Picture Bitcoin as a giant vault of $1 trillion, locked away because it’s hard to use for anything but holding. Now, imagine a high-tech ATM that lets you safely move that money into a bustling digital marketplace. That’s what BOB’s BitVM Bridge, launched on testnet May 19, 2025, is doing for Bitcoin DeFi. This bridge could unlock Bitcoin’s massive value for lending, trading, and earning interest, potentially sparking a $1 trillion DeFi boom in 2025, per nulltx.com. Curious how it works and why it’s a game-changer? Let’s break it down in simple terms, no crypto PhD required.

What Is BOB’s BitVM Bridge?

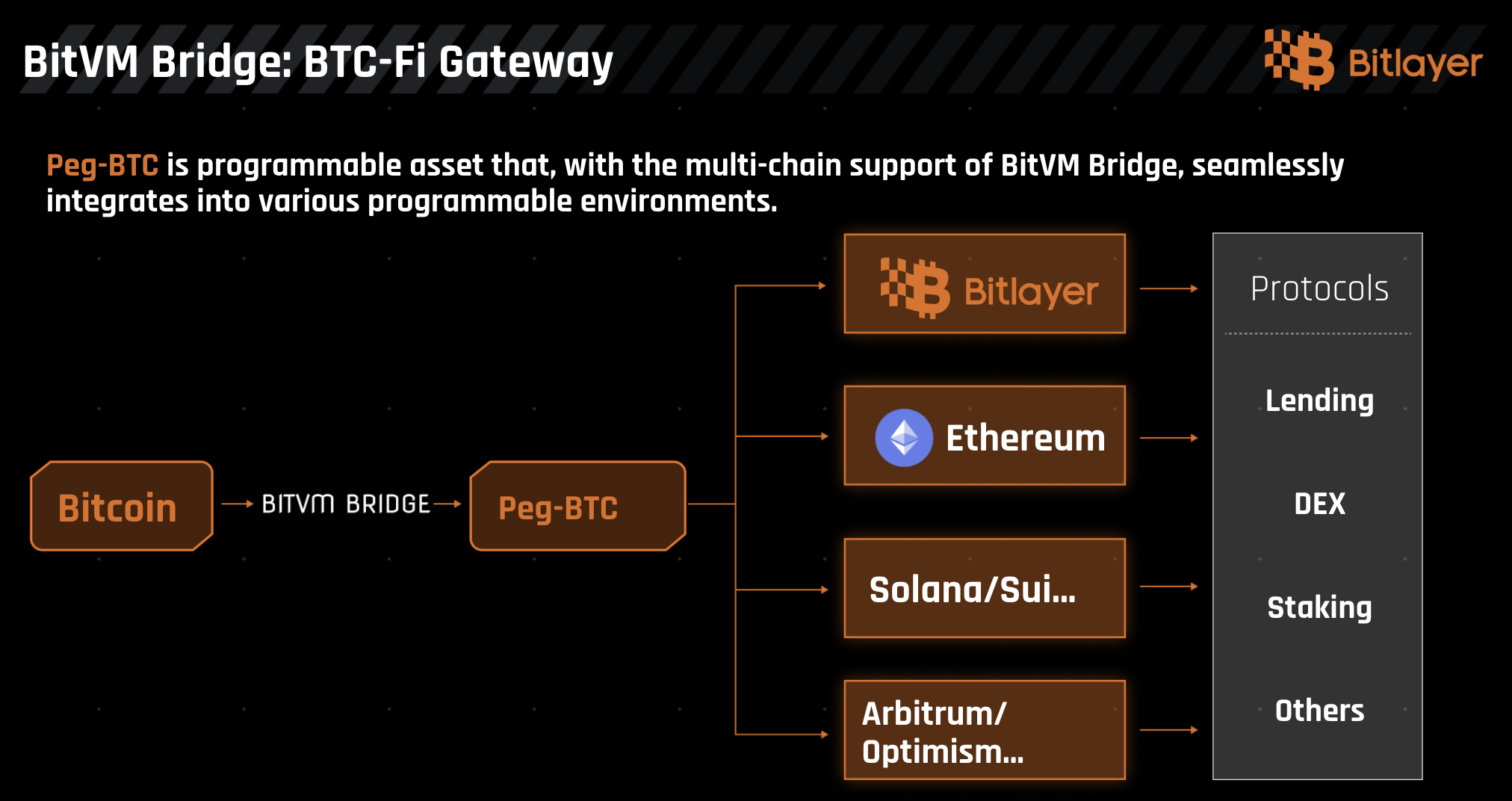

BOB, short for Build on Bitcoin, is a hybrid Layer-2 network blending Bitcoin’s rock-solid security with Ethereum’s DeFi playground. Its BitVM Bridge, developed with Fiamma Labs, lets you move Bitcoin (BTC) to BOB’s network to create bobBTC, a token you can use in DeFi apps like swapping or lending, per The Merkle. Unlike old-school bridges that rely on risky middlemen, this one uses BitVM—a tech that ensures your BTC is safe as long as one honest user is watching, per @BitcoinEcoTK. On May 19, 2025, the bridge hit testnet, handling deposits and withdrawals in under an hour, per blog.gobob.xyz.

For newbies, think of it like depositing cash into a secure ATM that gives you digital dollars to shop online, but you can always withdraw your cash later. BOB’s $200 million in DeFi total value locked (TVL) shows growing trust, per crypto-reporter.com.

Why It Matters

- Trust-Minimized: Only one honest user prevents theft, unlike Wrapped Bitcoin’s (WBTC) custodial risks, per The Merkle.

