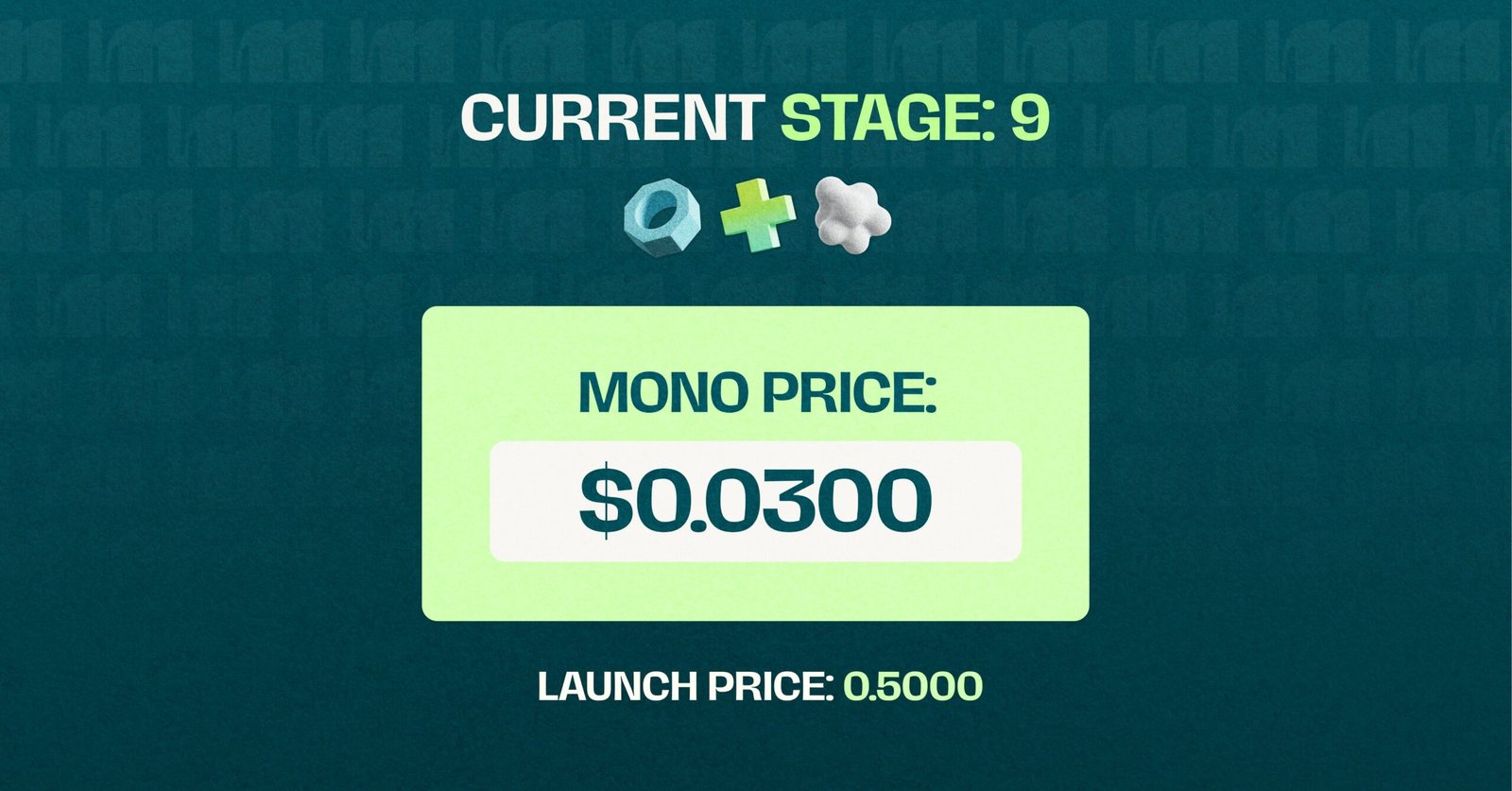

Ever felt like Web3 is a puzzle with pieces scattered across a dozen different boards—wallets here, tokens there, fees sneaking up from every chain? Now imagine snapping them all together with one effortless click, turning cross-chain chaos into smooth sailing. That’s the promise of Mono Protocol, a DeFi innovator hitting its stride in October 2025, where its presale just powered into Stage 9 with tokens priced at a tempting $0.0300. On day one alone, it pulled in $1.7 million from savvy backers eyeing the next big unification play. If you’re ready to grab a front-row seat in this cross-chain revolution without the usual hassle, this guide walks you through it like a friendly neighborhood tour—simple steps, no tech overload, just clear paths to potential upside in a market craving connectivity.

Demystifying Mono Protocol: Your Ticket to Unified DeFi

Mono Protocol isn’t another flashy token chasing trends; it’s the quiet engineer fixing Web3’s biggest headache: fragmentation. Picture this: You hold USDC on Ethereum, but want to lend it on Arbitrum or swap on Solana—without bridging fees eating your lunch or transactions fizzling out mid-hop. Mono steps in with chain abstraction magic, pooling your token balances into one universal view, powering MEV-resistant trades, and slashing costs by up to 40% through smart routing and execution bonds.

Launched with backing from crypto vets, it supports all major networks and tokens, letting devs build once and deploy everywhere. For everyday users? It’s like upgrading from a flip phone to a smartphone—seamless access to yields, loans, and swaps without the chain-hopping grind. As DeFi TVL climbs toward $200 billion in 2025 per DefiLlama forecasts, Mono’s focus on reliability positions it as a backbone for the masses, not just the pros.

