Ever felt like the crypto market is a wild storm, tossing your investments around without warning? With Bitcoin recently tumbling below $106,000 amid geopolitical tensions and tariff threats, that feeling is all too real for many—yet it’s moments like these that separate impulsive reactions from smart, steady plays that build lasting wealth.

The Recent Bitcoin Plunge: What’s Behind It?

Bitcoin’s value took a sharp nosedive in mid-October 2025, slipping to lows around $104,000 before stabilizing slightly above $105,000. This drop wiped out billions in market value, triggered by factors like escalating U.S.-China trade tensions and former President Trump’s announcement of steep tariffs on Chinese imports. Analysts point to massive liquidations in leveraged positions—over $961 million in a single day—as panic selling amplified the decline. The Crypto Fear & Greed Index hit extreme fear levels at 22, signaling widespread investor anxiety.

This isn’t the first time Bitcoin has faced such volatility; it’s dropped below key support zones like $107,000-$110,000 before. While some see it as a potential bottom for accumulation, others warn of further tests down to $100,000 if supports fail. For everyday investors, the key isn’t predicting the exact bottom but using proven tactics to weather the storm without losing sleep.

Tactic 1: Diversify Your Holdings to Spread the Risk

Don’t put all your eggs in one basket—especially when that basket is as unpredictable as Bitcoin. Diversification means splitting your investments across different cryptocurrencies, or even blending in stablecoins and traditional assets, to cushion against big swings in any single coin.

Start simple: allocate a chunk to established players like Bitcoin and Ethereum for stability, then add mid-cap altcoins for growth potential, and a small slice to high-risk, high-reward tokens. This approach reduces the impact of Bitcoin’s dips; if it falls, your other holdings might hold steady or even rise. Studies show diversified portfolios in crypto can lower overall volatility by up to 30%, making it easier for beginners to stay in the game long-term. Remember, the goal is balance—over-diversifying can dilute gains, so aim for 5-10 assets based on your research.

Tactic 2: Set Stop-Loss Orders to Protect Your Capital

Imagine having an automatic safety net that sells your Bitcoin if it drops too far, locking in what you’ve got before losses snowball. That’s the magic of stop-loss orders: you set a price threshold, and your trading platform executes the sale if hit, limiting downside without constant monitoring.

For instance, if Bitcoin is at $105,000, you might place a stop-loss at $100,000 to cap your loss at 5%. This tactic is crucial in volatile markets, where sudden crashes like the recent one can erase weeks of gains in hours. Experts recommend combining it with trailing stops, which adjust upward as prices rise, securing profits while still guarding against reversals. It’s not foolproof—gaps in overnight trading can skip your level—but for most retail investors, it’s a straightforward way to enforce discipline and avoid emotional selling.

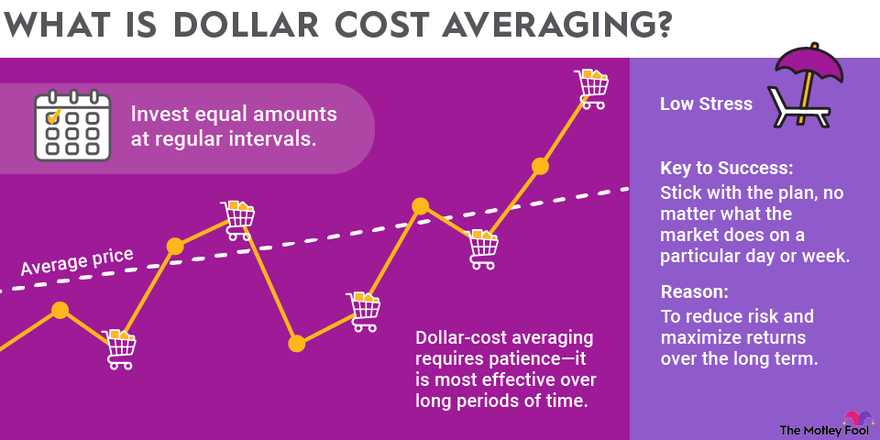

Tactic 3: Use Dollar-Cost Averaging for Steady Accumulation

Instead of trying to time the market’s lows, why not buy a fixed amount of Bitcoin regularly, regardless of price? Dollar-cost averaging (DCA) smooths out volatility by purchasing more when prices are low and less when they’re high, lowering your average entry cost over time.

In Bitcoin’s current turmoil, setting up weekly buys of $100 could turn dips into opportunities, as historical data shows DCA outperforming lump-sum investments in choppy markets by reducing regret from bad timing. It’s ideal for long-term holders, requiring patience but minimizing stress—apps and exchanges often automate it for you. Just ensure your budget allows for consistent contributions, even during prolonged downturns, to maximize its benefits.

Staying Ahead in Uncertain Times

Navigating Bitcoin’s fall below $106K doesn’t have to mean panic; with diversification, stop-loss orders, and dollar-cost averaging, you can turn market turmoil into a foundation for growth. These tactics, backed by real-world strategies from seasoned traders, emphasize protection and consistency over speculation. As the crypto landscape evolves, staying informed and adapting will keep you resilient—whether Bitcoin rebounds or tests lower depths, you’ll be positioned to thrive.