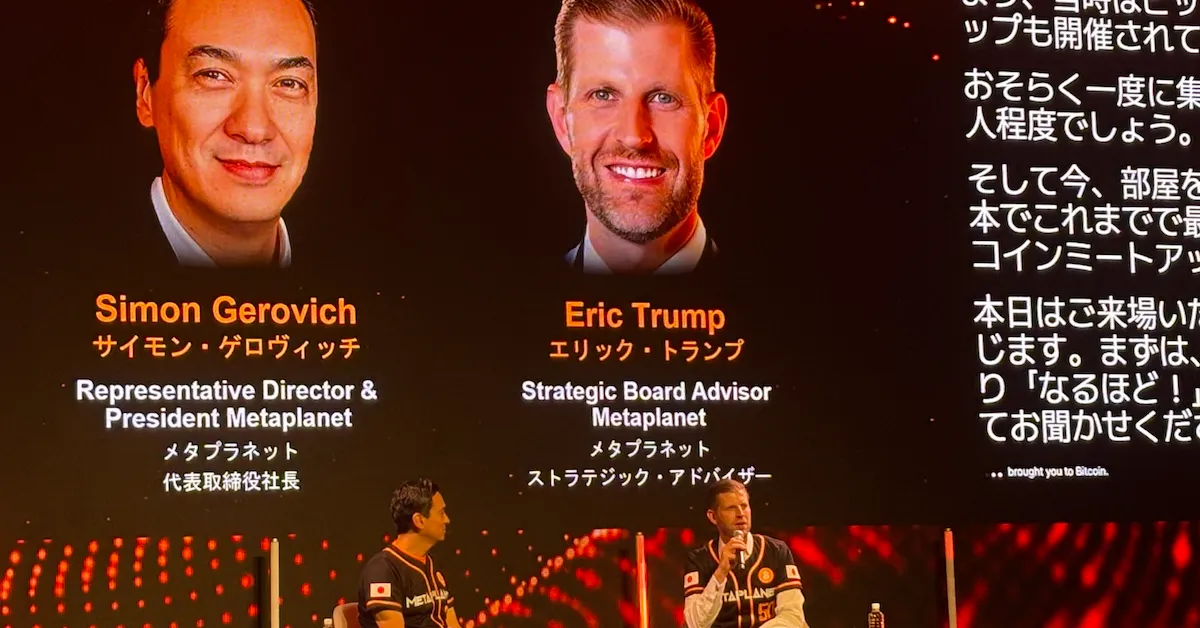

CEO Simon Gerovich thanked attendees post-meeting, calling it a strong mandate for the Bitcoin-focused vision.

