Imagine waking up to find that your favorite stock could suddenly vanish from the major indexes millions of investors rely on—not because the company failed, but because it holds too much Bitcoin. That’s the high-stakes drama unfolding right now between leading Bitcoin treasury firms and index giant MSCI, just as corporate crypto holdings surge past $1 billion in collective value.

What Is MSCI’s Proposed Crypto Exclusion Rule?

MSCI, the company behind some of the world’s most tracked stock indexes like the MSCI World and MSCI USA, is considering a new rule. If a company’s digital assets (think Bitcoin and other cryptocurrencies) make up 50% or more of its total assets, it could be kicked out of these indexes starting in 2026.

This isn’t about punishing bad performance—it’s about classification. MSCI worries that heavy crypto holders act more like investment funds than traditional operating businesses, which aren’t typically included in broad equity indexes.

Why Are Companies Like Strategy Pushing Back Hard?

Strategy (formerly known as MicroStrategy), the biggest corporate Bitcoin holder with over 660,000 BTC, fired off a detailed 12-page letter to MSCI on December 10, 2025. Led by Michael Saylor, they call the 50% threshold “arbitrary, discriminatory, and unworkable.”

Here’s their core argument in simple terms: Many regular companies pile most of their value into one type of asset—like oil firms with reserves or real estate trusts—and stay in indexes just fine. Why single out Bitcoin holders?

As Strategy’s letter points out (shared publicly by Saylor), these “Digital Asset Treasury” companies are real businesses using crypto strategically, not passive funds. Excluding them could force billions in automatic selling from passive ETFs and funds that track MSCI indexes—JPMorgan analysts estimate up to $8.8 billion in outflows if others follow suit.

The Bigger Picture: Billions at Stake in a Booming Market

Corporate Bitcoin treasuries have exploded in 2025, with public companies now holding assets worth well over $1 billion combined. Strategy alone accounts for a massive chunk, turning what started as an inflation hedge into a full-blown business model.

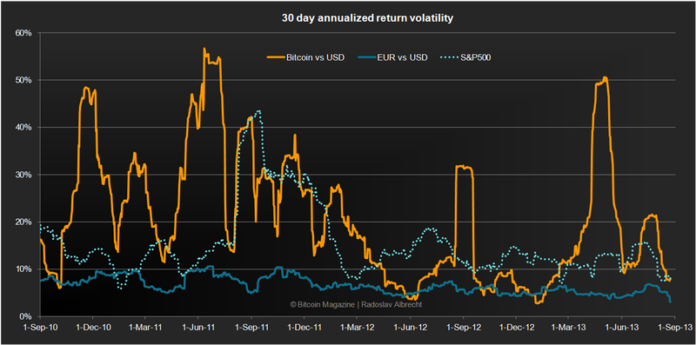

But volatility is the wildcard. Bitcoin prices can swing wildly, pushing a company over or under the 50% line without any real business change. Strategy warns this would create constant chaos—indexes flipping companies in and out based on market moods, not fundamentals.

According to reports from CoinDesk and Reuters, this fight isn’t just about one company. It could slow U.S. leadership in digital assets at a time when policies support innovation, like proposals for a national Bitcoin reserve.

Key Concerns Raised by Strategy

- Unfair Treatment: No similar limits exist for other concentrated assets.

- Market Instability: Frequent rebalances due to price swings.

- Policy Clash: Goes against pro-crypto shifts in federal priorities.

- Investor Impact: Misleads people seeking indirect crypto exposure through stocks.

What Happens Next and Why It Matters to Everyday Investors

MSCI’s consultation ends December 31, 2025, with a final decision by January 15, 2026. If the rule passes, it could trigger massive selling pressure on affected stocks, hurting prices short-term.

For regular folks, this highlights how crypto is blending into traditional finance. Holding Bitcoin through companies like Strategy has been an easy way for many to get exposure without buying coins directly. A change here might push more money into spot Bitcoin ETFs instead.

As Strategy urges in their response: Let the market evolve naturally, just like MSCI did with tech sectors years ago. This debate shows Bitcoin isn’t fringe anymore—it’s forcing Wall Street to adapt.

Sources: Strategy’s official letter (December 10, 2025), CoinDesk reporting, Reuters analysis, and JPMorgan estimates on potential outflows. This story is evolving—stay tuned as the crypto-stock crossover heats up!