It’s that late-night scroll through your phone, the one where you half-expect to see your crypto holdings dipped into the red again, but instead, a quiet notification pops: “+$47 from automated trades.” No all-nighters glued to charts, no second-guessing every tick—just smart software doing the heavy lifting while you catch some Z’s. In the whirlwind of 2025’s crypto markets, where Bitcoin’s flirting with $120K and altcoins swing like pendulums, trading bots have evolved from geeky gadgets to everyday allies for folks chasing steady gains. These aren’t get-rich-quick tricks; they’re like having a tireless co-pilot scanning exchanges for edges, from arbitrage plays to trend-following zips. Drawing from fresh benchmarks, we’ve handpicked six standouts that blend ease with punch—perfect for beginners turning coffee money into compound interest. Whether you’re hedging against volatility or scaling a side gig, these bots could nudge your returns from “meh” to “whoa.” Let’s gear up and see which one’s your match.

Demystifying Crypto Bots: Your 24/7 Market Scout

Think of a crypto bot as that friend who never sleeps, constantly eyeing price gaps across Binance, Coinbase, or Kraken so you don’t have to. At heart, it’s software that automates buys, sells, and strategies based on rules you set—like “snag Ethereum if it dips 2% but rebounds fast.” No coding degree needed; most run via apps or dashboards, linking to your exchange via secure APIs (keys that grant trade access without handing over passwords).

In 2025, with DeFi TVL topping $250 billion and AI sharpening predictions, bots shine brighter. A CoinBureau report flags them boosting average returns by 15-30% for users who tweak wisely, outpacing manual trading’s emotional pitfalls. For the average reader juggling jobs and life, they’re a low-drama way to dip into crypto without the FOMO frenzy. Risks? Sure—market crashes hit bots too—but starting small (say, $200) keeps it fun, not frantic.

The 2025 Edge: Why Bots Beat Watching Paint Dry

Markets move at warp speed now, with flash news from X or regulatory whispers flipping fortunes hourly. Manual trading? It’s like chasing buses in heels—exhausting and hit-or-miss. Bots, though, thrive on data: They backtest strategies on historical swings, dodge overtrading, and even diversify across coins like BTC, SOL, or emerging memes.

October’s buzz? With Ethereum’s upgrades slashing fees and Solana’s speed luring crowds, bots are feasting on cross-chain ops. TokenTax’s October roundup notes a 40% uptick in bot adoption, as users snag 5-10% monthly yields on conservative setups. Picture passive income that fits your commute: Set it Sunday, sip coffee Monday, withdraw gains Friday. But pick wrong? You might chase ghosts. That’s why our six are vetted for newbie-friendliness, security (2FA, no withdrawal perms), and real-user wins—no vaporware here.

Our Top 6 Picks: Bots That Deliver Without the Drama

We’ve sifted reviews from Koinly’s October deep-dive and AMBCrypto’s Telegram bot pulse for these gems. Each shines in a niche, from grid trading to AI signals, with free tiers to test-drive. Let’s meet them.