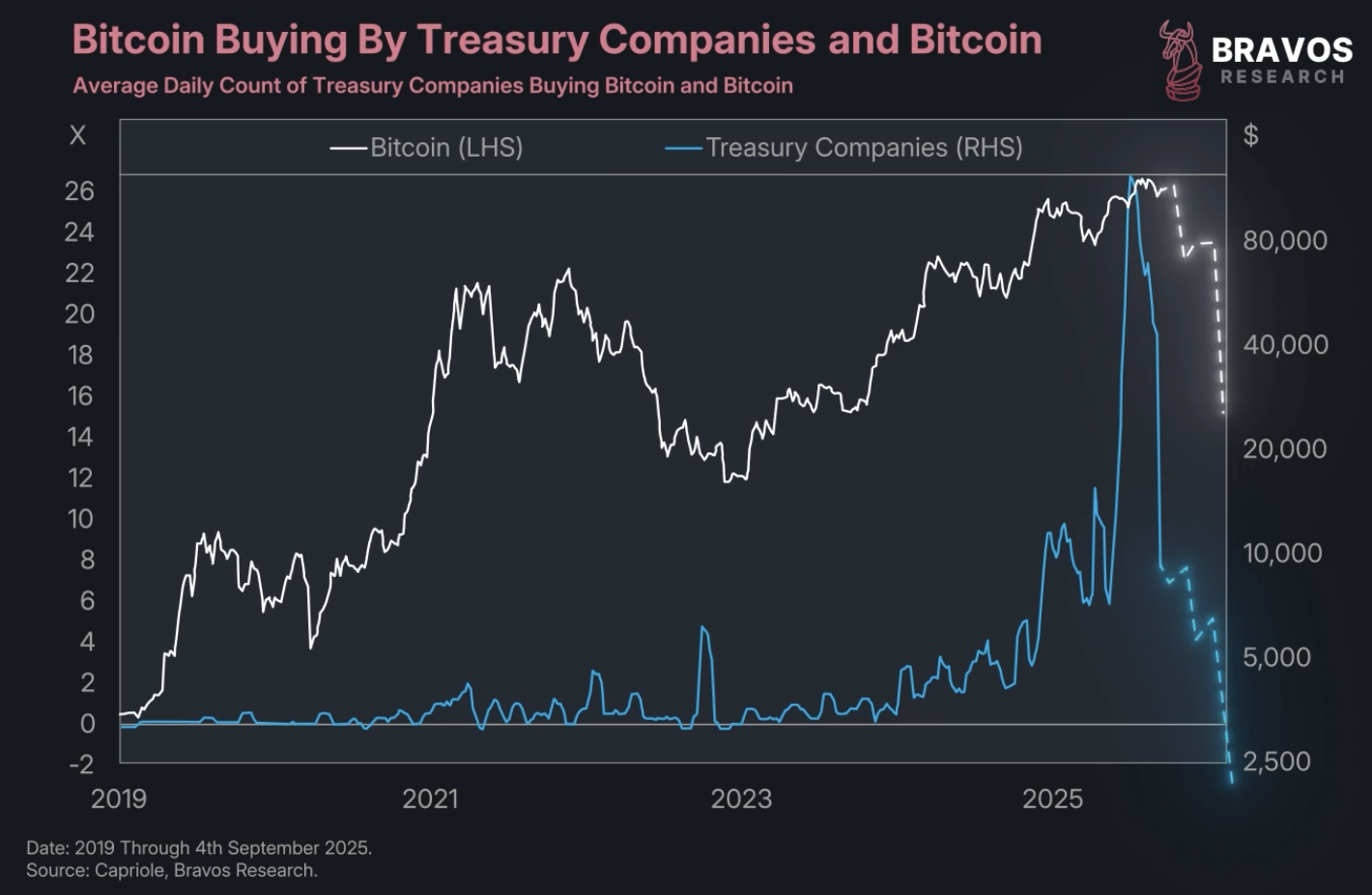

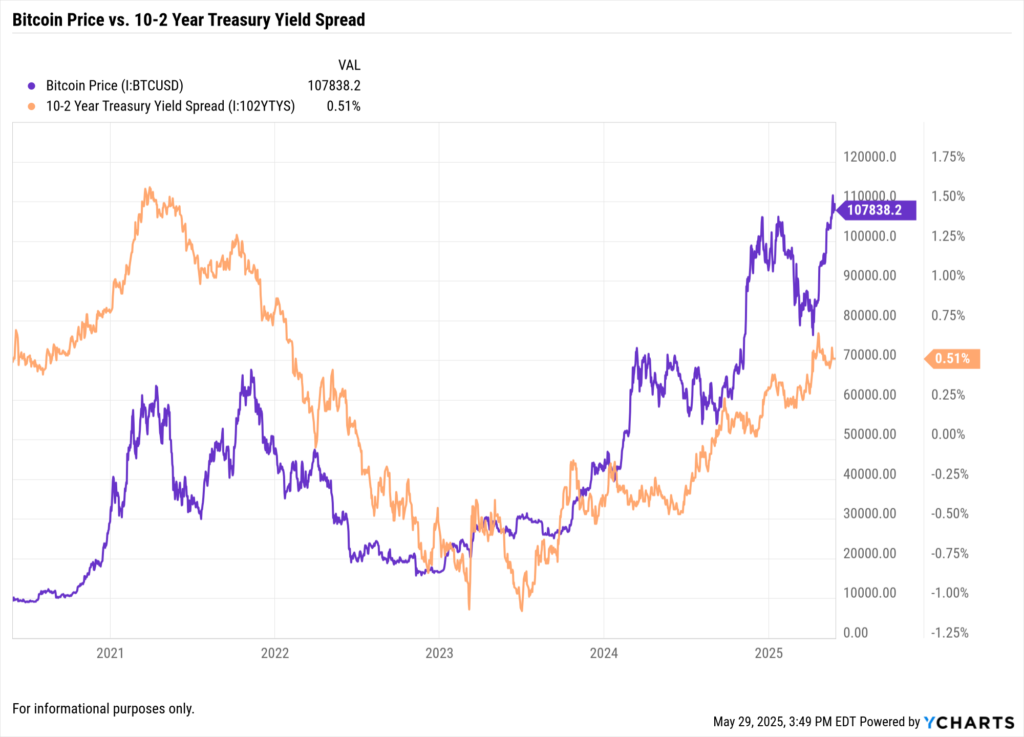

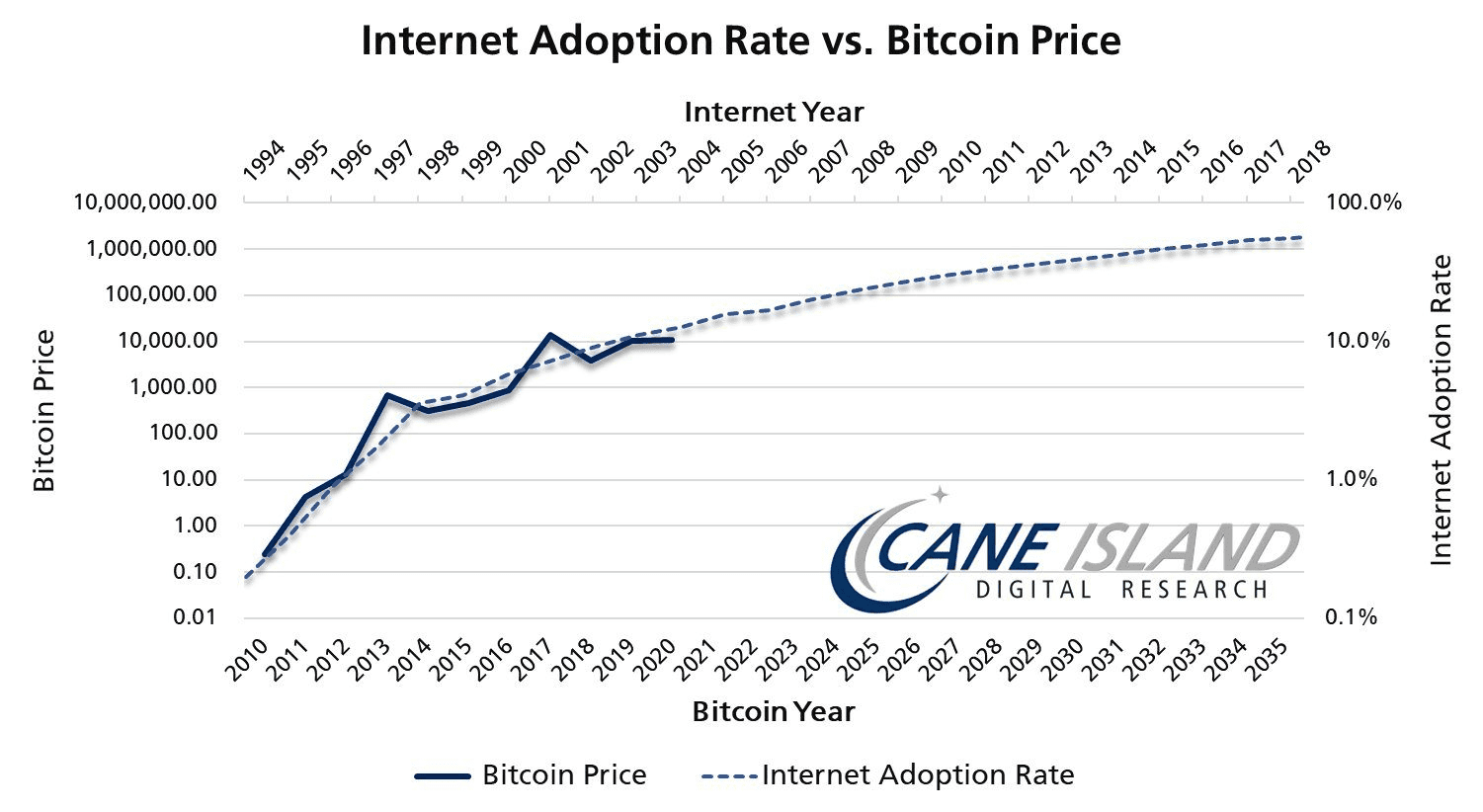

Broader Picture: Corporate Bitcoin Adoption Grows

Companies worldwide are adding Bitcoin to balance sheets as a hedge against inflation and currency risks. Metaplanet’s moves fit this trend, blending classic finance tools with digital assets.

Charts tracking corporate treasuries show steady growth in holdings throughout 2025, with public firms benefiting from price appreciation and strategic funding.

Outlook for Metaplanet and Bitcoin Holders

With obstacles removed, Metaplanet is positioned to scale efficiently into 2026. Reaching or exceeding 21,000 BTC would cement its status among top corporate players.

For anyone watching corporate adoption, this vote signals maturing strategies—rewarding patience with potential long-term gains. As usual, markets fluctuate, so personal research remains key when considering any investment tied to Bitcoin’s volatility. The shareholder victory marks another step in making corporate Bitcoin treasuries more mainstream.