Cryptocurrency is known for its wild price swings, where coins like Bitcoin or Ethereum can surge or drop 20% in a day. This volatility excites some investors but scares others. For beginners, understanding crypto volatility is key to making smart investment decisions in 2025. This guide explains why crypto prices fluctuate, how to manage the risks, and tips to invest confidently, all in simple terms.

What is Crypto Volatility?

Volatility refers to how much a cryptocurrency’s price changes over time. High volatility means big price swings—up or down—in short periods. For example, Bitcoin might be $60,000 one day and $50,000 the next. Unlike stocks or bonds, crypto is far more volatile due to its unique market dynamics.

Why It Matters: Volatility can lead to big gains but also big losses. Understanding it helps you avoid panic-selling or overinvesting.

Why Are Crypto Prices So Volatile?

Several factors drive crypto’s rollercoaster prices. Here’s what causes the ups and downs in 2025:

1. Market Sentiment and Hype

Crypto prices are heavily influenced by news, social media, and public mood. A single post on X or Reddit can spark buying or selling frenzies.

Examples:

- A celebrity tweeting about a coin can send its price soaring.

- Negative news, like a hack, can trigger a sell-off.

Tip: Don’t trust hype. Check market trends on CoinGecko for real data.

2. Low Market Liquidity

Many cryptocurrencies have smaller markets than stocks, so a few big trades can move prices significantly. Altcoins, especially, have low liquidity, making them prone to sharp swings.

Example: A whale (someone with lots of crypto) selling $1 million of an altcoin can crash its price if few buyers are active.

3. Regulatory News

Government regulations or bans can shake crypto markets. Uncertainty about laws in 2025 keeps prices unstable.

Example: If a country bans crypto trading, prices often drop. Conversely, pro-crypto laws can spark rallies.

Tip: Stay updated on regulations via Cointelegraph.

4. Speculation and Trading

Many crypto investors are speculators betting on price movements, not long-term value. This fuels volatility as traders buy and sell rapidly.

Example: Day traders might buy Bitcoin at $55,000 and sell at $60,000, amplifying price swings.

5. Technology and Network Events

Updates, hacks, or network issues (like Ethereum upgrades or Bitcoin halving) can sway prices. Positive developments boost confidence, while problems cause dips.

Example: Ethereum’s 2022 shift to Proof of Stake cut energy use, lifting its price. A hack could do the opposite.

How Volatility Affects New Investors

Volatility creates both opportunities and risks for beginners:

- Opportunities: Buying during dips can lead to gains if prices recover.

- Risks: Sudden drops can wipe out investments, especially if you panic-sell.

Common Mistakes:

- Buying at peak prices due to FOMO (fear of missing out).

- Selling during crashes out of fear.

- Overinvesting in volatile altcoins without research.

By managing volatility, you can avoid these pitfalls and invest smarter.

Strategies to Manage Crypto Volatility

Here are practical tips to navigate price swings and protect your investments in 2025.

