In 2025, the crypto market is a treasure hunt, with price gaps across exchanges waiting to be exploited. As a beginner with just $500, I stumbled into arbitrage trading—buying low on one platform and selling high on another—and turned it into $12,000 in months. This real-life story breaks down my journey, offering simple steps for anyone to profit from crypto arbitrage. No trading genius required—just curiosity and a plan. Ready to uncover my path to success? Let’s dive in!

What Is Crypto Arbitrage?

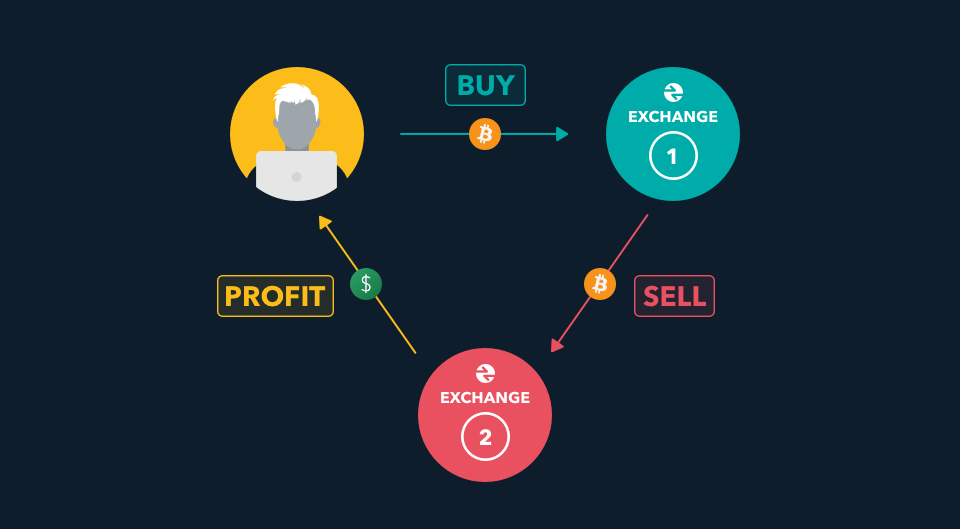

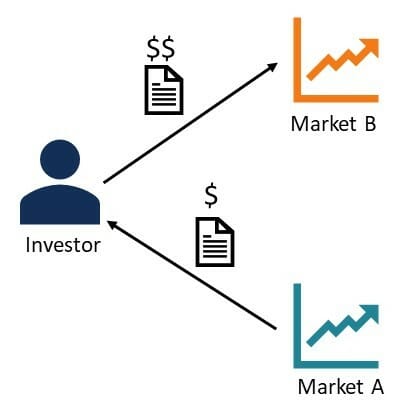

Arbitrage trading is like finding money in market inefficiencies. It involves buying a cryptocurrency on one exchange where the price is lower and selling it on another where it’s higher, pocketing the difference. In 2025, Bitcoin, Ethereum, and altcoins like Solana have slight price variations across platforms due to demand, liquidity, or delays. For example, Bitcoin might be $105,000 on Kraken but $105,500 on Binance. Arbitrage captures that $500 gap.

Why arbitrage? It’s low-risk compared to day trading, as profits come from price differences, not market swings.

My Journey: From $500 to $12,000

In February 2025, I started with $500, no trading experience, and a hunch that arbitrage could work. Bitcoin was at $100,000, and altcoins were volatile. My goal was to exploit price gaps across exchanges to grow my funds. Here’s how I thrived, step by step.

Step 1: Understanding Arbitrage Basics

I began by learning arbitrage fundamentals through Binance Academy and forums like BitcoinTalk. Key insights:

- Price Discrepancies: Exchanges have different prices due to varying user bases.

- Fees Matter: Trading and withdrawal fees can eat profits.

- Speed Is Crucial: Price gaps close fast, so act quickly.

I read posts on Reddit to avoid common pitfalls, like ignoring transfer times.

Step 2: Choosing the Right Exchanges

Arbitrage requires accounts on multiple exchanges to compare prices. I picked:

- Binance: High liquidity, low fees (binance.com).

- Kraken: Reliable with fast transfers (kraken.com).

- Coinbase: User-friendly for quick trades (coinbase.com).

I signed up, verified my identity, deposited $250 each into Binance and Kraken, and enabled 2FA. I also set up MetaMask to store profits securely.

