Picture this: You’re scrolling through your crypto app one morning, and suddenly, your BNB holdings spit out a surprise bundle of tokens worth thousands—without you doing anything extra beyond parking them safely. That’s the thrill Binance just delivered with Plasma (XPL), a fresh Layer 1 blockchain tuned for the stablecoin boom. On September 25, 2025, the exchange rolled out XPL as its 44th HODLer Airdrop, showering 75 million tokens (valued at roughly $75 million at launch) on loyal BNB stakers. With a capped 10 billion token supply and features like zero-fee USDT transfers, Plasma isn’t just another coin—it’s a quiet revolution in everyday digital money. Let’s unpack how this project is reshaping payments for the average user, from coffee runs to cross-border remittances.

Decoding Plasma: The Stablecoin Superhighway

At its heart, Plasma is like a dedicated express lane for stablecoins on the blockchain. Built as an EVM-compatible Layer 1 network, it specializes in handling high-volume transfers of assets like USDT without the usual gas fee headaches. Forget juggling multiple wallets or paying tiny fortunes in network costs just to send $50 abroad—Plasma’s design lets users zip stablecoins around the globe for free on simple transactions.

What makes it tick? A clever “paymaster” system covers gas fees for USDT sends, so you don’t need to hold XPL upfront. It’s EVM-friendly, meaning developers can port Ethereum apps over easily, while custom gas options let you pay fees in USDT or even BTC via a trust-minimized bridge. As one analyst put it, this setup “removes the biggest barrier to mainstream stablecoin adoption: the need for native tokens to even start.” For folks tired of clunky bank wires or volatile crypto swings, Plasma feels like the smooth operator we’ve been waiting for.

The $75M Airdrop: Free Tokens for BNB Loyalists

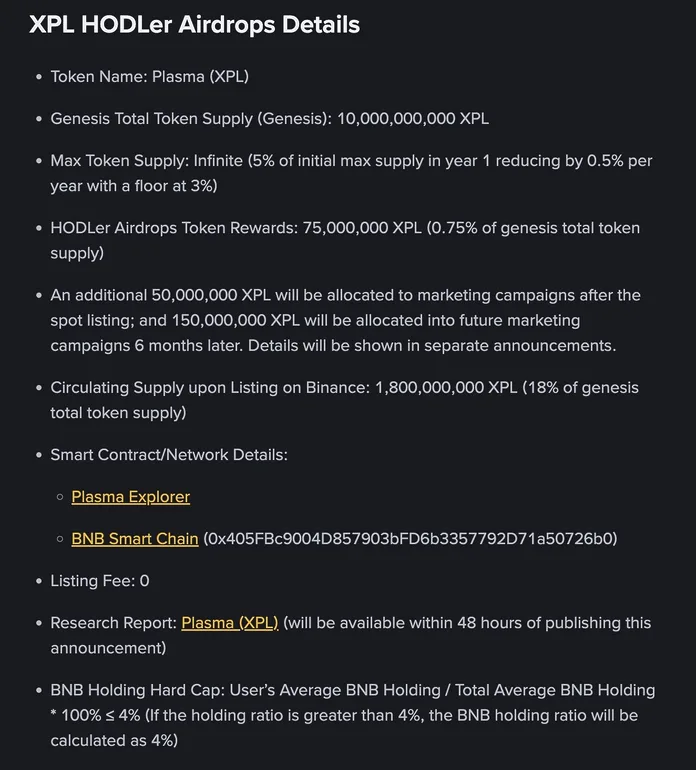

Binance’s HODLer Airdrops are the exchange’s way of saying “thanks” to long-term supporters, and Plasma’s edition was a standout. Announced as project number 44, it dropped 75 million XPL—0.75% of the genesis supply—directly into the wallets of qualifying users. At debut prices hovering near $1, that equaled about $75 million in instant value, turning passive BNB holders into XPL owners overnight.

Who Got the Windfall and Why It Matters

Eligibility was straightforward: Anyone who staked BNB in Binance’s Simple Earn products or On-Chain Yields between September 10 and 13, 2025 (UTC), snagged a proportional share. The more BNB you had locked in, the bigger your slice—no extra sign-ups or tasks required. Distributions hit accounts automatically post-listing on September 25, with trading pairs like XPL/USDT and XPL/BNB lighting up at 13:00 UTC.