1. Cryptohopper: The All-Rounder for Hands-Off Wins

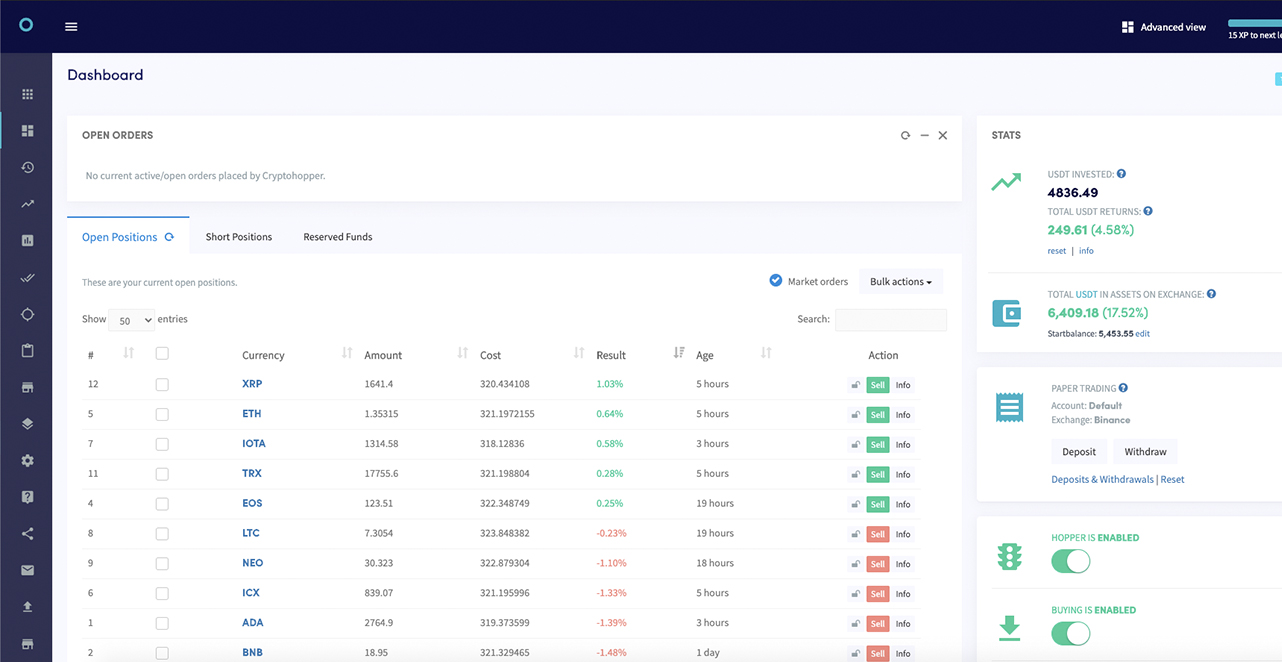

Ever wish your trades had a “set it and forget it” button? Cryptohopper’s your jam, blending marketplace templates (pre-built strategies from pros) with AI-driven signals that adapt to 2025’s wild swings. Hook it to 15+ exchanges, and watch it mirror whales or hunt arbitrage—all from a clean dashboard that feels like your banking app, but smarter.

Beginners rave about the $19/month starter plan yielding 8-12% on BTC pairs, per Coinmonks’ August benchmarks. Pro: Paper trading mode lets you practice risk-free. Con: Steeper learning for custom tweaks. If you’re easing in, this bot’s like training wheels that pay dividends.

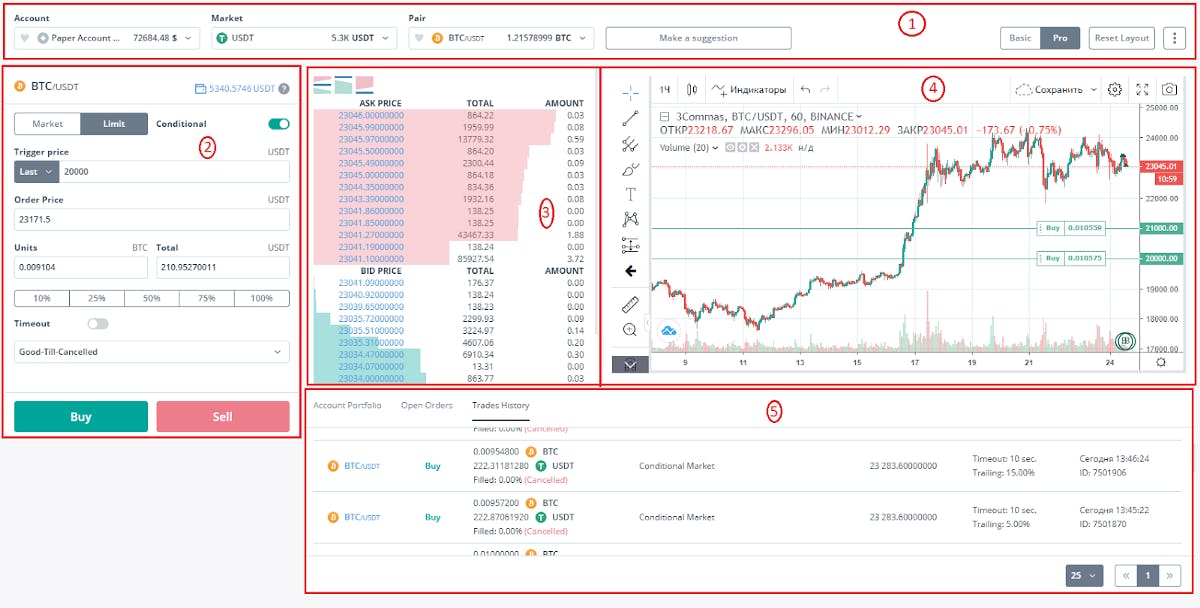

2. 3Commas: Power Tools for Portfolio Juggles

Juggling multiple coins feels overwhelming? 3Commas steps in with “smart trades”—one-click setups for scaling in/out, plus DCA (dollar-cost averaging) to smooth volatility. It’s a beast for multi-exchange syncing, turning your $500 spread across ETH and ADA into automated harmony.

October users report 20% efficiency gains over solo trading, thanks to its signal marketplace pulling from TradingView pros. At $22/month, it’s mid-tier priced but packs bots for grids, futures, and even copy-trading. Ideal for the multitasker who wants alerts without the noise.

.

.

