Imagine earning passive rewards from a cutting-edge crypto network without dealing with wallets, keys, or technical hassles. That’s exactly what Bitwise’s new Hyperliquid ETF promises, blending spot exposure to the HYPE token with automated staking yields—all wrapped in a regulated package.

Bitwise Tops $1 Billion in Assets Under Management

Breaking Down the Bitwise Hyperliquid ETF

Announced on December 15, 2025, this ETF (ticker: BHYP) will trade on NYSE Arca. It tracks the price of HYPE, the native token of the Hyperliquid blockchain, using a reliable benchmark from CF Benchmarks.

Unlike traditional investments, the fund plans to hold real HYPE tokens and stake them to generate extra rewards. This means the ETF could grow not just from price appreciation but also from on-chain yields, making it stand out in the crowded crypto ETF space.

Flipster Blog | What Is Hyperliquid (HYPE)?

Why Staking Rewards Make This ETF Special

Staking involves locking up tokens to help secure the network, earning new tokens in return. Hyperliquid, a high-speed Layer-1 blockchain focused on decentralized trading, rewards stakers generously.

The ETF intends to stake most of its HYPE holdings, passing those rewards back to investors by increasing the fund’s overall value. This feature echoes successful staking ETFs from Bitwise, like their Solana product, which has seen strong demand in 2025.

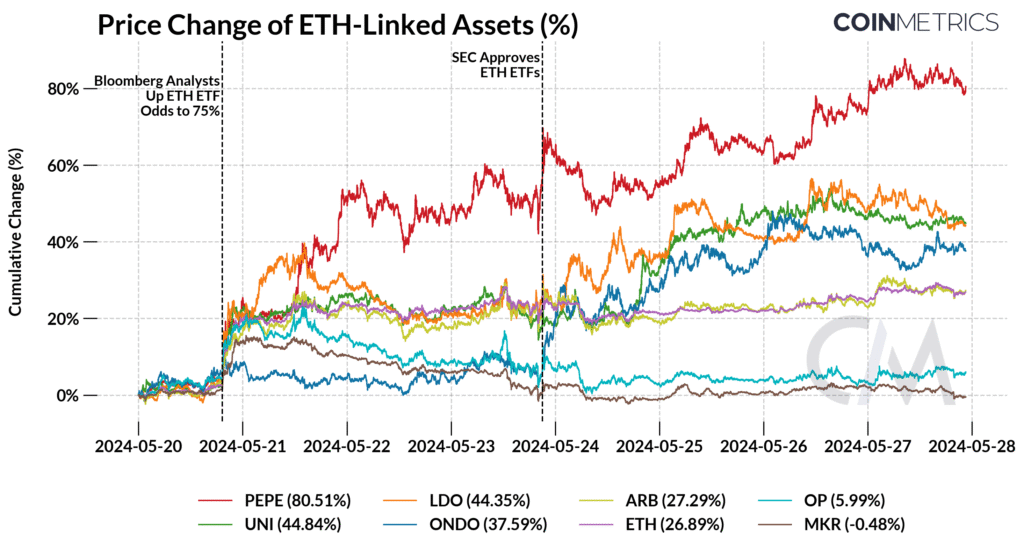

Exploring the Impacts of ETH ETF Approvals – by Tanay Ved

Understanding the 0.67% Fee

The annual fee is 0.67% (67 basis points), slightly higher than Bitcoin ETFs but typical for more complex altcoin products. This covers staking operations, custody, and other management costs.

While Bitcoin ETFs often charge around 0.20%, the added staking yield could offset the difference, potentially delivering better net returns for holders over time.

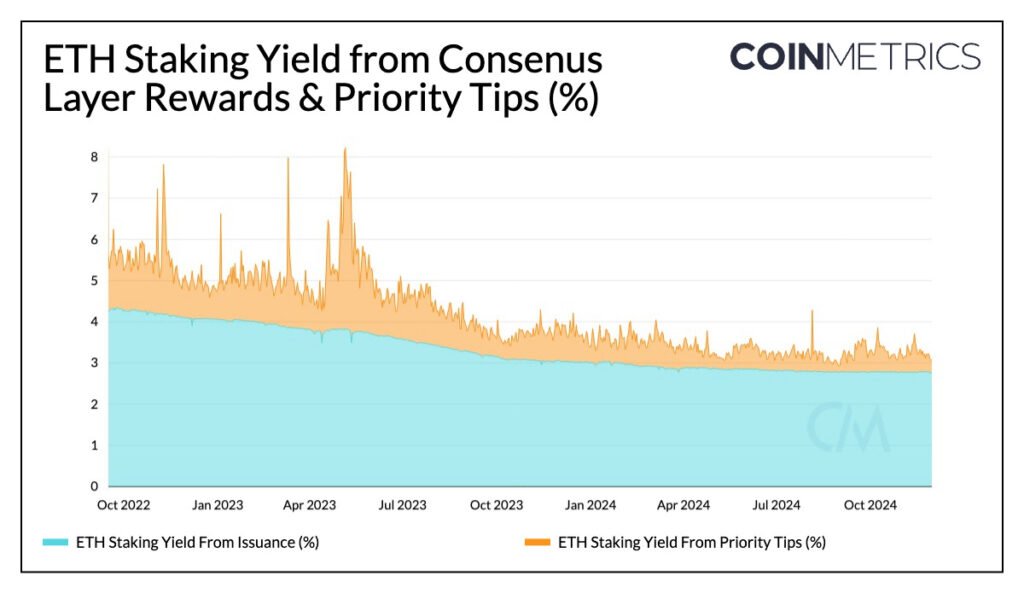

Understanding Staking Yields and Economics on Ethereum & Solana

Hyperliquid: The Blockchain Behind the Buzz

Hyperliquid is a blazing-fast Layer-1 chain designed for on-chain perpetual futures trading. It offers low fees, high throughput, and a fully decentralized order book that rivals big exchanges.

HYPE powers the ecosystem, covering fees, governance, and staking. With billions in trading volume, the network is gaining traction fast.

Understanding Hyperliquid: A Comprehensive Overview | by …

What’s Next for This ETF and Investors

Bitwise’s recent filing added the ticker, fee, and final registrations, signaling a launch could happen soon. Bloomberg analyst Eric Balchunas called it “imminent” based on standard SEC processes.

If approved, BHYP could make Hyperliquid accessible to retirement accounts, traditional portfolios, and everyday investors. It builds on the 2025 wave of altcoin ETFs, expanding options beyond Bitcoin and Ethereum.

This ETF bridges crypto’s innovation with Wall Street’s reliability, potentially attracting billions in new capital. For those curious about DeFi yields without the complexity, this could be a game-changer. Keep an eye on SEC updates for the official green light.