Imagine waking up to news that one of the world’s largest crypto exchanges is pouring millions in rewards into a promising Solana-based project. That’s exactly what happened recently with Meteora’s MET token, sparking fresh excitement in an already buzzing ecosystem. This move isn’t just about free tokens—it’s a clear signal that Solana’s decentralized finance (DeFi) scene is gaining serious momentum heading into 2026.

What Is Meteora and Why Does Its Binance Listing Matter?

Meteora is a key player in Solana’s DeFi world, acting as a smart liquidity layer that helps connect decentralized exchanges, token issuers, and everyday users. Think of it as the efficient plumbing that keeps money flowing smoothly without wasting resources. It offers tools like dynamic vaults that automatically chase the best yields across lending platforms and specialized pools for fair token launches.

In late 2025, Binance—the biggest crypto exchange by volume—listed the MET token and backed it with a generous $3.4 million reward campaign. This included token vouchers for trading volume, competitions, and referrals, running through late November 2025. Such promotions draw in traders and boost visibility, often leading to higher adoption.

According to reports from CryptoNinjas and BitcoinEthereumNews, this listing underscores growing support from centralized exchanges for Solana-native tools that improve liquidity and capital efficiency.

Types Of Cryptocurrency And Tokens With Examples

How Meteora Fuels Solana’s DeFi Expansion

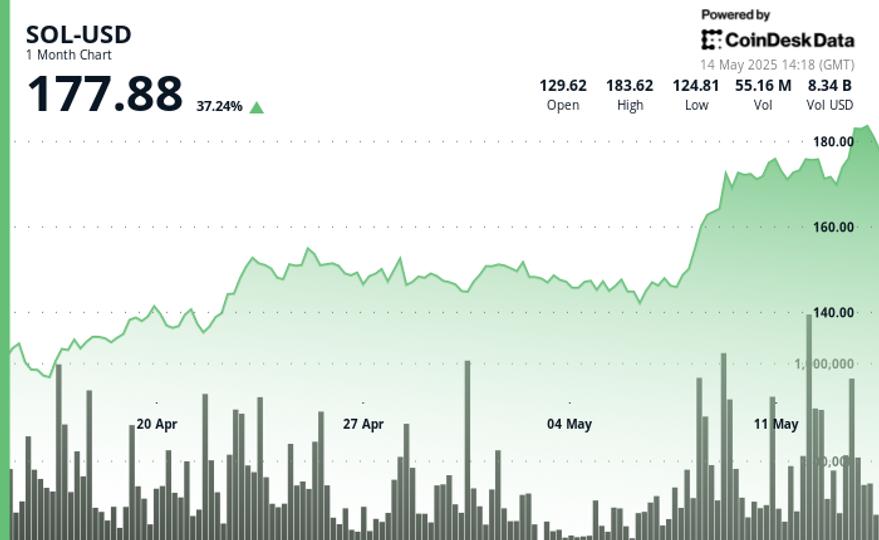

Solana has long been praised for its lightning-fast speeds and low fees, making it a go-to chain for DeFi activities like lending, borrowing, and trading. Meteora builds on this by solving common pain points: idle capital and inefficient launches.

- Dynamic Liquidity Management: Meteora’s vaults shift funds to top-performing opportunities, helping users earn more without constant manual tweaks.

- Better Token Launches: It provides protected pools that reduce bot interference, creating fairer starts for new projects.

