Ever wondered if your crypto holdings could work harder for you while you sip coffee? As Bitcoin surges past $80,000 and ecosystems like Ethereum evolve, 2025 is shaping up as the year for smart passive income. But between renting cloud power to mine coins and locking up tokens to validate networks, which path leads to the fattest wallet? Let’s break it down step by step, so even if you’re new to this, you’ll feel like a pro by the end.

Demystifying Cloud Mining: Renting Power Without the Headache

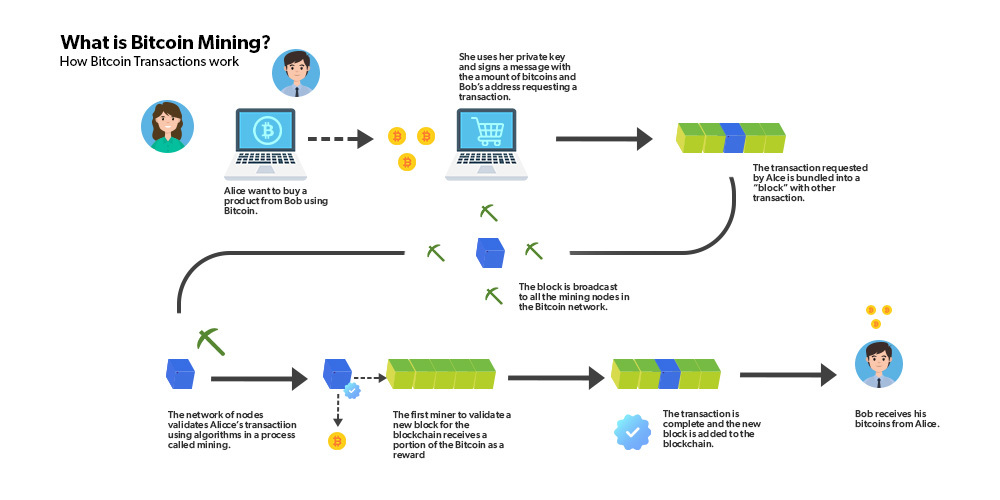

Cloud mining lets you dip into cryptocurrency mining without buying pricey rigs or dealing with noisy fans at home. Essentially, you pay a company to use their remote data centers—packed with high-powered computers—to solve complex puzzles and earn coins like Bitcoin or Ethereum. It’s like outsourcing the heavy lifting; you invest upfront for a share of the rewards.

For everyday folks, the appeal is clear: no technical setup required. Platforms handle maintenance, electricity, and cooling. In 2025, with AI optimizing operations, returns are stabilizing. A CoinTelegraph analysis shows average ROIs around 5% to 10% APR on trusted sites, though this can vary with crypto prices and energy costs. Think of it as buying a slice of a mining farm—your money funds the operation, and you get daily payouts minus fees.

But it’s not all smooth sailing. Upfront costs can range from $100 to thousands, and profitability dips if Bitcoin’s value drops. Plus, the industry has seen scams, so sticking to audited platforms is key.

Staking Explained: Putting Your Coins to Work on the Network

Staking flips the script by focusing on proof-of-stake (PoS) blockchains, where you “stake” your coins to help secure the network and validate transactions. In return, you earn rewards—new coins or fees—from the system. It’s like being a shareholder in a company; the more you hold and lock up, the bigger your slice of the pie.

This method is beginner-friendly: Buy compatible crypto like Ethereum or Solana, lock it in a wallet or exchange, and watch rewards accumulate. No energy-guzzling hardware needed—it’s eco-conscious and runs on your existing holdings. According to Koinly’s 2025 guide, top staking yields hover between 3% and 15% APY, with Ethereum at 4%-6% and newer chains like Sui pushing higher. For someone with $1,000 in ETH, that could mean $40-$60 yearly, compounded over time.

The downside? Your funds are locked for periods (days to months), and poor network performance might lead to “slashing”—losing a portion as a penalty. Still, it’s less risky than mining if you choose stable coins.

Head-to-Head: ROI Showdown in 2025’s Crypto Landscape

When it comes to returns, neither is a guaranteed jackpot, but numbers paint a picture. Cloud mining often delivers 5%-10% APR, per a recent EZBlockchain comparison, appealing for those chasing Bitcoin exposure without volatility in holdings. Staking, however, can edge higher at 5%-12% on platforms like Kraken, especially with rising adoption in DeFi.

Market trends favor staking in 2025, with PoS chains growing faster amid environmental concerns—Bitcoin mining’s energy use is under scrutiny. Yet, cloud mining shines during bull runs when hash rates soar. Your ROI boils down to crypto prices: A Bitcoin boom boosts mining, while stable altcoins favor staking.

Weighing the Pros and Cons: What Fits Your Style?

Cloud mining pros include hands-off operation and potential for quick scaling, but cons like high fees (up to 20%) and scam risks make it trickier, as noted in Investopedia’s overview. Staking’s advantages are lower barriers and steady income, though lock-ups and slashing add uncertainty, per Bitdeer’s guide.

Consider your budget: Cloud mining needs initial capital for contracts; staking starts with what you own. Risk appetite matters too—mining feels like gambling on hardware efficiency, while staking is more like a savings account with bonuses. Time horizon? Short-term favors mining’s flexibility; long-term suits staking’s compounding.

Spotlight on 2025’s Standout Platforms

For cloud mining, look at DeepHash for AI-driven efficiency and green energy, offering up to 10% ROI with free trials, as highlighted in CryptoNinjas. ECOS and BitFuFu also rank high for transparency and daily payouts.

On the staking side, KuCoin supports diverse coins with 5%-15% yields, while Kraken emphasizes security for U.S. users. Always check reviews and audits—2025’s surge in adoption means more options, but due diligence prevents pitfalls.

Your Roadmap to Decision-Making: Maximizing Gains Smartly

Ultimately, choosing between cloud mining and staking hinges on your goals. If you want Bitcoin without buying it outright, mining could deliver. For diversified, low-effort growth, staking wins. Diversify if possible—mix both for balanced ROI. As CoinGecko’s report on yields suggests, monitor blockchain trends; 2025’s ETF inflows could supercharge both. Start small, learn as you go, and remember: In crypto, knowledge is your best asset.