Picture this: a blockchain project racing toward a monumental launch while two established players push boundaries in scalability and finance. BlockDAG’s upcoming Genesis Day is stirring massive buzz, Solana is eyeing ETF breakthroughs, and Arbitrum is blending traditional stocks with crypto tech. These developments aren’t just headlines—they’re reshaping how everyday investors interact with digital assets in real time.

BlockDAG’s Genesis Day: A $430 Million Milestone on the Horizon

BlockDAG, a rising star in the layer-1 blockchain space, is gearing up for its highly anticipated Genesis Day on November 26, 2025. This event marks the transition from presale to full mainnet operations, promising faster transactions and enhanced scalability through its directed acyclic graph (DAG) structure. Unlike traditional blockchains, BlockDAG allows multiple blocks to be added simultaneously, potentially handling thousands of transactions per second without congestion.

The project’s presale has already raised over $430 million, with coins priced at $0.0015 during the final stages. This surge reflects strong investor confidence, especially as the team prepares for Keynote 4: The Launch Note, which will unveil new roadmap details. A live AMA on Binance this Friday at 3 PM UTC is set to reveal more about the launch, including partnerships like the one with BWT Alpine Formula One team.

For newcomers, think of BlockDAG as a high-speed highway in the crypto world—built to avoid traffic jams that plague networks like Ethereum during peak times. With a $600 million presale target in sight and features like multi-signature security and a live testnet, it’s positioning itself as a go-to for developers and users alike.

Solana’s Momentum: ETFs, Price Surges, and Ecosystem Growth

Solana continues to dominate conversations with its blend of speed and low costs, and October 2025 has brought fresh catalysts. The network recently launched the world’s first spot Solana ETF in Hong Kong, a move that’s boosting global adoption and attracting institutional money. This ETF, aimed at providing easy exposure to SOL, could pave the way for similar products elsewhere, especially as Solana’s price hovers around key support levels with predictions of breaking $200 soon.

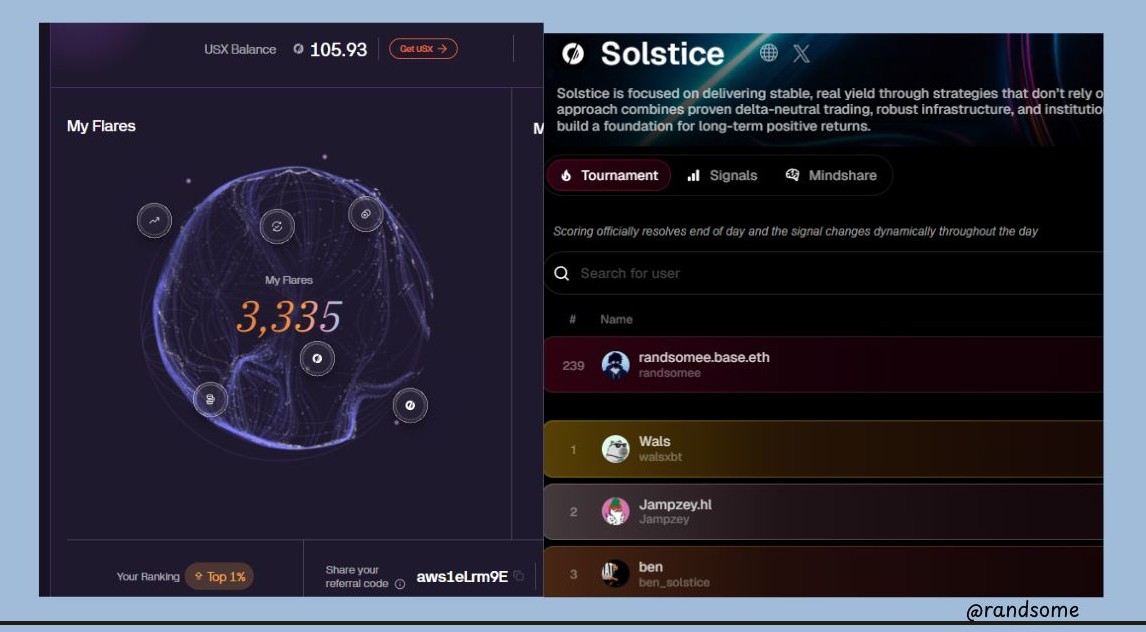

On the tech side, Solana is seeing inflows surge by 67% amid broader market outflows, signaling renewed interest from big players. Projects like Solstice Finance are hitting record TVL of $216.67 million with their USX stablecoin, offering delta-neutral yield strategies that minimize risk while generating returns. However, the end of support for the Saga Web3 phone marks a shift toward software focus, as analysts eye SOL climbing to $450 in a potential breakout.

If you’re dipping your toes into crypto, Solana’s appeal lies in its everyday usability—fast trades for pennies, powering everything from DeFi apps to NFTs. Recent updates, like optimized streaming from Triton One, ensure developers can build without hiccups.

How Solana Stands Out for Beginners

For those new to the space, Solana isn’t just about hype; it’s practical. Imagine swapping tokens or earning yields without waiting minutes or paying high fees. With tools like Saros DEX enhancing UI for smoother staking and farming, it’s becoming more user-friendly by the day.

Arbitrum’s Evolution: Tokenized Stocks and Layer-2 Innovations

Arbitrum, Ethereum’s leading layer-2 solution, is making waves by bridging traditional finance with blockchain. In October 2025, Robinhood expanded to nearly 500 tokenized U.S. stocks on Arbitrum One, allowing EU users to trade assets like Apple shares via crypto rails. This integration highlights Arbitrum’s role in merging DeFi with real-world assets, potentially unlocking trillions in value.

Price-wise, ARB is consolidating around $0.30, with experts forecasting a bullish reversal toward $0.41 if it breaks resistance. Key events include a $400,000 “Trick or Trade” contest on gTrade to boost engagement, and upgrades like ArbOS 50 for better performance. Partnerships, such as Brevis’s incentive platform with Euler Finance distributing $100K in rewards, show how Arbitrum is fostering verifiable, trustless ecosystems.

What does this mean for you? Arbitrum makes Ethereum affordable and fast, ideal for everyday transactions like lending or trading without gas fee nightmares. As it gains 7.8% amid market rotations, it’s a reminder of layer-2’s growing dominance.

Future Outlook for Arbitrum Users

Looking ahead, tools like HeyElsa AI simplify interactions—bridging assets or getting market insights seamlessly. With events like token unlocks and AWS outage lessons emphasizing decentralization, Arbitrum is solidifying its spot in a multi-chain world.

Why These Events Matter for the Crypto Landscape

From BlockDAG’s explosive presale to Solana’s ETF push and Arbitrum’s TradFi fusion, these stories highlight crypto’s maturation. They’re not isolated; together, they signal a shift toward accessible, efficient digital finance. Whether you’re investing small or going big, staying informed on these could unlock opportunities—always research and invest wisely.