Diving into cryptocurrency without the hassle of noisy rigs or sky-high electricity bills? Cloud mining lets everyday folks rent computing power from distant data centers to earn Bitcoin or other coins—think of it as outsourcing the heavy lifting while you sip coffee at home. But with scams lurking, we’ve crunched data from user ratings, security audits, and payout histories to spotlight the standouts for 2025, helping you mine smarter, not harder.

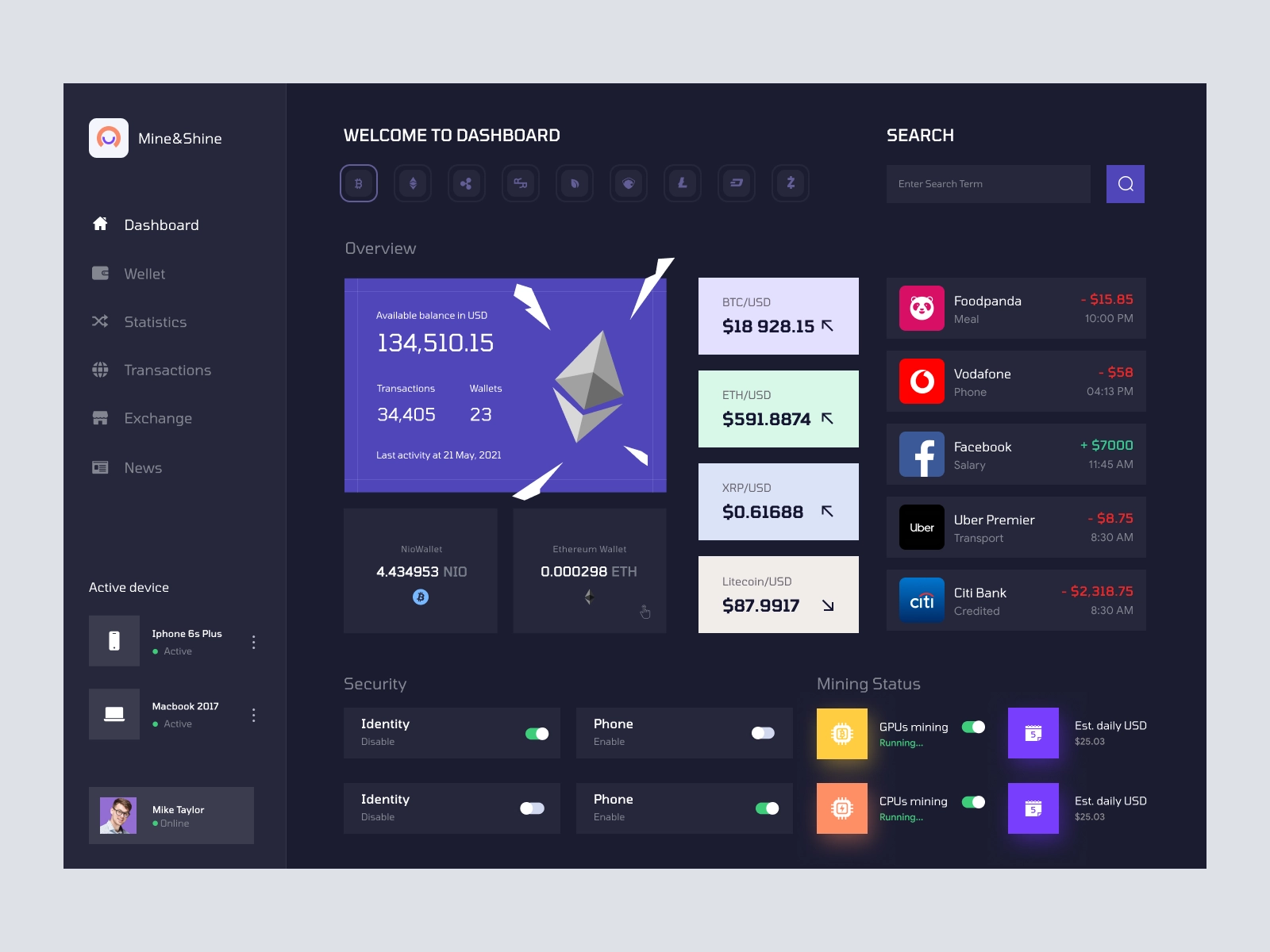

An illustrative overview of cloud mining technology in action.

Understanding Cloud Mining: The Basics for Beginners

Cloud mining is essentially a service where you pay to borrow someone else’s mining hardware over the internet. Instead of buying expensive ASICs or GPUs, you select a plan based on hash rate—the measure of computing power—and let the provider handle maintenance, cooling, and energy costs. Earnings come from solving complex puzzles on blockchain networks, rewarding you with crypto proportional to your rented power.

