Imagine a world where your investment dividends arrive instantly in your digital wallet, or royalties from creative work flow directly to creators without middlemen delaying payments. That’s the exciting shift happening right now in finance, and one major player is leading the charge on a surprising blockchain.

What Just Happened: WisdomTree’s Bold Move

WisdomTree, a well-established asset manager overseeing around $140 billion in investments, has announced plans to bring verifiable cashflow assets—like stock dividends and royalties—onto the Solana blockchain. This isn’t just another crypto experiment; it’s a serious step by traditional finance toward embracing blockchain technology.

Powered by Plume Network, this initiative focuses on creating on-chain versions of real income-generating assets. Instead of waiting days for dividend payouts or dealing with complex royalty tracking, these could become transparent and instantly transferable.

What is Tokenization – Types, Use Cases, and Implementation

Why Solana? The Speed and Efficiency Advantage

Solana stands out for its blazing-fast transactions and low costs, making it ideal for handling real-world financial tools. While other blockchains can get congested and expensive, Solana processes thousands of transactions per second reliably.

This choice positions Solana as an emerging hub for Real-World Assets (RWAs)—digital versions of traditional investments like funds, bonds, or income streams. According to recent reports, RWAs on Solana have grown rapidly in 2025, attracting major institutions seeking efficient on-chain solutions.

Real World Asset Tokenization (RWA): Benefits & Guide 2025

### What Are Tokenized Assets, Anyway?

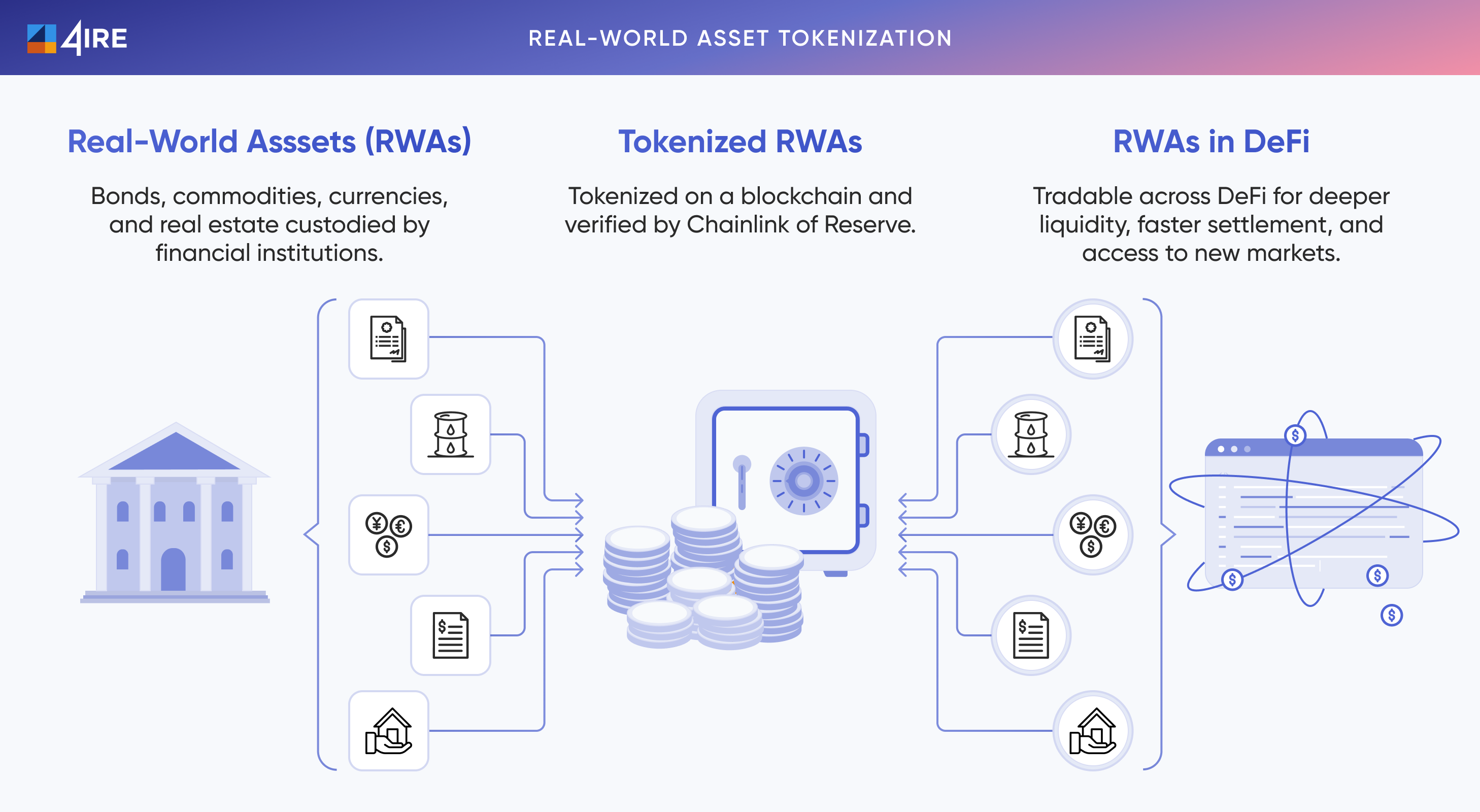

In simple terms, tokenization turns physical or traditional assets into digital tokens on a blockchain. Think of it like digitizing a stock certificate: You own a piece of something real, but it’s easier to trade, split, or manage.

For cashflow assets:

- Dividends: Regular payments from stocks become verifiable and instantly distributable.

- Royalties: Earnings from music, art, or intellectual property can flow directly and transparently.

This approach goes beyond speculative crypto—it’s about bringing stable, income-producing investments on-chain. A Boston Consulting Group report predicts the tokenized asset market could exceed $600 billion by 2030, highlighting the massive potential.

The Bigger Picture: Traditional Finance Meets Blockchain

WisdomTree’s decision signals growing confidence from big institutions in blockchain’s reliability. By choosing Solana, they’re betting on a network built for scale, where everyday investors could one day access these tokenized assets more easily.

This move also strengthens Solana’s role in institutional finance. With features like built-in compliance tools and high performance, it’s attracting more projects focused on regulated, real-world yield.

The Institutionalisation of Crypto: Are TradFi and DeFi Finally …

What Could This Mean for Everyday Investors?

For ordinary people, tokenized assets could open doors to:

- Fractional ownership of high-value investments.

- Faster access to earnings without traditional banking delays.

- More transparent tracking of income from assets.

While still early, these developments suggest a future where blockchain makes investing simpler and more inclusive. As more firms like WisdomTree join in, the line between old-school finance and crypto continues to blur.

On-Chain Finance | American Banker

This evolution in finance is worth watching—it’s not just about hype, but real improvements in how money works for everyone. Stay tuned as on-chain assets become a bigger part of the investment landscape.