Imagine watching the crypto market like a surfer eyeing ocean waves—Bitcoin crashes down in a correction, but that’s when the smarter waves for altcoins start building up. In 2024, as Bitcoin dipped from its all-time highs, savvy investors turned their gaze to alternative cryptocurrencies that promised not just recovery, but real innovation and growth. This guide dives into those opportunities, explaining the why, the what, and the how in simple terms, so even if you’re new to crypto, you can ride the next wave confidently.

Understanding Bitcoin Corrections

A Bitcoin correction isn’t the end of the world—it’s more like a market taking a breath after a sprint. In simple words, it’s when Bitcoin’s price drops by 10% or more from its recent peak, often due to profit-taking, economic news, or regulatory jitters. Back in 2024, we saw Bitcoin correct multiple times, like after hitting around $73,000 in March, influenced by factors such as the halving event and ETF approvals.

These dips reset the market, shaking out weak hands and creating space for fresh capital. Historically, corrections have averaged about 15-20% in bull markets, and 2024 was no exception, with one notable pullback in summer amid global economic uncertainty.

Why does this matter for altcoins? When Bitcoin corrects, money doesn’t vanish—it rotates. Investors pull out of the big player and hunt for undervalued gems that could multiply faster during the rebound.

Why Altcoins Thrive Post-Correction

Think of the crypto ecosystem as a family dinner: Bitcoin is the loud uncle dominating the conversation, but when he steps out for a smoke, the cousins (altcoins) get their chance to shine. Post-correction, altcoins often outperform Bitcoin because they’re more volatile and tied to emerging tech trends like DeFi, NFTs, or AI integrations.

In 2024, data showed altcoins gaining traction as Bitcoin stabilized, with total altcoin market cap projected to surge toward $1.4 trillion by late year. This “altseason” happens when investor risk appetite returns, fueled by lower prices making entry points attractive. Plus, altcoins benefit from Bitcoin’s infrastructure—many run on Ethereum or similar networks, inheriting security while innovating on top.

But it’s not just hype; real-world adoption played a role. For instance, institutional inflows into altcoins doubled in some portfolios, signaling long-term confidence beyond Bitcoin’s shadow.

Top Altcoins to Watch in 2024

2024 highlighted altcoins with strong fundamentals, not just memes. We focused on those with real utility, growing ecosystems, and resilience during dips. Here’s a breakdown of standouts, based on market trends and expert picks.

Ethereum (ETH): The Backbone of Innovation

Ethereum isn’t just an altcoin—it’s the platform where most others live. After Bitcoin’s corrections, ETH often led the charge, thanks to upgrades like the Dencun update in 2024 that slashed fees and boosted scalability. If you’re into decentralized apps or staking, Ethereum offered yields around 4-6% annually, making it a steady pick for ordinary investors.

Analysts noted ETH’s rebound potential, with portfolio holdings rebounding post-dip, driven by ETF rumors and DeFi growth. For everyday folks, think of it as investing in the internet’s next layer—simple, with big upside.

Solana (SOL): Speed and Scalability Champ

Solana exploded in popularity during 2024’s corrections, offering lightning-fast transactions at pennies per trade. Unlike slower networks, Solana handled high-volume apps like gaming and memes without choking, attracting developers fleeing Ethereum’s congestion.

Post-Bitcoin dip, SOL saw institutional traction, with holdings dipping temporarily but rebounding as a buying opportunity. It’s perfect for beginners wanting low-cost entry into NFTs or DeFi—imagine sending money faster than a text message, without bank fees.

Chainlink (LINK): Connecting the Dots

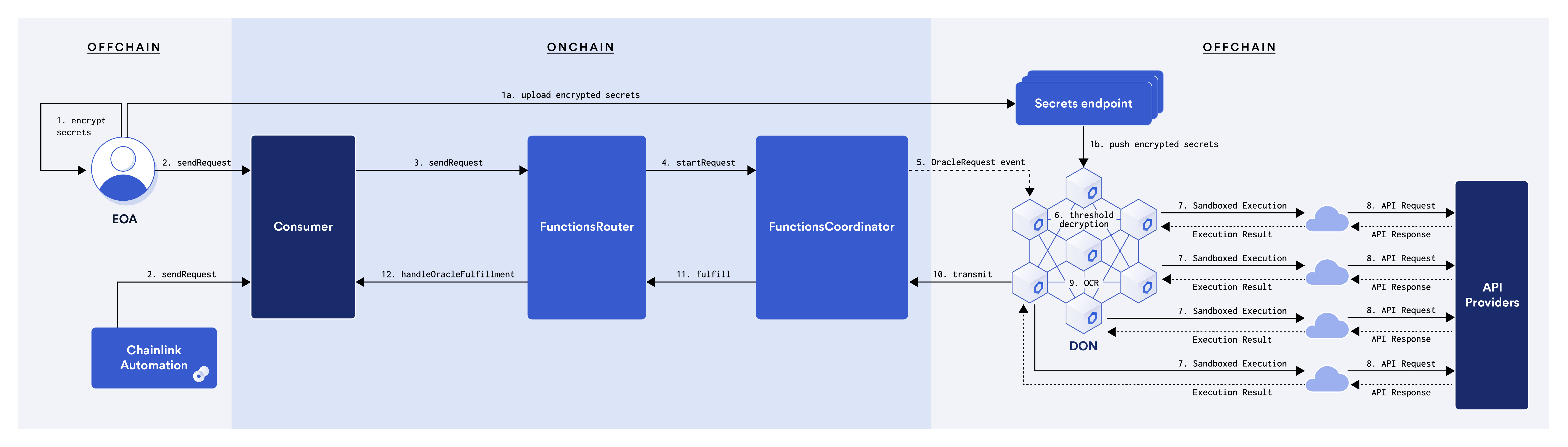

Chainlink acts like a bridge between blockchains and the real world, feeding reliable data to smart contracts. In 2024, as markets corrected, LINK’s oracle network became crucial for DeFi protocols needing accurate prices or weather data.

Experts pegged it as a top exploder, with integrations in finance and insurance driving adoption. For regular people, it’s like investing in the plumbing that makes crypto work—essential and undervalued during dips.

Polkadot (DOT): The Interoperability Hub

Polkadot’s magic is connecting different blockchains, allowing them to talk seamlessly. During 2024 corrections, DOT benefited from parachain auctions and cross-chain projects, making it a go-to for diversified ecosystems.

With peer-reviewed tech and potential ETF buzz, it stood out for long-term holders. Picture it as the universal adapter for your gadgets—practical for anyone building a varied portfolio.

Other notables included Cardano (ADA) for its research-backed approach and XRP for payment efficiency, both showing surges in on-chain activity post-dips.

Risks and Smart Strategies

No opportunity is risk-free—altcoins can swing wildly, with some losing 50% in a week. Key risks in 2024 included regulatory crackdowns and market manipulation. To navigate, diversify: don’t put all eggs in one basket. Use dollar-cost averaging—buy a little regularly—to smooth out volatility.

Research thoroughly: Check whitepapers, team backgrounds, and community vibes. And remember, only invest what you can afford to lose. Tools like CoinMarketCap helped track trends without overwhelm.

Wrapping It Up: Seize the Moment

2024’s Bitcoin corrections weren’t setbacks—they were setups for altcoin breakthroughs. By focusing on projects with real value like Ethereum, Solana, Chainlink, and Polkadot, everyday investors found ways to grow their holdings amid the chaos. Stay informed, stay patient, and who knows? Your next wave could be a big one.