This model appeals to newcomers because it’s low-barrier: no tech expertise needed, and you can start with as little as $100. However, profitability hinges on crypto prices, network difficulty, and platform fees. Data from industry reports shows average returns can range from 1-5% daily on entry-level plans, but volatility means thorough research is key. Always check for transparency in operations to avoid fly-by-night schemes.

Our Evaluation Criteria: A Transparent Approach

To rank these platforms, we analyzed factors like user ratings from Trustpilot and app stores, security features (e.g., regulatory compliance and audits), payout consistency from real-user data, and eco-friendliness amid growing energy concerns. We drew from independent reviews, prioritizing platforms with at least 8/10 ratings and proven track records. Cost-effectiveness was gauged by comparing entry prices to projected ROI, using calculators from the sites themselves. We excluded any with widespread complaints of non-payments, focusing on those verified as operational in 2025 for reliability.

Top 5 Cloud Mining Platforms for 2025

1. BitFuFu: The Transparent Powerhouse

BitFuFu leads the pack as a NASDAQ-listed company, bringing stock-market level accountability to cloud mining. Partnered with hardware giant BITMAIN, it operates 17 global farms, letting users mine Bitcoin without upfront gear costs. With over 455,000 users, it’s ideal for those seeking stability in a volatile space.

Key perks include flexible plans and direct wallet payouts, minimizing delays. Entry contracts start around $100, with hash rates scaling up for higher earners—data shows potential daily yields of $5-50 based on market conditions. On the flip side, it’s Bitcoin-focused, limiting diversification. Security shines with public trading oversight, making it a top choice for risk-averse beginners.

2. ECOS: User-Friendly with Built-In Tools

ECOS stands out for its all-in-one ecosystem, blending mining with portfolio management and an exchange. Based in Armenia’s free economic zone for cheap power, it boasts 60 MW of infrastructure and over 20,000 devices. Newbies love the mobile app for real-time tracking and ROI calculators that predict earnings transparently.

Plans kick off at $149, offering 200 TH/s free trials to test waters—user data indicates average daily payouts around $10-30 for mid-tier setups. Pros: Low entry barriers and daily payouts to its wallet. Drawbacks: Some reports of withdrawal hiccups, though resolved via support. Its license and transparent hardware listings build trust, earning a 9.3 rating in reviews.

3. Genesis Mining: The Veteran with Global Reach

As one of the industry’s pioneers since 2013, Genesis Mining offers contracts for Bitcoin, Ethereum, and more, powered by renewable energy in Iceland and Sweden. It serves users in over 100 countries, emphasizing long-term stability with fixed-term plans.

Pricing begins at about $5,000 for premium options, but smaller bundles exist—analytics suggest 2-4% monthly ROI under stable markets. Strengths: Proven payout history and eco-conscious ops. Weaknesses: Longer contracts reduce flexibility, and occasional user gripes about delays. Its longevity and 9.2 rating make it reliable for patient investors.

4. NiceHash: Flexible Marketplace for Hash Power

NiceHash flips the script as a peer-to-peer marketplace where you buy or sell hash power on demand, no long commitments needed. Founded in 2014, it’s perfect for experimenting with Bitcoin or altcoins, with dynamic bidding for competitive rates.

Start with as little as $20; marketplace data shows variable earnings, often 1-3% daily after 3% fees. Advantages: High adaptability and broad liquidity. Downsides: Requires monitoring bids, and profits fluctuate wildly. Trusted for its large user base and 9.4 rating, with security via encrypted transactions.

5. Hashing24: Reliable for Long-Haul Miners

Hashing24, established in 2012, partners with top providers for real mining power, offering Bitcoin, Dogecoin, and Litecoin contracts. Its Trading Room lets you buy/sell plans, adding a layer of liquidity.

Contracts are flexible, starting low—user metrics point to steady 2-5% returns over time. Benefits: Intuitive dashboard and no hardware woes. Limitations: No free trial, and Bitcoin-centric. Its decade-plus track record and positive feedback cement it as a solid pick.

Comparing the Platforms: Key Metrics at a Glance

| Platform | Starting Price | Supported Coins | Payout Frequency | User Rating | Key Strength |

|---|---|---|---|---|---|

| BitFuFu | $100 | BTC | Daily | 9.5 | Transparency |

| ECOS | $149 | BTC | Daily | 9.3 | User Tools |

| Genesis Mining | $5,000 (premium) | BTC, ETH, LTC | Daily | 9.2 | Longevity |

| NiceHash | $20 | BTC, Altcoins | Near-Daily | 9.4 | Flexibility |

| Hashing24 | Flexible | BTC, DOGE, LTC | Daily | 9.0 | Reliability |

This table draws from aggregated data, showing how each excels in different areas.

Final Thoughts: Getting Started Safely

Choosing a cloud mining platform boils down to your budget and risk tolerance—start small, use trials, and diversify. While 2025 promises greener, AI-boosted options, remember crypto’s ups and downs; always withdraw earnings regularly. By sticking to these vetted picks, you’re positioning yourself for passive gains in an evolving market. Dive in with eyes open, and happy mining!