In short, if Web3’s promise feels bogged down by bridges and bots, Mono is the protocol whispering, “Let me handle that.”

The Stage 9 Edge: Why $0.0300 Feels Like Early Bird Gold

Presales are crypto’s whisper network—get in low, ride the build. Stage 9 marks a pivot point for Mono, with the token price locked at $0.0300 after steady climbs from earlier rounds, offering a 10x potential pop by mainnet launch if adoption mirrors peers like LayerZero. Why jump now? Whitelists are filling fast, KYC slots are geo-limited in spots, and the $1.7 million day-one haul signals whale interest without the post-hype dump risk.

A Messari deep-dive on chain abstraction projects pegs 2025 growth at 300% for protocols solving liquidity silos, with Mono’s execution bonds—locking solver stakes for guaranteed settlements—standing out as a game-changer for dApp retention. At this price, you’re not just buying tokens; you’re staking a claim in a tool that could make cross-chain the default, not the exception. Risks? Sure—volatility and dev timelines—but audited contracts and a vested team tilt the odds toward builders over buzz.

Quick Perks of Stage 9 Entry

- Priority Allocation: Whitelist perks lock in your share before public frenzy.

- Governance Votes: Early MONO holders influence treasury spends and upgrades.

- Yield Boosts: Post-TGE staking rewards kick off at 15-20% APY estimates.

It’s the sweet spot where conviction meets convenience.

Your Foolproof Roadmap: Buying MONO in Minutes

No PhD needed—just a wallet and a dash of curiosity. Mono’s presale is designed for the everyman, accepting ETH or USDT on Ethereum for quick buys. We’ll map it out, from setup to claim, so you can wrap up before your coffee cools. Pro tip: Double-check gas fees on a low-congestion day like midweek mornings.

Step 1: Gear Up Your Wallet Essentials

Start with a trusty non-custodial wallet like MetaMask or WalletConnect—free downloads from their official sites. Fund it with 0.01-0.05 ETH (about $25-125 at current rates) for gas, plus your investment in ETH or USDT. Enable EVM compatibility if bridging stables. New to this? A quick tutorial on Etherscan’s blog covers the basics in under five minutes.

Security first: Use a hardware ledger for bigger plays, and never share seeds. You’re set when your balance shows green.

Step 2: Head to the Official Presale Hub

Fire up https://purchase.monoprotocol.com—the one-stop portal vetted by the team. Skip shady links; bookmark from monoprotocol.com to dodge phishing. Here, you’ll see Stage 9 details: price, cap progress (aiming for $20M total), and a countdown to TGE in Q1 2026.

Connect your wallet with a single click—approve the session, but deny any fund requests. The interface pulls your address automatically, showing eligible amounts based on whitelist status (apply via Telegram if needed).

Step 3: Lock In Your Purchase and Track It

Select your buy amount—say, $500 for ~16,667 MONO at $0.0300—then pick ETH or USDT. Review the tx: It swaps your input for an allocation receipt, not tokens yet (to avoid presale dumps). Hit confirm, pay the gas (under $5 typically), and voilà—receipt emails to your linked address.

Monitor via the portal’s dashboard or Etherscan for tx hashes. No instant tokens? That’s by design; claim them post-TGE when liquidity hits exchanges like Binance or Uniswap.

Step 4: Claim and Activate Post-Launch

TGE drops in early 2026: Return to the portal, connect, and claim your MONO stack. From there, stake for yields or trade. A CoinTelegraph primer on presale claims notes 90% of backers see seamless unlocks with proper wallet hygiene.

| Step | Time Estimate | Key Tip |

|---|---|---|

| Wallet Setup | 5 mins | Use official app stores |

| Portal Connect | 2 mins | Verify URL ends in .com |

| Purchase Tx | 1-3 mins | Check gas on ethgasstation.info |

| Claim (Later) | 5 mins | Set calendar reminder for TGE |

Peering Ahead: Tokenomics and Mono’s 2025 Blueprint

MONO isn’t vaporware—its economics reward longevity. Total supply: 1 billion tokens, with 50% (500M) earmarked for public presale like Stage 9, ensuring broad distribution. The rest? 10% liquidity for smooth trades, 10% marketing to amp adoption, and slices for team (vested over years), treasury, and ecosystem rewards. Utility shines in fees: Pay gas in any token, stake for security, or bond for solver gigs.

2025’s roadmap? Q4 wraps audits and community builds, flowing into Q1 mainnet with SDK drops for devs. By mid-year, expect partnerships with oracles like Chainlink and wallets like Privy, per the litepaper. A Deloitte blockchain forecast tips cross-chain tools like Mono capturing 25% of DeFi volume by year-end, fueling organic growth.

Wrapping It Up: Your Move in Mono’s Momentum

Snagging MONO at Stage 9’s $0.0300 isn’t about chasing moons—it’s betting on the plumbing that makes Web3 workable for wallets like yours. With raised funds fueling real tech and a community humming on Telegram, this could be the quiet multiplier in your crypto kit. DYOR, start small, and remember: Bridges build empires. Ready to connect the dots? Hit that presale link and claim your piece of the unified future. What’s holding you back—a wallet tweak or just the thrill of the jump?