sprinter who stumbled mid-race but is now picking up speed again. That’s SUI in May 2025, clawing back from a 60-day correction after peaking at $5.37 in January, now running at $4.58, per CoinGecko. This Layer-1 blockchain, known for lightning-fast transactions, has traders buzzing about whether it can sustain its comeback or trip again. With a $4.35 billion market cap and a 68% TVL surge in April-May, per themarketperiodical.com, SUI’s got momentum. Let’s jog through this crypto rally like we’re catching up on a hot trend, keeping it simple for anyone new to the game.

What Sparked SUI’s Comeback?

SUI, a blockchain built for speed and scalability, hit a rough patch after soaring to $5.37 in January 2025, dropping 15% to $4.58 by mid-March, per ccn.com. But recent gains, up 10% in a week, signal a rebound, per @santimentfeed. Here’s what’s powering this sprint.

1. TVL and Ecosystem Growth

SUI’s Total Value Locked (TVL) jumped 68.11% from April to May 2025, outpacing Bitcoin’s 67.48%, per themarketperiodical.com. With 70+ DeFi projects like Navi Protocol, SUI’s ecosystem is thriving, per crypto-news-flash.com, drawing capital like a magnet.

2. Technical Breakout

SUI broke out of a falling wedge pattern in May, a bullish sign, climbing past $4.00, per themarketperiodical.com. RSI above 50 and a bullish MACD crossover, per TradingView, show buying pressure, like a runner finding their stride.

3. Network Upgrades

SUI’s whitelist function, added May 23, 2025, aims to return stolen funds to liquidity providers, boosting trust, per crypto-news-flash.com. Its wBTC bridge, live since February, drives Bitcoin DeFi, per @rektcapital, with 90,000 active wallets, per @santimentfeed.

Can SUI Keep Running? Technical Outlook

SUI’s at $4.58, just above its $4.35 support, per CoinGecko. Analysts see a path to $5.30 if it holds $4.00, but a deeper correction looms if it slips, per themarketperiodical.com.

1. Bullish Case

A sustained move above $4.00 could push SUI to $5.30, a 15% gain, per themarketperiodical.com. If TVL grows another 20%, analysts predict $9.38 by year-end, per ccn.com. X post @Trader_XO sees $4.00 as a springboard for altcoin rallies.

2. Bearish Risks

A drop below $4.00 risks a 20% fall to $3.60 or $3.30, per themarketperiodical.com. A break below $3.30 could trigger panic selling, echoing a 30% dip in February 2025, per coinpedia.org. X post @CryptoMtnDrew flags profit-taking after recent gains.

3. Market Context

SUI’s $4.35B market cap ranks it #30, with $1.2B daily volume, per CoinGecko. Its 900% surge in 2024, per ccn.com, mirrors NEAR’s recovery, per tronweekly.com, but a broader market dip could drag SUI to $2.92 by July, per ccn.com.

Risks to SUI’s Rally

SUI’s 18% daily volatility risks sharp drops, per CryptoWorldClub. A November 2024 outage, linked to an integer overflow, shook confidence, per cryptonews.net. Scams, hitting 5% of DeFi tokens, cost $15M in 2024, per @PeckShieldAlert. Regulatory uncertainty in 45% of countries, per The Block, could slow growth. X post @Web3Warden notes 7% of SUI traders hit phishing scams, per Dune analytics.

How to Jump into SUI

Ready to join SUI’s race in May 2025? Here’s a newbie-friendly guide, per CoinGecko and @santimentfeed.