- Fast: Transfers take under an hour, beating Ethereum’s slower bridges, per blog.gobob.xyz.

- Huge Potential: Bitcoin’s $1 trillion market cap could flood DeFi, per nulltx.com.

How Does the BitVM Bridge Work?

The bridge uses BitVM, introduced by Robin Linus in 2023, to run complex programs off-chain while settling disputes on Bitcoin’s blockchain, per cryptotvplus.com. Here’s the simple version: when you send BTC to BOB, it’s locked in a smart contract. You get bobBTC to use in DeFi apps on BOB’s network, which runs on Ethereum for speed but anchors to Bitcoin for security, per docs.gobob.xyz. To withdraw, an operator pays you BTC, then reclaims it from BitVM if everything checks out, per blog.gobob.xyz. A single honest user can challenge fraud, making it super safe, per @btc_board.

It’s like lending your bike to a friend through a smart lock: they can use it, but only you can unlock it later. BOB’s partnerships with ZeroSync and Babylon Labs boost security, per ainvest.com.

Key Features

- Non-Custodial: No middleman holds your BTC, unlike WBTC, per crypto-reporter.com.

- Dispute Resolution: On-chain checks stop fraud, per prnewswire.com.

- Intent-Based Swaps: BOB’s Gateway makes deposits smooth, per eblockmedia.com.

Why Could It Unlock $1 Trillion in Bitcoin?

Bitcoin’s $1 trillion market cap dwarfs DeFi’s $133 billion TVL, but only 0.3% of BTC is in DeFi due to clunky bridges, per nulltx.com. BOB’s BitVM Bridge changes that by making BTC DeFi easy and safe. With 2,700 BTC in derivatives already on BOB, per @BitcoinEcoTK, and $200 million TVL, per crypto-reporter.com, it’s gaining traction. Analysts predict a $47 billion Bitcoin Layer-2 ecosystem by 2025, per bitcoinethereumnews.com, and BOB’s trust-minimized model could channel Bitcoin’s liquidity into lending, staking, and trading, per The Merkle.

Real-World Impact

Imagine earning 5% interest on your BTC by lending it on BOB, or swapping it for stablecoins without a bank. X post @fiamma_labs notes the bridge’s testnet success, signaling a “Bitcoin renaissance,” per prnewswire.co.uk. With Bitcoin at $95,000 in May 2025, per financemagnates.com, even small investors could join DeFi.

Challenges to Watch

BOB’s bridge isn’t perfect yet. It runs with one operator now, which isn’t fully decentralized, though multi-operator plans are coming, per The Merkle. Scalability is a concern: Bitcoin’s 7 transactions per second (TPS) limit bottlenecks high volumes, per cryptotvplus.com. Scams, affecting 5% of DeFi projects, are a risk, per @PeckShieldAlert. Regulatory hurdles, with 10% of DeFi platforms facing scrutiny, could slow growth, per The Block. X post @Allinbtc0x highlights zero-knowledge (ZK) layers for privacy, but these are still in development.

Staying Safe

Start with $50 in BTC, use audited platforms like BOB’s Gateway, and verify transactions on explorers like BtcScan.org, per CoinGecko. Store BTC in a hardware wallet like Ledger with 2FA, per @PeckShieldAlert. Follow @build_on_bob for updates, as 15% of new DeFi projects may be scams, per The Merkle.

How to Use BOB’s BitVM Bridge

Ready to try BOB’s DeFi? Here’s a beginner’s guide, based on 2025 trends.

1. Set Up a Wallet

Download MetaMask or Trust Wallet, fund it with $50 in BTC ($95,000 price, per financemagnates.com), and connect to BOB’s testnet at gobob.xyz. Deposit $25 BTC to get bobBTC, costing $0.10, per CoinGecko. BOB’s $200 million TVL ensures liquidity, per crypto-reporter.com.

2. Try DeFi

Use bobBTC to lend on Avalon Finance or swap on Uniswap V3 via Okutrade, per @BitcoinEcoTK. Lending $25 bobBTC could earn 4% annually, per DeFiLlama. Withdraw bobBTC to BTC anytime, taking under an hour, per blog.gobob.xyz.

3. Stay Updated

Join BOB’s 30,000-member Discord or follow @build_on_bob, per CoinDesk. Monitor BTC’s RSI at 60, neutral for DeFi moves, per TradingView. Check @fiamma_labs for bridge updates, as mainnet is planned for Q3 2025, per @btc_board.

What’s Next for BOB and Bitcoin DeFi?

BOB’s mainnet launch in Q3 2025 could push its TVL to $500 million, per The Merkle. Integration with Babylon’s BTC staking could add $1 billion in liquidity, per crypto-reporter.com. The BitVM/acc Working Group, with partners like Chainlink and ZeroSync, aims for 100,000 daily users, per prnewswire.com. X post @beingivish predicts BOB leading BTC DeFi with 2,700 BTC in derivatives, per @BitcoinEcoTK. If Bitcoin hits $200,000, per cryptonews.com, the $1 trillion surge could become reality.

Your First Step in Bitcoin DeFi

BOB’s BitVM Bridge, with $200 million TVL and trust-minimized transfers, is opening Bitcoin’s $1 trillion vault, per nulltx.com. Start small: deposit $25 BTC on BOB’s testnet, try lending for 4% returns, and store bobBTC in MetaMask, per CoinGecko. Follow @build_on_bob for mainnet news and @BitcoinEcoTK for DeFi tips. With only 5% scam risks, per @PeckShieldAlert, BOB’s your ticket to Bitcoin DeFi—just keep your wallet secure!