3. Pionex: Built-In Grids for Free-Flow Fees

Why pay for bots when your exchange bakes them in? Pionex, a hybrid platform, offers 16 free bots—like infinite grids that buy low/sell high in ranging markets—right on its app. No API hassles; just fund and fire up.

In 2025’s choppy seas, its 0.05% fees crush competitors, netting users 10-15% on stable pairs like USDT/BTC, per CoinTracker’s August picks. Downside: Fewer advanced signals. But for mobile-first folks starting with $100, it’s the no-brainer gateway to bot life.

4. Bitsgap: Arbitrage Hunter for Cross-Exchange Gold

Spotting price diffs between KuCoin and Gate.io? Bitsgap automates it, scanning 25+ spots for arb ops and executing in seconds. It’s like a treasure detector for the $1-5% gaps that pop daily in fragmented markets.

ValueWalk’s September review hails its 25% ROI potential on volatile alts, with a unified dashboard curbing multi-tab madness. Starts at $19/month; watch for withdrawal fees on tiny wins. Suited for the savvy saver eyeing low-risk edges.

5. Coinrule: Rule-Maker for If-Then Simplicity

No tech chops? Coinrule’s drag-and-drop builder lets you craft rules like “If RSI >70, sell 20% SOL”—no code, just logic blocks. It backtests against 2025’s bull runs, ensuring your “what ifs” hold water.

Medium’s Coinmonks update praises its 15% average boosts for rule-followers, with 250+ templates for lazy launches. Free for basics, $29/month for unlimited. Great for the strategist who loves puzzles but hates plumbing.

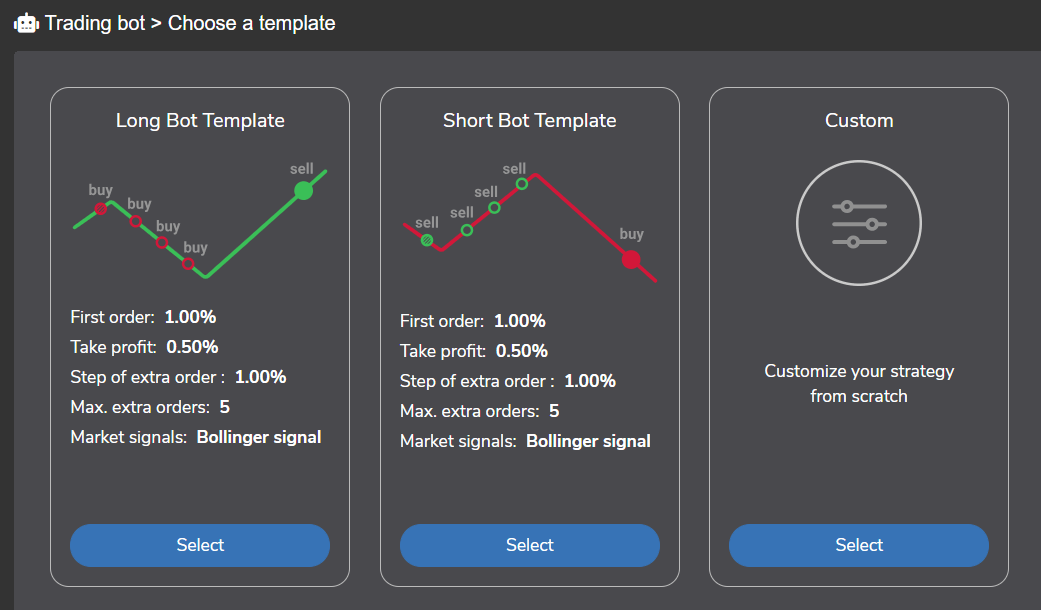

6. TradeSanta: Cloud Cruiser for Steady Signals

Riding trends without the chase? TradeSanta’s long/short bots use Bollinger Bands for entry/exit pings, running cloud-based so your laptop can nap. Pair it with Telegram alerts for bite-sized updates.

CoinBureau’s fresh October list spots 12-18% yields on its DCA setups amid ETF inflows. $14/month entry; simple for scaling small pots. The pick for patient growers who value peace over pace.

Level Up Your Bot Game: Quick Wins for New Riders

Diving in? Link one exchange first (Binance for liquidity), fund modestly, and backtest like mad—most bots simulate years in minutes. Diversify strategies (one grid, one arb) to weather dips, and audit monthly: Tweak rules if yields lag 5%. Tools like these aren’t fire-and-forget; they’re amplifiers for your gut checks.

Crypto’s no crystal ball, but in 2025’s $3T arena, bots tilt odds your way—turning “maybe someday” into “look at that.” Which one’s sparking your setup? Start small, stay curious, and watch those returns ripple. Your portfolio’s co-pilot awaits—what’s the first rule you’ll rule?