Ever wondered if the next big crypto winner is hiding in plain sight, away from the Bitcoin and Ethereum spotlight? Sui and Digitap represent two intriguing paths—one a speedy blockchain foundation, the other a bridge between everyday banking and digital assets. As markets heat up in late 2025, let’s unpack their stories, strengths, and potential pitfalls to help you decide where to park your investment dollars.

Understanding Sui: The High-Speed Blockchain Challenger

Sui, often flying under the radar despite its tech prowess, is a layer-1 blockchain designed for lightning-fast transactions and scalability. Built by former Meta engineers from the Diem project, it uses a unique object-centric data model that allows parallel processing, meaning it can handle thousands of operations per second without the bottlenecks seen in older networks like Ethereum.

Currently trading around $3.67, Sui has shown resilience amid market dips, with a 5% gain recently alongside peers like Dogecoin. Its ecosystem is buzzing with meme coins and DeFi growth, boasting over $491 million in total value locked (TVL) and more than $20 billion in cumulative trading volume. For everyday users, this translates to smoother gaming, NFTs, and staking experiences—think earning yields on your holdings without long waits.

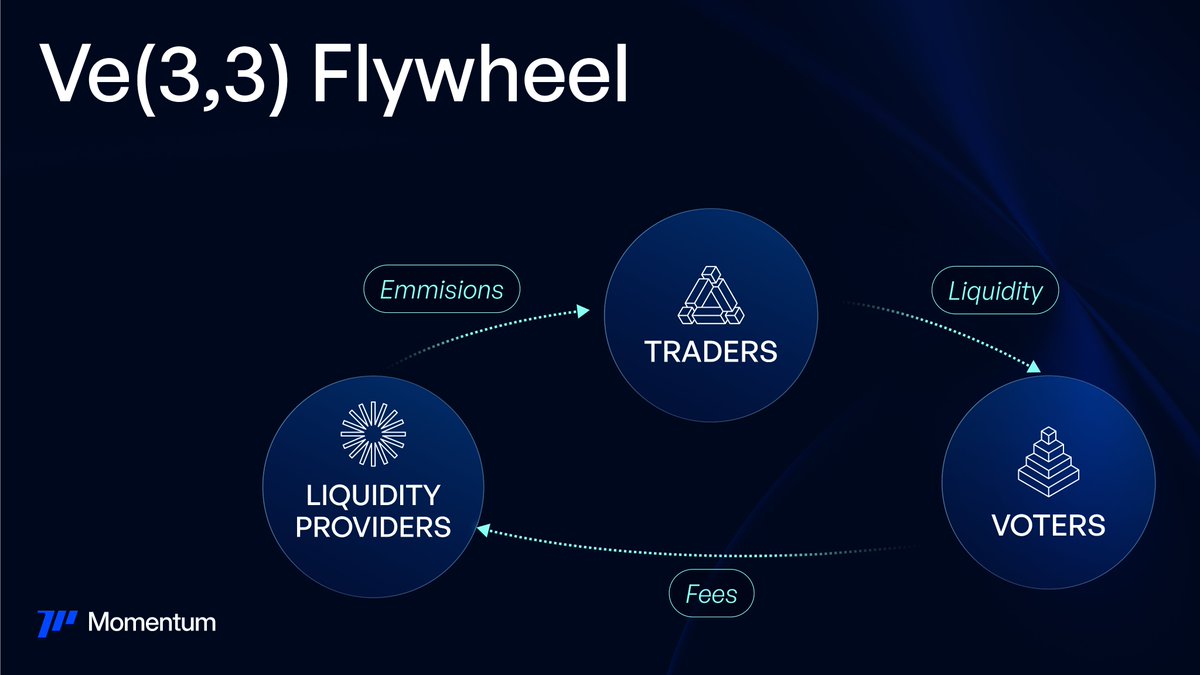

What sets Sui apart is its focus on real-world utility. Projects like Momentum Finance are integrating real-world assets (RWAs) such as tokenized real estate, making it easier for non-crypto natives to dip in. A recent report from CoinMarketCap highlights Sui’s October 2025 milestones, including $5 million raised for stablecoin infrastructure and $4.5 million for printing tech, signaling strong developer interest.

Sui’s Growth Drivers and Challenges

On the upside, Sui’s price predictions vary but lean optimistic for long-term holders. Analysts see it potentially hitting $5 soon if bullish momentum continues, driven by ecosystem expansions like multi-chain integrations. However, short-term risks include a possible dip to $1.91 by late October due to oversold conditions. Volatility is part of the game, but Sui’s low fees and high speed make it appealing for beginners building portfolios.

Exploring Digitap: The Crypto-Fiat Fusion Innovator

Digitap, a fresher face in the crypto scene, positions itself as the “world’s first omni-bank” app, blending cryptocurrency with traditional fiat money in one seamless platform. Launched with a focus on payments, it allows users to send, spend, and store both crypto and fiat globally, complete with a Visa-backed card for real-time conversions. This isn’t just hype—it’s a live product disrupting sectors like cross-border transfers, where it competes with giants like XRP and Stellar by offering instant, low-cost swaps.

Priced at $0.0125 during its presale, Digitap has already raised nearly $900,000, with projections of explosive growth—some experts forecast 5,000% gains, pushing it toward $14 or even $18 amid a global banking boom. For the average person, imagine paying for coffee with Bitcoin without conversion hassles or high fees— that’s Digitap’s everyday appeal.

Backed by real utility, Digitap’s model emphasizes security and accessibility, with features like multi-currency wallets and earn rewards on holdings. A Chainalysis-inspired analysis notes similar projects in fintech-crypto hybrids could capture trillions in market value by 2030, positioning Digitap as a timely entrant.

Digitap’s Strengths and Potential Risks

Digitap shines in practicality, especially for those tired of fragmented wallets. Its presale success and partnerships, like the Visa integration, suggest strong momentum. Yet, as a newer token, it faces regulatory hurdles in payments and competition from established players. Price volatility could swing wildly post-launch, but its “finished product” status gives it an edge over experimental tech.

Head-to-Head: Comparing Sui and Digitap for Investors

When pitting Sui against Digitap, consider your goals. Sui excels in infrastructure—it’s the backbone for future apps, with a mature ecosystem and steady TVL growth. Digitap, meanwhile, targets usability, making crypto spendable like cash, which could attract mass adoption faster.

Market-wise, Sui’s $13.32 billion market cap dwarfs Digitap’s presale stage, but the latter’s lower entry point offers higher upside potential—think 3x to 10x returns if it disrupts payments. Risks? Sui might weather market crashes better due to its established base, while Digitap’s success hinges on user adoption and regulatory nods.

In a Deloitte-like projection for blockchain in finance, both could thrive, but Digitap’s fiat-crypto bridge might edge it for short-term gains, while Sui suits long-haul believers.

Final Verdict: Picking the Winner for Your Portfolio

If you’re chasing infrastructure plays with proven traction, Sui might be your pick—its speed and ecosystem make it a solid, under-the-radar bet for 2026 growth. But for those eyeing quick flips in payments innovation, Digitap’s live app and presale buzz could deliver bigger rewards, especially with forecasts hitting $18. Always DYOR, diversify, and remember: crypto thrives on patience. Which one sparks your interest—tech foundation or everyday utility?