This isn’t just free money; it’s a nudge toward ecosystem building. By rewarding stakers, Binance funnels liquidity into Plasma early, boosting its TVL (total value locked) which hit $2.5 billion at launch, including $1 billion from Binance Earn deposits alone. Everyday investors love it because it levels the playing field—small holders with a few hundred bucks in BNB walked away with meaningful XPL stacks, potentially kickstarting their DeFi journey.

XPL Tokenomics: A Balanced 10B Supply Blueprint

Plasma’s token design keeps things predictable and fair, with a hard-capped total supply of 10 billion XPL. No endless inflation here; it’s fixed to foster scarcity as adoption grows. At genesis, the full 10 billion entered circulation in phases, but vesting schedules ensure steady unlocks over time.

Break it down:

- 40% (4B XPL): Ecosystem and growth—fuels partnerships, liquidity pools, and community grants. Right out of the gate, 800 million unlocked for initial liquidity on exchanges like Binance.

- 25%: Team and advisors, vested over four years to align long-term incentives.

- 25%: Investors, from seed rounds backed by heavyweights like Founders Fund (Peter Thiel’s outfit) and Tether/Bitfinex.

- 10%: Public sale, which oversubscribed wildly, raising $373 million against a $50 million target—proof of real hype from retail crowds.

XPL isn’t just a speculative ticker; it powers the network as gas for complex transactions, staking for security, and rewards for validators. Stakers earn yields while securing the chain, and delegation lets non-techies participate without running nodes. Reports from CoinMarketCap peg the circulating supply at 1.8 billion as of October 2025, with XPL trading around $0.92—down from its $1.54 peak but up 14% in the last day alone.

How Plasma Powers Real-World Stablecoin Wins

Stablecoins like USDT are already a $150 billion market, but sending them often feels like mailing cash through a keyhole—slow and costly. Plasma flips that by optimizing for payments: Transactions settle in seconds at near-zero cost, with global coverage for 100+ currencies and payment rails. It’s launching “Plasma One,” a neobank-style app for saving, spending, and earning on stablecoins, partnering with fintechs for seamless fiat on-ramps.

For the average person, this means remitting money home without exchange fees eating your lunch, or paying bills in digital dollars that actually arrive today. Backed by Tether’s Paolo Ardoino and Delphi Digital’s seal of approval, Plasma’s architecture prioritizes privacy too—upcoming “Confidential Payments” will mask amounts and recipients without breaking wallet compatibility. In a world where 1.7 billion people lack bank access, tools like this could bridge the gap, one frictionless transfer at a time.

Jumping In: Trade, Stake, or Watch XPL Soar?

Getting your hands on XPL is as easy as firing up Binance. Search the ticker, grab some via spot trading (pairs include USDT, BNB, and FDUSD), or dive into Earn products for yields plus potential future airdrops. Newbies: Start with a small buy during dips—XPL’s volatility suits dollar-cost averaging over FOMO buys.

But hold up—crypto’s no sure bet. Plasma carries a “seed tag” on Binance, flagging it as high-risk due to its early stage. Prices can swing 20% daily, and while the 10B cap adds appeal, regulatory hiccups in stablecoin land could ripple through. Always DYOR, diversify, and maybe chat with a financial advisor if stakes are high.

Wrapping Up: Plasma’s Shot at Stablecoin Supremacy

Binance’s Plasma launch isn’t hype for hype’s sake—it’s a calculated bet on stablecoins as tomorrow’s cash. That $75M airdrop hooked thousands, the 10B supply blueprint promises longevity, and zero-fee magic could make digital dollars as easy as Venmo. Whether you’re a remittance warrior or just crypto-curious, XPL offers a peek at finance without borders. As Plasma’s TVL climbs and integrations roll out, keep an eye on this one—it might just redefine how we move money in 2026 and beyond. Ready to stake your claim, or playing the long game? The blockchain’s waiting.