What if one of the world’s biggest investment funds quietly gave a thumbs-up to a small Japanese company stacking Bitcoin like it’s going out of style? That’s exactly what happened in December 2025: Norway’s massive sovereign wealth fund — managing around $1.9 trillion in assets — voted “yes” on all five proposals from Metaplanet, a Tokyo-listed firm that’s become Asia’s top corporate Bitcoin holder.

This isn’t just a routine shareholder vote. It’s a signal from a super-conservative giant that Bitcoin treasury strategies might be here to stay in mainstream finance. For everyday investors watching crypto from the sidelines, this move shows how traditional money is slowly warming up to digital assets.

Who Is Metaplanet and Why Is It Buying So Much Bitcoin?

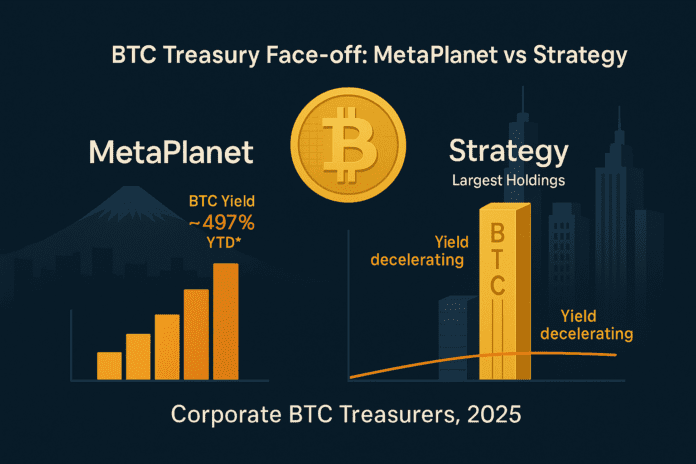

Metaplanet, often called “Asia’s MicroStrategy,” started shifting its focus to Bitcoin in 2024. Instead of holding cash or bonds, the company uses its balance sheet to buy and hold Bitcoin as a long-term reserve asset.

By late 2025, Metaplanet had accumulated over 30,800 BTC — worth billions — making it the fourth-largest public corporate Bitcoin holder worldwide. The goal? Protect against inflation and yen weakness while generating value for shareholders.

What Exactly Did Norway’s Fund Do?

Norway’s Government Pension Fund Global (managed by Norges Bank Investment Management, or NBIM) owns about 0.3% of Metaplanet’s shares. Ahead of the company’s December 22 Extraordinary General Meeting, NBIM voted in favor of all five management proposals.

These proposals included:

- Reducing capital reserves to free up funds for Bitcoin buys, dividends, or buybacks

- Increasing authorized shares for future fundraising

- Introducing new perpetual preferred shares (MARS and MERCURY) to raise money without diluting common shareholders

The changes make it easier for Metaplanet to raise capital specifically for more Bitcoin purchases — all while keeping things shareholder-friendly.

Why This Vote Matters for Bitcoin Adoption

Norway’s fund is one of the most respected and cautious investors on the planet. It avoids high-risk assets directly but gets indirect exposure through stocks like Metaplanet.

This endorsement adds huge legitimacy. If a $1.9T fund is okay with a company’s Bitcoin-focused plan, it could encourage other institutions to follow. Analysts say this helps move Bitcoin from “speculative gamble” to “strategic reserve asset.”

Broader Trends: Institutions and Bitcoin in 2025

Norway’s fund has been quietly increasing its indirect Bitcoin exposure for years. Through holdings in companies like Metaplanet, MicroStrategy, and Coinbase, it now has exposure to thousands of BTC.

A 2025 report from K33 Research showed Norway’s indirect BTC holdings hit new highs, growing over 192% in the past year. This fits a global trend: big money prefers “Bitcoin proxies” (public companies) over buying the coin directly due to regulations.

Metaplanet’s success — surpassing 30,000 BTC ahead of schedule — shows the model works when done right.

What Could This Mean for Regular Investors?

If more funds follow Norway’s lead, companies holding Bitcoin could see more interest and higher stock prices. For everyday people:

- Bitcoin might become a standard corporate asset like gold or bonds

- It could stabilize crypto markets with long-term holders

- Indirect exposure becomes easier through stocks

But remember, Bitcoin is still volatile. Norway’s vote is supportive, not a guarantee.

Looking Ahead: Metaplanet’s Next Moves

With the proposals likely to pass, Metaplanet can keep raising funds for Bitcoin. The company has talked about ambitious targets, like 210,000 BTC by 2027.

This Norway backing could accelerate that plan and inspire similar strategies in Asia and beyond.

In a world where cash loses value to inflation, moves like this show Bitcoin is gaining serious traction — even from the most traditional players.

Sources: CoinDesk (December 17, 2025), Bitcoin Magazine (December 17, 2025), K33 Research 2025 Reports, Metaplanet official disclosures.