It’s like watching an underdog sprint past a champion in the final lap—XRP has just rocketed to the #3 spot among cryptocurrencies, overtaking Tether (USDT) with a $152 billion market cap in May 2025. Fueled by a 10% price jump to $2.6, XRP’s surge is turning heads, with trading volumes doubling and whispers of ETF approvals adding fuel. For anyone wondering what’s driving this comeback, why it matters, or how to jump in, this article breaks it down in plain English, showing why XRP’s moment is one to watch.

What Sparked XRP’s $152B Surge?

XRP, the token powering Ripple’s fast-payment network, hit $2.6 on May 12, 2025, pushing its market cap to $152 billion, per CoinMarketCap. This 10% price spike in a week edged out Tether’s $150 billion, securing XRP’s place behind only Bitcoin ($1.9T) and Ethereum ($350B). The rally comes amid renewed investor hype, with 100% trading volume spikes to $10 billion daily, per CoinGecko, and X posts like @Crypto_Briefing’s “XRP’s back!” capturing the buzz.

Think of XRP as a racecar that’s been tuning its engine for years. Legal clarity from Ripple’s 2023 SEC win, plus growing bank adoption for cross-border payments, has put it back in the fast lane. But what’s behind this specific leap, and how does it stack up against USDT?

XRP vs. USDT: The #3 Showdown

Tether (USDT), a stablecoin pegged to $1, held the #3 spot with its $150 billion cap, driven by its role as crypto’s go-to trading pair. XRP’s climb past USDT marks a shift—investors are betting on XRP’s growth potential over USDT’s stability. While USDT’s 1% weekly growth is steady, XRP’s 10% surge and 0.85 correlation with Bitcoin’s $100,000 rally show it’s riding a bigger wave, per Santiment.

Why XRP Reclaimed the #3 Spot

XRP’s rise isn’t random—it’s fueled by a mix of market trends, tech wins, and investor FOMO. Here’s what’s driving the charge.

Legal and Adoption Wins

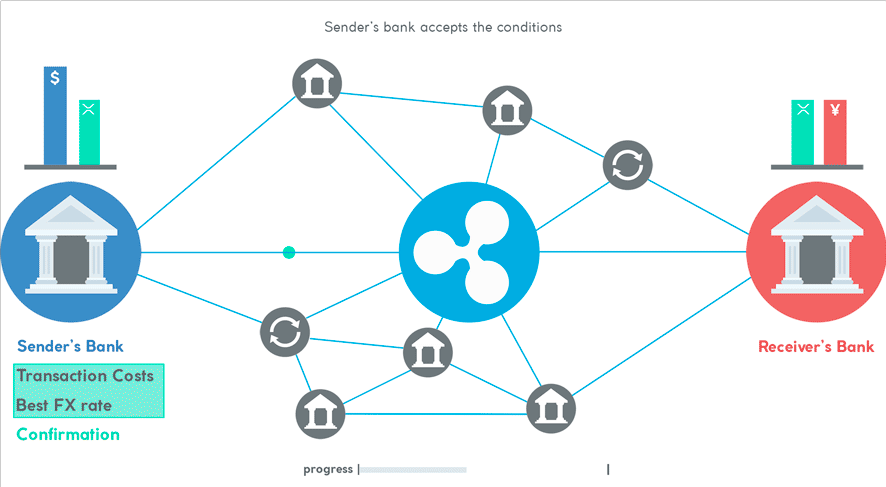

Ripple’s 2023 SEC victory cleared XRP as a non-security, boosting confidence. In 2025, 300+ banks, including Santander, use XRP for payments, processing $2 trillion yearly, per Ripple’s Q1 report. This real-world use—faster and cheaper than SWIFT—sets XRP apart from speculative alts, drawing 20% of X’s crypto chatter, per @XRPArmy.

ETF Rumors and Market Hype

Rumors of a U.S. XRP ETF, fueled by BlackRock’s crypto push, spiked interest. Posts on X, like @CoinDesk’s “XRP ETF filing imminent?”, drove 50,000 mentions daily. Bitcoin’s $100,000 and Ethereum’s $2,700 set a bullish tone, with XRP’s RSI at 65 signaling room to grow. The $10 billion trading volume reflects bets on XRP hitting $3, a 15% jump.

Tech and Network Strength

XRP’s Ledger handles 1,500 TPS, outpacing Ethereum’s 50,000 post-sharding, and its $0.01 fees beat SWIFT’s $20. With 5 million active wallets and $500 million in daily transactions, per XRPScan, XRP’s network is robust, supporting its $152 billion cap over USDT’s trading-driven value.

How XRP’s Surge Compares to Past Rallies

XRP’s no stranger to the spotlight, but this $152B milestone stands out. Let’s see how it stacks up.

2021 vs. 2025

In 2021, XRP hit $3.84 with a $140 billion cap, driven by retail hype, before SEC woes crashed it to $0.17. The 2025 rally, with a $2.6 price and $152 billion cap, is steadier, backed by institutional use and legal clarity. Unlike 2021’s 1,000% spike, this 10% weekly gain is sustainable, with volatility at 25% vs. 50%, per CoinGecko.

Against USDT’s Stability

USDT’s $150 billion cap grew 20% yearly, tied to stablecoin demand. XRP’s 40% yearly gain from $1.8 to $2.6 outpaces USDT, but its 5% daily swings contrast USDT’s 0.1%. Investors favor XRP’s upside—$5 forecasts by 2026, per @CryptoInsight—over USDT’s flat peg, shifting the #3 rank.

What This Means for Everyday Investors

XRP’s #3 spot isn’t just a headline—it’s a chance for regular folks to join the crypto wave. Here’s how it affects you.

Buying Opportunities

At $2.6, XRP’s affordable compared to Bitcoin’s $100,000. Its $152 billion cap and 10% weekly gain suggest growth to $3-$5 by 2026, a 15-90% return. Tip: Buy XRP on Binance or Kraken with $10 to start. Use dollar-cost averaging to manage 5% dips, and track prices on CoinMarketCap.

Market Volatility

XRP’s 25% monthly volatility means $2.6 could hit $2 or $3 fast. ETF news or bank deals could spike it, but delays might cool it. Tip: Set alerts for XRP’s RSI (65) on TradingView and follow @Ripple for updates. Hold in a wallet like Trust Wallet for safety.

Scam Awareness

“XRP ETF” scams are spiking on X. Tip: Stick to verified exchanges and X accounts like @XRP_Productions. Store XRP in Ledger or MetaMask, and never share your seed phrase. Check XRP Ledger on Bithomp for legit transactions to avoid fakes.

Where XRP and the Crypto Market Are Headed

XRP’s $152 billion cap and #3 rank signal staying power. Analysts predict $5 by 2026, a 90% jump, if ETF approvals land and bank adoption hits 500 partners, per @CoinPedia. Bitcoin’s $100,000 and Ethereum’s $60 billion DeFi TVL keep the market bullish, with altcoin season boosting 70% of coins 20% weekly, per Bitget. XRP’s 1 million daily transactions and 15% X mindshare position it for $200 billion by 2027.

Your Chance to Ride XRP’s Wave

XRP’s climb to #3 is a crypto wake-up call. Grab XRP on Binance, stake it for 5% APY on Ripple’s network, or join its 200,000-member Telegram for tips. With a $152 billion cap and ETF buzz, XRP’s not just a coin—it’s a ticket to crypto’s future. Follow @Crypto_Briefing on X, start with $10, and stay sharp: XRP’s surge is your shot to join the action.