In the fast-paced arena of digital finance, where innovation meets big capital, a fresh player is stepping up to supercharge XRP’s journey. Evernorth Holdings, with backing from crypto heavyweight Ripple and Japanese financial giant SBI, is merging with a SPAC to raise more than $1 billion—aiming straight at building the world’s largest publicly traded XRP treasury. This isn’t just about stacking coins; it’s a strategic play to bridge traditional investing with blockchain’s promise, potentially unlocking new doors for everyday investors curious about crypto’s next chapter.

Unpacking Evernorth: A New Force in Digital Assets

Evernorth Holdings might sound new, but it’s rooted in established players. Formed as a digital assets company, it’s designed to accelerate XRP’s adoption in institutional circles. The firm’s CEO, Asheesh Birla, a former Ripple executive, brings deep expertise in payments and blockchain tech. Evernorth’s mission? To create a massive treasury focused on XRP, leveraging it for everything from cross-border payments to DeFi applications.

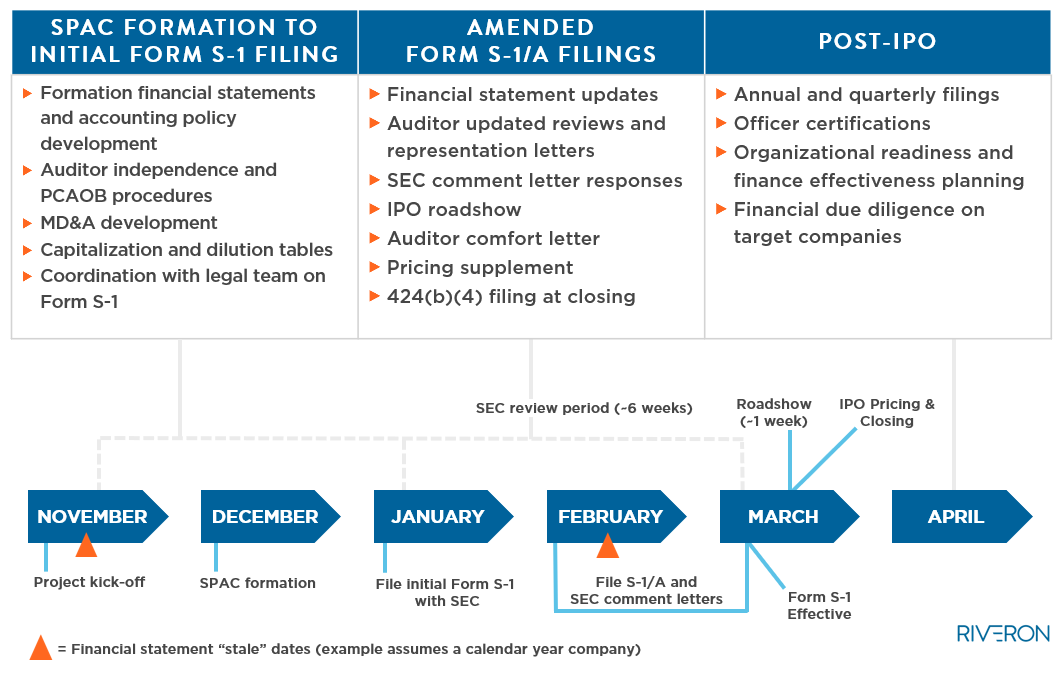

This SPAC merger with Armada Acquisition Corp II is the vehicle propelling Evernorth public. SPACs, or blank-check companies, allow firms to list on stock exchanges faster than traditional IPOs by merging with an existing shell company. In this case, the deal values Evernorth at around $1 billion in gross proceeds, with the merged entity set to trade on Nasdaq under the ticker “XRPN.” For folks new to this, think of it as a shortcut to Wall Street, bypassing some regulatory hurdles while attracting big investors.

The Ripple and SBI Backing: Powering the Vision

Ripple, the company behind XRP, isn’t just cheering from the sidelines—it’s a key backer. Ripple’s tech focuses on fast, low-cost international transfers, and XRP serves as a bridge currency in its network. By supporting Evernorth, Ripple aims to amplify institutional exposure to XRP, which has faced regulatory battles but emerged stronger post-SEC clarity.

Enter SBI Holdings, Japan’s financial powerhouse, investing $200 million into the venture. SBI has long partnered with Ripple for remittance services in Asia, using XRP for efficient money flows. This alliance isn’t new; SBI and Ripple have collaborated since 2016, expanding XRP’s use in Southeast Asia for real-world payments. Together, they’re fueling Evernorth’s treasury build-out, blending Eastern financial muscle with Western crypto innovation.

Why XRP? The Token’s Unique Appeal

XRP stands out in the crypto crowd for its speed—transactions settle in seconds—and tiny fees, making it ideal for global payments. Unlike Bitcoin’s energy-hungry mining, XRP uses a consensus mechanism that’s eco-friendly. A Chainalysis report underscores XRP’s role in remittances, noting billions in annual volume through networks like RippleNet. Evernorth’s treasury will hold vast amounts of XRP, potentially stabilizing its price and encouraging more firms to adopt it.

How the Merger Fuels the Largest XRP Treasury

The $1 billion infusion from this SPAC isn’t pocket change—it’s earmarked to amass what Evernorth calls the “world’s largest institutional XRP treasury.” This means buying and holding XRP on a scale that could rival major funds, providing liquidity and signaling confidence to the market. Post-merger, as a public company, Evernorth will offer transparency through Nasdaq listings, attracting retail investors who want a piece of crypto without directly buying tokens.

Interestingly, this comes amid Ripple co-founder Chris Larsen’s sale of 50 million XRP, worth about $120 million, which stirred community chatter but aligns with Evernorth’s treasury ambitions. Analysts see this as a maturation step for XRP, potentially boosting its value as institutional interest surges.

Broader Impacts on Crypto and Investors

This deal could ripple—pun intended—across the crypto landscape. By creating a public XRP treasury, Evernorth might inspire similar moves for other tokens, blending stocks and crypto in hybrid investments. For ordinary people, it lowers barriers: Buy XRPN shares via your brokerage app, and you’re indirectly exposed to XRP’s growth without managing wallets or keys.

Market-wise, XRP’s price has reacted positively, with odds of an XRP ETF approval climbing to 99% in some predictions. A Bloomberg analysis points to increasing institutional inflows into crypto, projecting trillions in assets by 2030 as barriers fall. Risks remain, like regulatory shifts or market volatility, but this merger underscores crypto’s shift from fringe to mainstream.

What Lies Ahead for Evernorth and XRP

As approvals roll in, expect Evernorth to hit Nasdaq soon, with its treasury growing rapidly. This could catalyze XRP’s adoption in payments and beyond, especially in Asia via SBI’s networks. For curious readers dipping into crypto, it’s a reminder: Research thoroughly, start small, and watch how traditional finance evolves with blockchain.

In a world craving efficient money movement, Evernorth’s bold step might just redefine what’s possible with XRP—turning a digital token into a cornerstone of global finance.