Woke up to your phone buzzing like a hornet’s nest? That’s how October 10, 2025, hit for crypto holders worldwide—a sleepy Friday turning into a full-blown market meltdown. Bitcoin, fresh off a $122,000 high, nosedived to $101,000 in hours, vaporizing $19 billion in leveraged bets and zapping over 1.6 million traders. But here’s the twist: it wasn’t some shadowy exchange plot. Enter Meta Financial AI, the digital detective sifting through blockchain breadcrumbs to reveal a tale of tariffs, tech glitches, and too much borrowed bravado. If charts make your eyes glaze, fear not—this breakdown’s like chatting over brunch, minus the jargon overload.

The Perfect Storm: From Peak to Plunge

Picture Bitcoin cruising at all-time highs, greed index spiking past 60, when—bam—global markets jitter. The crypto arena, already leveraged to the hilt, couldn’t brace for impact. In a 24-hour frenzy, $19.38 billion in positions got liquidated, with longs taking a 6.7-to-1 beating over shorts. Hyperliquid alone swallowed $10.3 billion, while Binance’s spot volume surged to $12.6 billion just to keep order books from crumbling. This wasn’t your garden-variety dip; CoinGlass dubbed it the biggest dollar-value wipeout ever, dwarfing even the FTX fallout.

The Numbers That Stung

Altcoins fared worse—some plunged 90% on Binance—erasing $380 billion in total market cap. Ethereum dipped alongside, but DeFi darlings like Uniswap clocked a record $10 billion daily volume, proving decentralized spots don’t buckle like centralized ones. For the average punter, it meant checking apps to find portfolios in the red, wondering if that “quick flip” was now a slow burn.

Tariff Tempest: How Politics Lit the Fuse

Blame game starts with a tweet—or rather, a presidential podium. President Trump’s surprise 100% tariff threat on Chinese imports, unveiled amid “Make America Wealthy Again” fanfare, sent shockwaves through trade-sensitive assets. Crypto, tied to global risk appetite, felt the ripple: stocks tumbled, safe-havens like gold flickered, and leveraged bets cascaded like dominoes on a weekend with thin liquidity.

Beyond Borders: The Global Ripple

This wasn’t isolated—U.S.-China tensions amplified fears of supply chain snarls for tech giants, indirectly hitting Bitcoin miners reliant on cheap Asian hardware. Arthur Hayes of BitMEX called it a “necessary reset,” eyeing Fed easing by 2026 as the real bull fuel. For folks outside the U.S., like Indian markets, it meant cross-border investor flight, turning a policy pop into a portfolio panic.

AI Sleuth Mode: Meta Financial Clears the Fog

Enter Meta Financial AI ($MEFAI), the blockchain bloodhound that dove into wallet trails, filtering transfers over $10,000 for foul play. Verdict? No massive dump from Binance or its ex-CEO CZ—despite the finger-pointing. Their probe spotlighted a “savage” market maker, Wintermute, known for hype-then-dump deals, but the real culprits were pre-crash wallet shuffles at Coinbase: 1,066 BTC moved from cold to hot storage hours before the drop.

Wallet Whodunit: The Evidence Trail

A mystery U.S. entity scooped 1,100 BTC from Binance days prior, funneling it to Coinbase—prime for OTC desks serving big institutions. Meta’s AI crunched it transparently: no exchange orchestration, just over-leveraged retail caught in a macro maelstrom. As one X thread unpacked, “Wintermute isn’t a nightmare; they’re just profit sharks.” This clears Binance’s name, shifting blame to systemic risks over sabotage.

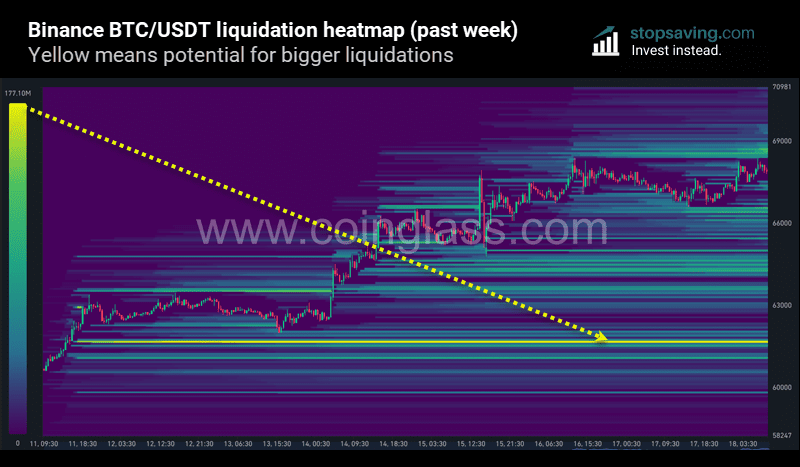

Liquidation Labyrinth: Heatmaps and Heartbreak

Visualize a battlefield via liquidation heatmaps—those colorful grids on CoinGlass showing where bets clustered. Yellow zones screamed vulnerability around $110K-$120K, where longs piled up, primed for the tariff trigger to torch them.

Exchange Echoes: Glitches in the Grid

Binance buckled under $7 billion liquidated in one hour, with outages delaying exits and sparking compensation pledges. Users hit by tech hiccups can claim reimbursements with transaction proof— a silver lining in the server sweat. Meanwhile, a $21 million Hyperliquid hack added insult, but the system’s resilience shone as BTC clawed back to $112K.

Road to Recovery: Silver Linings in the Smoke

Post-purge, leverage flushed out, NUPL metrics hover at 0.51—holders still green, no full capitulation. Institutions eye the dip as a buy, with ETF inflows steady. Hayes predicts a 2026 surge, but watch exchange flows and volatility for the next cue.

For the everyday earner, this saga whispers wisdom: diversify beyond leverage, eye macro news, and treat dips as discount days. Meta’s AI reminds us—crypto’s wild, but data demystifies the mayhem. As markets mend, that brunch chat might just turn to “told you so” triumphs. What’s your next move in this rebound rally?