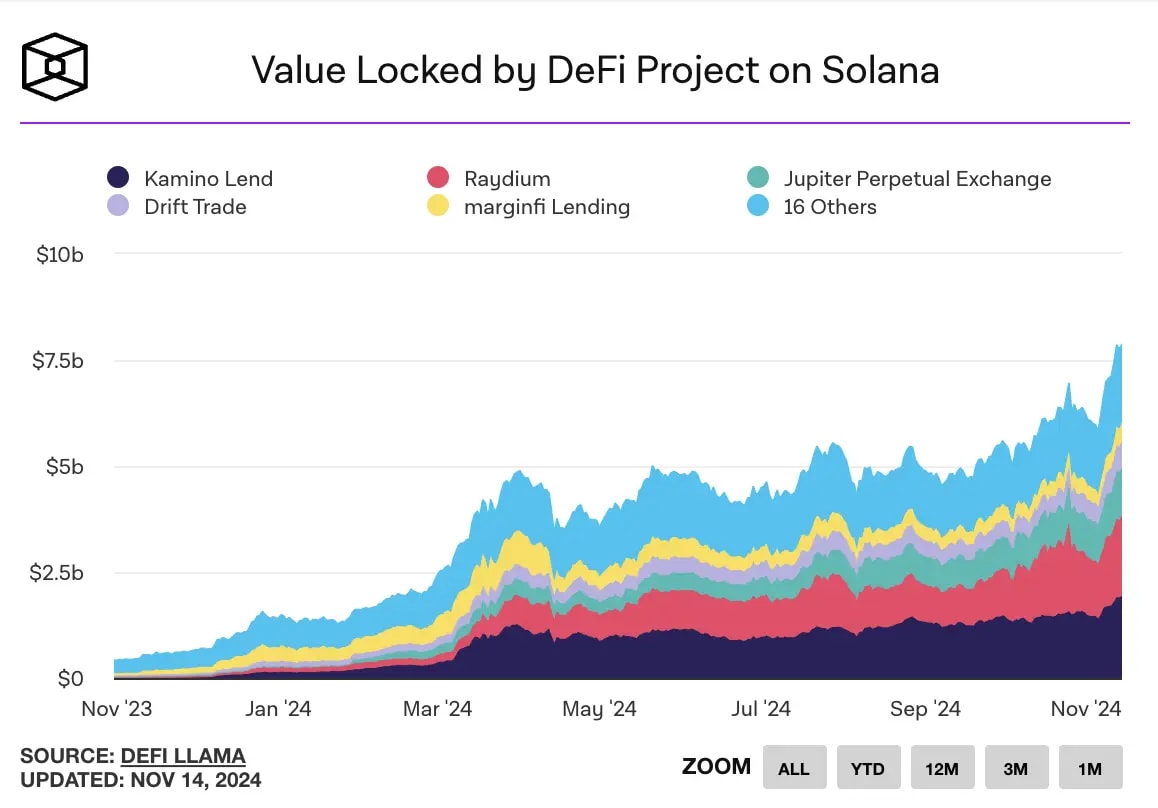

This infrastructure has helped Meteora process billions in volume while maintaining strong total value locked (TVL). As of recent data from CoinGecko, the protocol holds a significant share in Solana’s liquidity market.

The Binance boost arrives at a perfect time. Solana’s overall DeFi TVL has seen impressive climbs in 2025, reaching highs above $13 billion earlier in the year, driven by staking and innovative protocols (source: CryptoBriefing).

Key Metrics Highlighting the Momentum

| Aspect | Details | Source |

|---|---|---|

| MET Reward Campaign | $3.4 million in vouchers for trading and referrals | CryptoNinjas (2025) |

| Solana DeFi TVL Peak | Over $13 billion in 2025 | CryptoBriefing |

| Meteora Cumulative Volume | More than $208 billion since launch | CoinGecko |

What This Means for Everyday Crypto Users

If you’re new to crypto or just dipping into DeFi, events like this can open doors. The rewards encourage trying out MET trading pairs on Binance, potentially earning extra tokens while exploring Solana apps.

More broadly, stronger liquidity layers like Meteora make the whole ecosystem friendlier: easier swaps, better yields, and less risk from volatile launches. This attracts more people, creating a positive cycle that could push Solana’s growth even further.

Analysts note that centralized exchange support often validates on-chain projects, drawing institutional interest and stabilizing prices during volatile periods (referencing trends in DefiLlama reports on chain revenue).

A journey into the Solana DeFi ecosystem

Looking Ahead: A Brighter Outlook for Solana DeFi

With major players like Binance throwing weight behind projects such as Meteora, Solana’s DeFi landscape looks poised for continued innovation. Whether you’re holding SOL, providing liquidity, or just watching from the sidelines, these developments suggest exciting times ahead—faster, cheaper, and more efficient ways to manage digital assets.

As always, crypto involves risks, so research thoroughly and only invest what you can afford to lose. But stories like this remind us why many see Solana as a powerhouse in the evolving world of decentralized finance.