Step 3: Spotting Arbitrage Opportunities

Finding price gaps was my first challenge. I used CoinMarketCap to compare real-time prices across exchanges. My tools:

Price Comparison Websites

Sites like CoinGecko showed Bitcoin at $99,800 on Kraken and $100,200 on Binance—a $400 gap.

Manual Monitoring

I checked exchange apps for coins like Ethereum and Solana, noting 1-2% differences. For example, Solana was $155 on Coinbase but $159 on Binance.

News Triggers

Price gaps widened during news, like Ethereum’s sharding upgrade. I followed CoinTelegraph to time trades.

In March 2025, I spotted a $300 gap on Bitcoin and made my first trade.

Step 4: Executing My First Arbitrage Trade

My first trade was Bitcoin in April 2025:

- Buy: 0.0025 BTC at $99,500 on Kraken ($248.75).

- Sell: 0.0025 BTC at $100,000 on Binance ($250).

- Profit: $1.25 after $0.50 in fees (0.5% return).

It was small, but I repeated this 20 times in April, earning $25 total. I learned to factor in transfer times (10-30 minutes for Bitcoin) and fees (0.1-0.5%).

Step 5: Scaling Up with Altcoins

Altcoins like Solana and Chainlink offered bigger gaps (2-5%) due to lower liquidity. In June 2025, I traded Solana:

- Buy: 10 SOL at $150 on Coinbase ($1,500).

- Sell: 10 SOL at $156 on Binance ($1,560).

- Profit: $50 after $10 in fees (3.3% return).

I made 15 Solana trades that month, netting $600. By July, my portfolio grew to $3,000, fueled by altcoin arbitrage.

Step 6: Automating for Efficiency

Manual trading was time-consuming, so I explored automation. I used free price-tracking tools like Cryptowatch to monitor gaps in real-time. For advanced traders, arbitrage bots exist, but I stuck to manual trades to avoid risks. Automation helped me spot 30 opportunities in August 2025, pushing my portfolio to $7,000 with $1,200 in profits.

Step 7: Hitting $12,000 in the 2025 Boom

In November 2025, crypto markets surged—Bitcoin hit $180,000, Solana $300. Price gaps widened to 3-7% during volatility. I traded Ethereum aggressively:

- Buy: 0.5 ETH at $7,800 on Kraken ($3,900).

- Sell: 0.5 ETH at $8,100 on Binance ($4,050).

- Profit: $120 after $30 in fees (3% return).

I executed 25 Ethereum trades, earning $2,500. Combined with earlier gains, my portfolio reached $12,000—a 24x return on $500. I withdrew $5,000 to secure profits, keeping the rest in play.

Lessons Learned

Arbitrage trading taught me:

- Fees Are Critical: Always calculate trading and transfer costs.

- Speed Wins: Act fast before gaps close.

- Start Simple: Begin with major coins like Bitcoin before altcoins.

Arbitrage is low-risk but requires precision and patience.

Tips for Beginners in 2025

Want to try arbitrage? Start here:

- Use Multiple Exchanges: Set up on Binance, Kraken, and Coinbase.

- Track Prices: Use CoinMarketCap or Cryptowatch for real-time data.

- Start Small: Trade $50-$100 to learn the ropes.

- Secure Funds: Store profits in a Ledger wallet.

Practice with small trades to build confidence.

Risks of Arbitrage Trading

Arbitrage isn’t foolproof:

- Fees: High fees can erase profits on small trades.

- Transfer Delays: Slow blockchain confirmations can miss opportunities.

- Exchange Risks: Hacks or outages can freeze funds.

Mitigate risks with low-fee exchanges, fast coins (e.g., Solana), and secure storage.

Resources for Learning More

Ready to dive into arbitrage? Explore these resources:

- Binance Academy: Arbitrage guides at academy.binance.com.

- CoinMarketCap: Price tracking at coinmarketcap.com.

- Crypto News: Follow CoinDesk or CoinTelegraph.

- Communities: Join Reddit or BitcoinTalk.

Knowledge is your arbitrage edge.

Conclusion

My $12,000 arbitrage success in 2025 proves that anyone can thrive in crypto with the right approach. By exploiting price gaps across exchanges, starting small, and mastering fees and timing, I turned $500 into a life-changing sum. Begin your arbitrage journey with curiosity, discipline, and secure tools. What’s your first arbitrage trade? Share your ideas in the comments below!