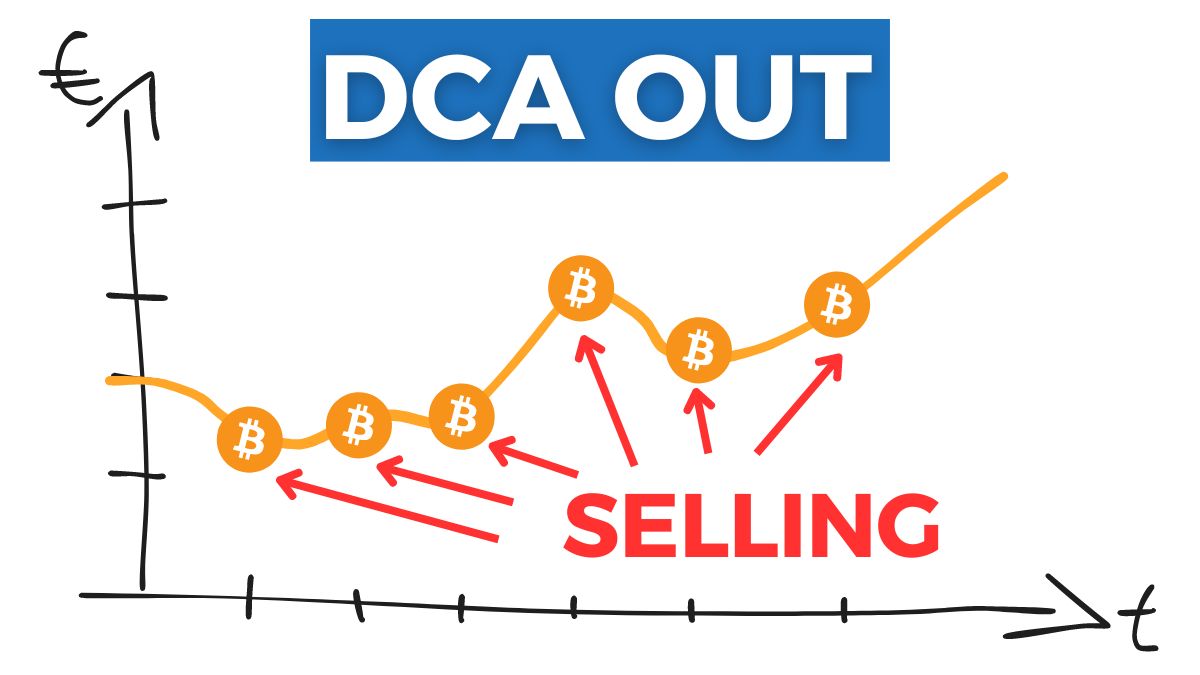

1. Use Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount regularly, regardless of price, to reduce the impact of volatility.

How to Do It:

- Buy $25 of Bitcoin weekly on Coinbase or Kraken.

- Over time, you’ll average out high and low prices.

- Stick to the plan, even during dips or spikes.

Example: Investing $100 monthly in Ethereum buys more when prices are low and less when high, lowering your average cost.

2. Invest Only What You Can Afford to Lose

Volatility means you could lose a chunk of your investment. Never risk money you need for essentials like rent or bills.

How to Do It:

- Start with $10–$50 to learn without stress.

- Treat crypto as a speculative investment, not a savings account.

- Avoid borrowing or using credit to buy crypto.

Example: Losing $50 in a market crash won’t ruin you, but losing $5,000 could.

3. Diversify Your Portfolio

Spreading your investment across multiple coins reduces risk. If one coin crashes, others may hold steady.

How to Do It:

- Invest in established coins like Bitcoin and Ethereum (60–70% of your portfolio).

- Add stablecoins like USDC (20–30%) to minimize volatility.

- Limit risky altcoins to 10–20%.

Example: A $1,000 portfolio might be $600 Bitcoin, $200 Ethereum, $200 USDC. Track prices on CoinGecko.

4. Focus on Long-Term Investing

Volatility is less scary if you hold crypto for years, not days. Long-term investing smooths out short-term swings.

How to Do It:

- Choose coins with strong fundamentals, like Bitcoin or Ethereum.

- Plan to hold for 1–2 years, ignoring daily price changes.

- Store crypto in a secure wallet like Ledger for safety.

Example: Bitcoin dropped 50% in 2022 but later recovered. Long-term holders weathered the storm.

:max_bytes(150000):strip_icc():format(webp)/5KeyInvestmentStrategiestoLearnBeforeTrading_final-9d7b3680b134437996eb36592186314f.png)

5. Avoid Emotional Trading

FOMO or panic can lead to buying high and selling low, locking in losses. Staying calm is key to managing volatility.

How to Do It:

- Set clear goals (e.g., sell at a 20% gain or hold for a year).

- Limit price checks to once a week on CoinGecko.

- Practice with demo accounts on TradingView to build discipline.

Example: Selling Ethereum during a 30% dip out of fear might mean missing a recovery. Stick to your plan.

6. Research Before Investing

Volatile coins with no real value (e.g., some meme coins) are riskier. Researching projects helps you pick solid investments.

How to Do It:

- Read whitepapers and verify team credentials on project websites.

- Check community feedback on Reddit’s r/cryptocurrency or CoinDesk.

- Avoid coins hyped on X without a working product.

Example: Ethereum’s smart contracts have real-world use, unlike many volatile altcoins with empty promises.

Additional Tips to Handle Volatility

Here are extra strategies to stay safe in volatile crypto markets:

- Secure Your Funds: Use a hardware wallet like Ledger and enable 2FA on exchanges like Binance.

- Minimize Fees: High trading fees can eat into gains. Use low-fee platforms like Kraken.

- Track Taxes: Volatile gains may be taxable—use tools like CoinTracker for compliance.

- Stay Informed: Follow Cointelegraph for market insights.

How to Start Investing in Volatile Markets

Ready to invest in crypto while managing volatility? Follow these steps:

- Choose a Trusted Platform: Sign up on Coinbase or Kraken for secure trading.

- Start Small: Invest $10–$50 in Bitcoin or Ethereum to learn without stress.

- Use DCA: Buy small amounts regularly to average out price swings.

- Secure Your Crypto: Store funds in a wallet like Trust Wallet or Ledger.

- Research Thoroughly: Study coins on CoinDesk before investing.

Tip: Join Reddit’s r/cryptocurrency for community advice on handling volatility.

Conclusion

Crypto volatility is both a challenge and an opportunity for new investors in 2025. By understanding why prices swing, using strategies like DCA, diversifying, and staying calm, you can navigate the market with confidence. Start with a trusted platform like Coinbase, secure your funds with a Ledger wallet, and keep learning from Cointelegraph. With these tips, you’ll manage volatility and invest smarter!