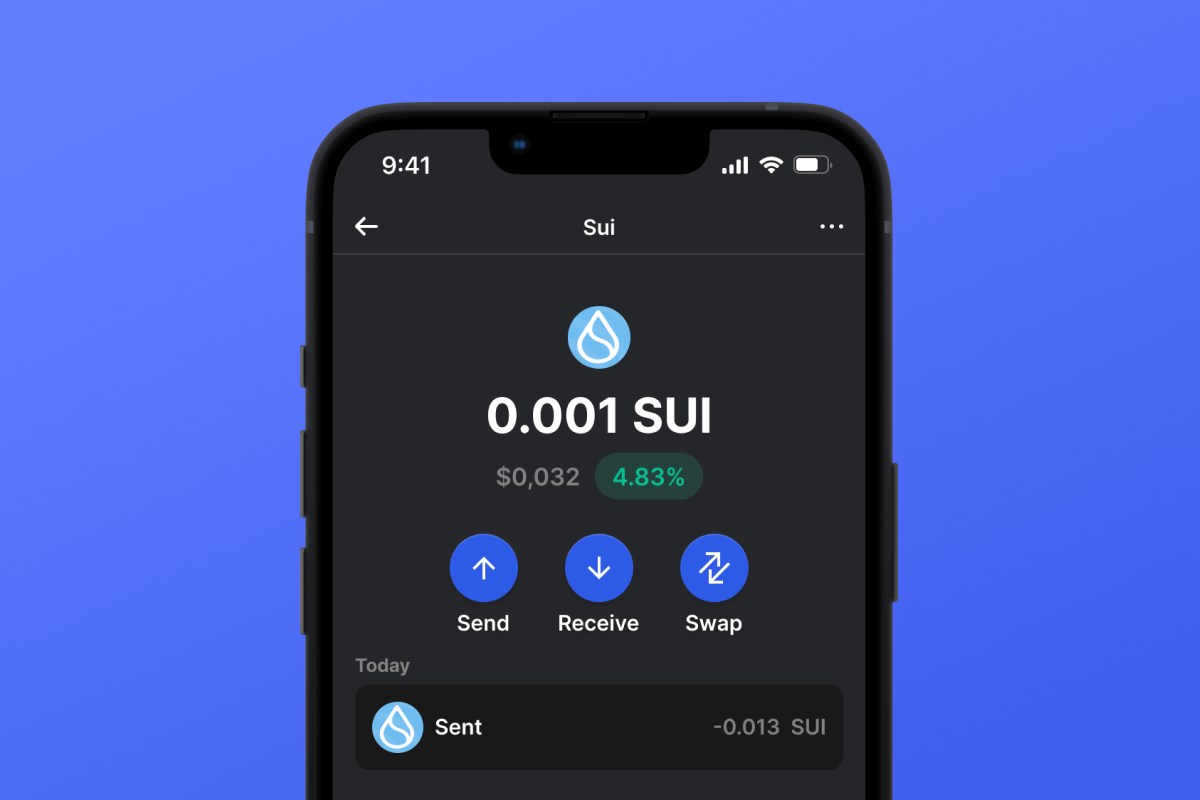

1. Grab a Wallet

Install Sui Wallet or MetaMask, deposit $20 in USDT, and buy $15 SUI ($4.58 price, per CoinGecko), with $0.15 fees. SUI’s $4.35B market cap ensures liquidity, per coinmarketcap.com.

2. Trade or Stake

Trade $15 SUI on Binance for 10% gains if it hits $5.00, or stake on Navi Protocol for 6% APY, per CoinCodex. Store in Sui Wallet, per @santimentfeed. SUI’s $1.2B volume, per The Merkle, supports trades.

3. Stay in the Loop

Follow @rektcapital for SUI updates and @themerklehash for market buzz. Join SUI’s 50,000-member Telegram, per crypto-news-flash.com. Monitor RSI on CoinGecko, as 55 signals steady momentum, per TradingView.

Will SUI Cross the Finish Line?

SUI’s at $4.58, sprinting after a 60-day correction, with $5.30 in sight if it holds $4.00, per themarketperiodical.com. Its 68% TVL spike and wBTC bridge fuel hope, per @rektcapital, but a slip below $3.60 could mean a stumble, per coinpedia.org. Start with $20: buy $15 SUI, trade on Binance, and secure it in Sui Wallet, per CoinGecko. Track @santimentfeed and dodge 7% scam risks, per @PeckShieldAlert. With $1.2B volume, per coinmarketcap.com, SUI’s comeback is a race worth watching—just stay sharp!