Blockchain networks like Bitcoin and Ethereum rely on consensus mechanisms to secure transactions and prevent fraud. The two most popular mechanisms are Proof of Work (PoW) and Proof of Stake (PoS). But what are they, and how do they differ? This beginner-friendly guide breaks down the technical details of PoW and PoS, comparing their strengths, weaknesses, and real-world applications. Let’s dive in!

What Are Consensus Mechanisms?

A consensus mechanism is a set of rules that ensures all participants in a blockchain network agree on the validity of transactions. Without a central authority, blockchains use mechanisms like PoW or PoS to prevent double-spending and maintain trust. Think of it as a voting system for deciding which transactions get added to the blockchain.

PoW and PoS are the leading approaches, each with unique ways of achieving this agreement.

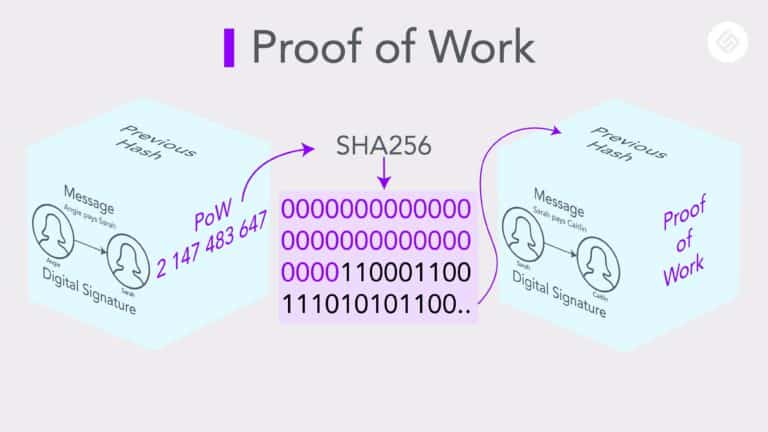

Proof of Work (PoW): How It Works

Proof of Work is the original consensus mechanism, introduced by Bitcoin. In PoW, miners compete to solve complex mathematical puzzles to validate transactions and add them to the blockchain. The first miner to solve the puzzle earns a reward (e.g., newly minted BTC).

Key Features:

- Computational Power: Miners use powerful hardware (like GPUs) to solve puzzles, requiring significant energy.

- Difficulty Adjustment: Puzzles get harder as more miners join, ensuring consistent block times (e.g., ~10 minutes for Bitcoin).

- Security: The high cost of mining deters attacks, as altering the blockchain requires controlling over 51% of the network’s computing power.

Proof of Stake (PoS): How It Works

Proof of Stake, used by Ethereum (post-2022 Merge) and others, takes a different approach. Instead of mining, validators are chosen to create new blocks based on the amount of cryptocurrency they “stake” (lock up) as collateral. The more you stake, the higher your chance of being selected.

Key Features:

- Staking: Validators lock up coins (e.g., ETH) to participate, earning rewards for validating blocks.

- Random Selection: Algorithms choose validators based on stake size and other factors, reducing energy use.

- Security: Attackers need to own a majority of staked coins (costly) to manipulate the network.

PoS is like putting money in a savings account to earn interest, while PoW is like running a power-hungry computer race.

Technical Comparison: PoW vs. PoS

Let’s compare PoW and PoS across key technical aspects to understand their differences.

1. Energy Consumption

PoW: Extremely energy-intensive. Bitcoin’s mining consumes more electricity than some countries, raising environmental concerns.

PoS: Energy-efficient. Validators don’t need powerful hardware, making PoS eco-friendly. Ethereum’s switch to PoS reduced its energy use by over 99%.

Winner: PoS, for its minimal environmental impact.

2. Security

PoW: Battle-tested for over a decade, PoW is highly secure due to the massive computational cost of attacks. Bitcoin has never been hacked at the protocol level.

PoS: Secure but newer, with less real-world testing. Attacks are expensive (requiring majority stake), but PoS systems are still proving their resilience.

Winner: PoW, for its proven track record, though PoS is catching up.

3. Scalability

PoW: Slower and less scalable. Bitcoin processes ~7 transactions per second (TPS), and high energy costs limit network growth.

PoS: More scalable. Ethereum’s PoS supports higher TPS and integrates with layer-2 solutions (e.g., Optimism) for faster transactions.

Winner: PoS, for better throughput and growth potential.

4. Decentralization

PoW: Promotes decentralization but favors large mining pools, which can centralize control. Small miners struggle to compete.

PoS: Encourages decentralization, but wealthier validators (with more staked coins) have more influence, risking “rich-get-richer” dynamics.

Winner: Tie—both have trade-offs, with neither fully solving centralization risks.

5. Accessibility

PoW: Requires expensive hardware and high energy costs, making mining inaccessible for most people.

PoS: More accessible. Anyone with enough coins (e.g., 32 ETH for Ethereum) can stake, and pooling options lower the entry barrier.

Winner: PoS, for broader participation.

Real-World Use Cases

PoW Use Cases:

- Bitcoin: Secures the world’s largest cryptocurrency with unmatched reliability.

- Ethereum (pre-2022): Powered early smart contracts and DApps before switching to PoS.

PoS Use Cases:

- Ethereum (post-2022): Runs DApps, DeFi, and NFTs with lower energy use.

- Cardano, Solana: Supports fast, scalable networks for global applications.

PoW suits networks prioritizing battle-tested security, while PoS fits those needing scalability and efficiency.

Pros and Cons Summary

Proof of Work:

- Pros: Proven security, decentralized, resistant to attacks.

- Cons: High energy use, slow transactions, expensive to participate.

Proof of Stake:

- Pros: Energy-efficient, scalable, accessible to more users.

- Cons: Less tested, potential for validator centralization.

Choosing between PoW and PoS depends on your project’s goals—security vs. sustainability.

Which Is Better for the Future?

PoW has been the gold standard, but its energy demands are unsustainable as blockchains grow. PoS offers a greener, more scalable alternative, making it the choice for modern networks like Ethereum. However, PoS must prove its long-term security to rival PoW’s track record.

Many experts believe PoS (or hybrid models) will dominate as blockchain adoption increases, but PoW will likely remain relevant for high-security networks like Bitcoin.

Resources for Learning More

Deepen your understanding of PoW and PoS with these resources:

- Ethereum Docs: Details on PoS at ethereum.org.

- Bitcoin Whitepaper: Original PoW explanation at bitcoin.org.

- Blockchain Communities: Discuss with experts on Bitcoin Stack Exchange or Ethereum forums.

Stay curious and explore both mechanisms to understand their evolving roles.

Conclusion

Proof of Work and Proof of Stake are the backbone of blockchain consensus, each with unique strengths. PoW offers unmatched security but guzzles energy, while PoS is eco-friendly and scalable but still proving itself. By understanding their technical differences, you can better appreciate how blockchains like Bitcoin and Ethereum operate.

Which mechanism do you think will shape the future of blockchain? Share your thoughts in the comments below!